In this new series of posts we're going to share an investment opportunity that could boost your ISA and/or SIPP portfolio over the coming years.

This same opportunity is right under everybody’s noses but because they have not been informed about it, they have no idea it exists. There is an English Proverb that sums this up beautifully, ‘Some men go through a forest and see no firewood.’

This information is taken from our free report A Golden Opportunity, to download a copy please just click here.

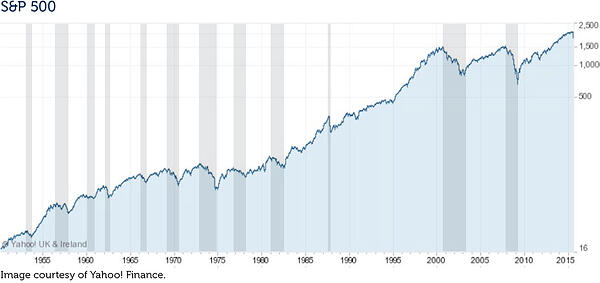

To explain how it’s possible to capitalise on this rare opportunity, we are going to start with some basic lessons about the stock market. Let’s begin. Most Britons have heard of the FTSE 100 but fewer have heard of the S&P 500. The FTSE 100 is an index in the UK that has the top 100 companies trading in it. The S&P 500 is its equivalent in the United States and, you guessed it, this one has 500 companies that belong to it.

What long-term trend has this index formed? Is it up, down or sideways?

Yes, that’s right, it’s in an uptrend.

Can you see the grey vertical shaded areas on the chart?

These represent the down periods in the market. They are known as bear markets. On the other hand, the white areas on the chart are the times when the market rose. These periods are called bull markets.

What do you see happening after each bear or down market?

That’s right, the market goes up. Would you agree that after every bear market the index has always eventually moved into new high ground?

Excellent!

Did you know that historically, bull markets or up markets have lasted between two and four years?

Bear or down markets tend not to last as long. Bear markets last between nine and eighteen months and therefore are much shorter than bull markets. Because bull markets last longer, the stock market forms an uptrend. It’s like a staircase effect where you have three stairs up and one stair down.

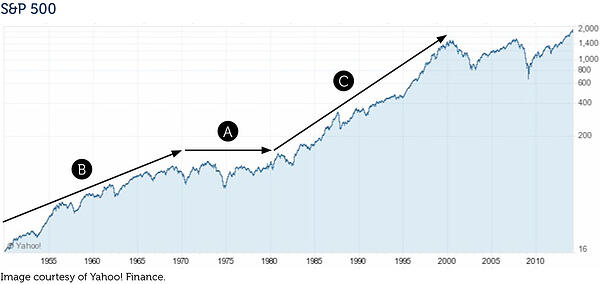

Just before we move on, take a look at the period on the chart from 1970 to 1980.

Notice that the market made very little price progress over that decade (Point A). Do you see that?

Do you also see what happened before it went sideways? Can you see the strong uptrend (Point B)?

And what happened after 1980?

Do you see that after the ten year sideways period, the market had a nice run (Point C)?

So let’s quickly recap what we just learned. Prior to 1970, the market was in a strong uptrend, then it went sideways for ten years and then it resumed its uptrend.

Did you see that? Good, because we will be talking more about that later in this series and in our post next week we'll move on to talking about funds.

This information is taken from our free report A Golden Opportunity, to download a copy please just click here.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

As we grow our wealth, you grow yours. Together we prosper.

ISACO are a specialist in ISA and SIPP investment and together with our clients have an estimated £75 million actively invested1. To help investors like you, we offer a high end service called ‘Shadow Investment’. Put simply, we invest and you invest beside us. As we grow our wealth, you grow yours.

How does Shadow Investment work?

Shadow Investment allows you to look over our shoulder and buy the same investments that we are buying. It’s an intensely personal service which gives you the opportunity to piggyback on our expertise and makes investing easier, simpler and much more enjoyable.

Delivering superior performance

We have an active investment strategy which aims to control risk and deliver superior performance. Over the last 17 years2, we’ve beaten the FTSE 100 by 77.9% and over the last 3 years3, we’ve made an average annual return of 9.5% versus the FTSE 100’s 5.7%.

Get in touch

If you have over £250,000 actively invested, click here to arrange a free financial review (valued at £495) with Paul Sutherland, ISACO’s Managing Director.

1 Internal estimation taken January 1st 2015 of total ISA and pension assets owned by the ISACO Investment Team and ISACO premium clients.2 December 31st 1997 - December 31st 2014 ISACO 105.5%, FTSE 100 27.6%.

3 December 31st 2011 – December 31st 2014.

ISACO investment performance verified by Independent Executives Ltd.