Frequently Asked Questions

Common questions

Does this mean I get the chance to 'copy' your trades?

What type of clients is your Shadow Investment Service aimed at?

What are your annual investment return aims?

What is your investment track record?

How much does the Shadow Investment Service cost?

I believe you make a promise to your clients. What is that promise?

The service

How does your ‘Shadow Investment’ Service work?

What is your investment strategy?

How do your clients ‘shadow’ your portfolio?

What does your Shadow Investment Service include?

What is the minimum investment period?

Who would be my dedicated contact at your firm?

Our investment track record

How have you performed in bear markets?

Due diligence, compliance and governance

Are you authorised and regulated by the Financial Conduct Authority (FCA)?

Are you covered by the Financial Ombudsman Service?

Do you offer ‘personalised investment advice’?

Has any of your clients ever complained to the FCA about you?

Do you have a 'code of ethics'?

Does your company have professional indemnity insurance?

What are your investment team’s qualifications?

Do you have any reviews or testimonials from satisfied clients?

Common questions

What does ISACO do?

ISACO are a specialist in ISA and SIPP investment and together with our clients have an estimated £75 million actively invested1.

Our ‘Shadow Investment Service’ gives high net worth ‘DIY’ investors, the opportunity to look over our shoulder and buy the same funds that we personally own, effectively piggybacking on our expertise.

1 Internal estimation taken January 1st 2015 of total ISA and pension assets owned by the ISACO Investment Team and ISACO premium clients.

What is 'Shadow Investment?

'Shadow Investment’ is a unique service which gives high net worth ‘DIY’ investors, the opportunity to look over our shoulder and buy the same funds that we personally own, effectively piggybacking on our expertise.

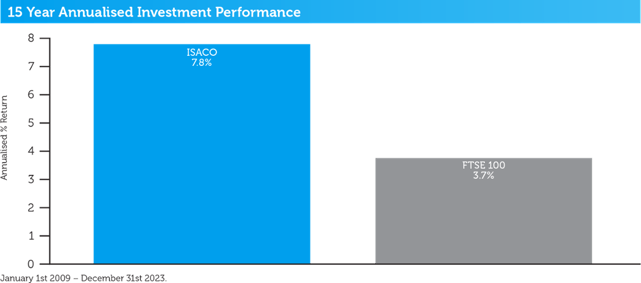

As an ISACO premium client, you’ll have the opportunity to copy our ‘market–beating’1 fund portfolio throughout the year, giving you the potential for achieving almost identical returns to the ones we make.

- Opportunity to buy the same funds that we buy

- Low cost (typically 1% per year)

- Potential for ‘tax free’ growth of 6-8%

- Keep full control of your investment account

By following our lead, you discover what funds we are buying, when we are buying them and when we are selling them. This means you get to see what we are doing with our own personal money and if you agree with our fund pick, you have the chance to copy the trade. Typically, we only make about 1-2 trades over the course of a year allowing the service to be very time friendly.

1January 1st 2009 - December 31st 2023. ISACO annualised return of 7.8% compared to FTSE 100's 3.7% over 15-year period beating our benchmark on average by 4.1% per year.

Does this mean I get the chance to 'copy' your trades?

Yes, throughout the year you get to see what we are doing with our ISA and pension money and if you agree with our fund pick, you have the chance to copy the trade. This means you are in the driver’s seat at all times and can decide which funds you want to buy and how much you want to invest.

Due to our outstanding track record of performance growth, most clients copy our exact movements throughout the year. Some clients however, do begin their term with us by partially copying and as time passes, their confidence tends to grow in our ability, which results in them deciding to copy us to the letter.

What type of clients is your Shadow Investment Service aimed at?

It’s been purposely created for ISA and SIPP ‘DIY’ investors with over £250,000 actively invested. Our client base includes wealthy retirees, business owners, self-employed professionals, corporate executives, IFAs and wealth managers.

What are your annual investment return aims?

Our aims are 6-8% per year.

What is your investment track record?

Beaten the FTSE 100 by 3.0% per year

The FTSE 100, our benchmark, has annualised 5.1% since its inception 40years ago4. That tells us that if we can beat the FTSE 100 over the long term, we’re going to be blessed with a reasonable rate of return.

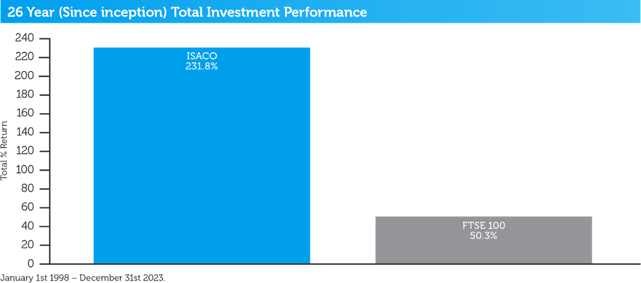

We are delighted that since beginning investing back in 19975, to the close of 2023, we’ve beaten the FTSE 100 on average by 3.0% per year. Past performance is no guarantee of future performance.

