In this series of posts we're sharing an investment opportunity that could boost your ISA and/or SIPP portfolio over the coming years.

In this post we'll move on to talking about funds and ISAs. What do you know about investment funds? In case you are unsure, an investment fund is a pooled investment vehicle that allows investors like you and us to invest in the stock market. They are controlled and managed by a professional investor who is called a fund manager. These fund managers buy stocks (companies) that they believe are going to rise in value. If they choose well, the fund’s value will do well and all the people invested in the fund will be rewarded with an increase in their investment portfolio.

This information is taken from our free report A Golden Opportunity, to download a copy please just click here.

Job 1: Find fund managers with great track records

Investment funds are the investment vehicles that have the potential of growing your account at 8-10% each year, if the market is trending upwards and if you choose well. Fund managers are the individuals who manage investment funds and they are the people who decide which companies they want to invest in.

If they choose well, the funds overall value will increase and people who invest in the fund will be rewarded. So your first job is to find a fund manager with an outstanding track record. Here’s how we do that: when the market is in a confirmed uptrend, we scan for funds managed by exceptional fund managers. We like to ensure that the fund manager has proven they can beat the market in the short and the long term.

Job 2: Find fund managers in the money flow

However, what a lot of investors don’t realise is that many fund managers with great track records will not always be ‘on form’ and producing good returns.

There is however, a good reason why this happens.

Do you have any idea what this is?

The reason is that each fund manager has an objective and a mandate that they have to stick to, such as only investing in Japanese stocks, British stocks or possibly American stocks. Some managers’ mandates state that they can only invest in a particular sector, such as the technology or the basic resources sector. The important thing to understand here is that all fund managers have a brief that they have to stick to.

This puts many managers at a disadvantage because the big money can only flow into a handful of countries/sectors at any given time. This is one of the reasons why most top managers are never going to be able to constantly outperform the market every single year.

That’s why you have to always be active. Instead of just finding a fund run by a top manager, buying it and then holding it, you have to be dynamic. You have to be aware of where the big money is flowing at any given time and then aim to invest in the best fund managers who are right in the middle of the money flow.

Why we love ISAs

ISAs are fantastic. Yes, they really are the UK’s best-kept secret and it’s not commonly known how they work or how powerful they are. Many people think that when they take out an ISA with a bank, their ISA has to remain with that same bank for life. A few peoplemistakenly think that they are locked in and can’t move their ISA. Both these myths are utter nonsense.

With your ISAs, you have the power to control where your money is being parked or invested. And you can change your mind at any time. If you have been placed in a stocks and shares ISA, perhaps by your bank manager, broker or financial adviser, it’s really easy to check how good their recommendations have been. All you need is a little training.

This is just one of the things we like to teach our clients. We have to say that when they’ve been given that knowledge, they tell me it makes their bank managers, brokers or advisers feel very nervous. Knowledge of the characteristics of a good fund versus those of a bad fund gives you serious power over your adviser.

Real ISA millionaires

Most people in the UK are totally unaware that ISAs can help them accumulate a multimillion pound, tax-free portfolio.

Yes, it’s true, some ISA investors have accounts in the tens of millions (Source: FT.com 8th Oct 2010 -’ISAs’ values rise to £1m for some investors’).

Did you know that an ISA is not an investment, but is the name of a wrapper that goes around an investment, sheltering it from the Inland Revenue?

Think about a sweet in a wrapper. The investment is the sweet and the ISA is the wrapper. Did you know that there is no limit to how much your tax-free portfolio can grow into?

Yes, it’s true. If you start with say £1000 and eventually over time it grows into, let’s say, £1 million then all of that £1 million would be tax-free.

Three out of four stocks move in the same direction as the market

One of the things that we first learned about how the stock market works is that three out of every four stocks move in the same direction as the market.

So if the market is in an uptrend, approximately 75% of stocks move up. And if the market is in a downtrend, approximately 75% of stocks move down. And because investment funds own stocks, funds also move in the same direction as the market.

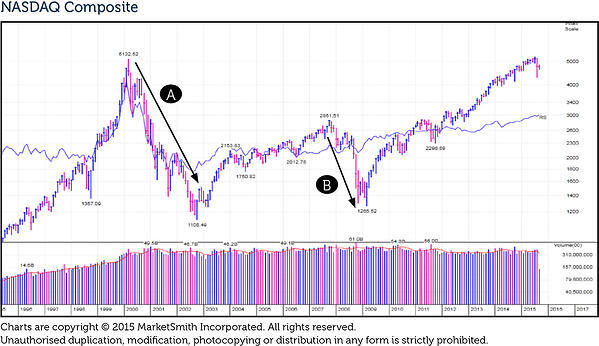

When the market had huge corrections during 2000-2002 and 2007-2009, individuals who remained invested in the market’s downtrend will have lost a lot of money.

Take a look at this 20 year chart of the NASDAQ. On this chart we are showing you something important. When the market was in a major downtrend from 2000-2002 (Point A) and during the period 2007-2009 (Point B), the smart money was out on the sidelines.

You see, the market is like a river. If it’s heading downwards, then you don’t want to be in the river trying to swim upstream against a strong current. Your aim should be to stay on the sidelines patiently waiting for the flow of the river to change. You therefore need to swim with the current and not against it.

How to win

To win at ISA and SIPP investing, your job is to know how to pick a top performing investment fund that is currently ‘in the money flow’ and then wrap an ISA and/or SIPP around it. You also need to aim to buy it when the market is in a confirmed uptrend.

William J. O’Neil is not well known in the UK, but in the US he is regarded as a stock market master. Back in 2000 and 2001, O’Neil taught us an investment strategy – a method based on how the market has operated in each of the cycles over the last 125 years.

Not missed the start of a single bull market

What I discovered from Bill is that one of the secrets to investment success is to be ‘active’. We earned that over the last 50 years, using this dynamic investment method, Bill had not missed the start of a single bull market. This impressive fact was just one of the many reasons that drew us towards this method of investing.

In our next post in this series, we'll look at how investors can capitalise on the investment opportunity that the next 5-10 years could offer. To learn more, please just download our free report A Golden Opportunity.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

As we grow our wealth, you grow yours. Together we prosper.

ISACO are a specialist in ISA and SIPP investment and together with our clients have an estimated £75 million actively invested1. To help investors like you, we offer a high end service called ‘Shadow Investment’. Put simply, we invest and you invest beside us. As we grow our wealth, you grow yours.

How does Shadow Investment work?

Shadow Investment allows you to look over our shoulder and buy the same investments that we are buying. It’s an intensely personal service which gives you the opportunity to piggyback on our expertise and makes investing easier, simpler and much more enjoyable.

Delivering superior performance

We have an active investment strategy which aims to control risk and deliver superior performance. Over the last 17 years2, we’ve beaten the FTSE 100 by 77.9% and over the last 3 years3, we’ve made an average annual return of 9.5% versus the FTSE 100’s 5.7%.

Get in touch

If you have over £250,000 actively invested, click here to arrange a free financial review (valued at £495) with Paul Sutherland, ISACO’s Managing Director.

1 Internal estimation taken January 1st 2015 of total ISA and pension assets owned by the ISACO Investment Team and ISACO premium clients.2 December 31st 1997 - December 31st 2014 ISACO 105.5%, FTSE 100 27.6%.

3 December 31st 2011 – December 31st 2014.

ISACO investment performance verified by Independent Executives Ltd.