4 January 3rd 1984 - December 31st 2023.

5 January 1st 1998 - December 31st 2023.

How much does the Shadow Investment Service cost?

The only fee you have to pay is a service fee which is typically 1%1 per year. There are no fees to pay for performance, no initial charges2, no upfront fees3, no switching fees, no exit fees and no ‘per hour’ charges.

1 For portfolios of £250,000 and above.

2 Initial charges on investment funds.

3 For portfolios of £250,000 and above.

I believe you make a promise to your clients. What is that promise?

OUR PROMISE

- Opportunity to mirror / copy our fund trades

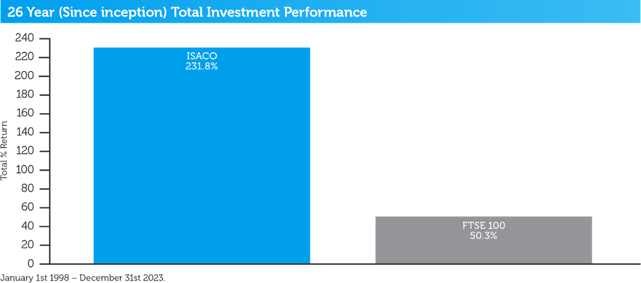

- 26-year market-beating performance2

- Investment aims of 6-8% per year

- No fees for performance

- No initial charges3

- No upfront fees4

- No switching fees

- No exit fees

- No ‘per hour’ charges

- Tax-free growth5

- ISACO Director as your dedicated contact

- Timesaving

- Authorised and regulated by the Financial Conduct Authority

1 Internal estimation taken January 1st 2015 of total ISA and pension assets owned by the ISACO Investment Team and ISACO premium clients.

2 January 1st 1998 - December 31st 2023. ISACO total return over 26 years of 231.8% compared to FTSE 100's 50.3%. ISACO beat their benchmark (the FTSE 100) on average over the 26-year period by 3.0% per year.

3 Initial charges on investment funds.

4 For portfolios of £250,000 and above.

5 Using ISA and SIPP wrappers.

The service

How does your ‘Shadow Investment’ service work?

Shadow Investment allows you to look over our shoulder and buy the same funds that we are buying. It’s an intensely personal service which gives you the opportunity to piggyback on our expertise and makes investing easier, simpler and much more enjoyable. Because we have ‘skin in the game’, it creates a huge incentive for us to deliver superior performance.

One of the secrets to our impressive returns is to buy our funds using ‘wrappers’ such as Individual Savings Accounts (ISAs) and Self Invested Personal Pensions (SIPPs). Both of them are perfect for helping to boost your annual investment returns.

The service gives you the potential of achieving almost identical returns to the ones we make. It’s been created to save you the time and effort of having to become an investment expert and allows you to keep full control of your investment account.

What is your investment strategy?

We have an active investment strategy which aims to control risk and deliver superior performance. The investment team invest in a number of actively managed funds to form a complete investment portfolio. The team, led by Stephen Sutherland, select what they believe to be the best funds in each asset class, monitor all the investments selected, replacing under-performers and continuously rebalance the portfolios with the aim of maximising growth potential and managing risk. Fund allocations can be adjusted quickly to adapt to changing economic conditions or to capitalise on opportunities as they arise.

The investment process involves identifying the world’s best managers and combining them effectively to achieve diversification and reduce our exposure to risk – this strategy ensures our return is not dependent upon any one manager’s performance. We have resources that allow us to identify who we believe to be the world’s most skilled investment managers, wherever they are in the world. Through structured research and highly informed decision-making, our investment team can focus on taking bold, active decisions that they believe will positively contribute to superior performance.

Our team use a range of tools to fully understand the funds selected and use that deep understanding to build portfolios that seek to create the most compelling blend of different managers. Our strategy and the underlying fund managers are then monitored and reviewed. Whenever we change our view on a fund, or identify a better opportunity, we take swift, decisive action. In selecting the top experts in a market, country or sector, our Shadow Investment solution creates optimum diversification and improves risk management.

What is active investing?

Active investing is the process of selecting funds to add to and remove from a portfolio, based on fundamental and technical analysis, in an effort to outperform the broader market or a specific index on a risk-adjusted basis.

How do your clients ‘shadow’ your portfolio?

Our Shadow Investment service has been purposely designed to take the hard work out of investing. Five days per week, we send you a Daily Market Update which offers the opportunity to copy our fund picks. The update typically takes under three minutes to read, however many of our client’s scan the information which takes less than sixty seconds.

In about 99% of all the updates we send, we’ll report that we are taking no trading action. However, in approximately 1%, we’ll report that we are about to make a ‘switch’ in our portfolio. That simply means that we will be placing a trade and these are the rare days clients get the opportunity to copy our fund pick. Typically, we only make about 1-2 trades over the course of a year.

Who makes the trades?

We make the trades in our portfolios and if you want to copy the trade we’ve made, you’d simply make the same trade in your own investment account.

What does your Shadow Investment Service include?

The service includes:

- 241 ‘Daily Market Updates’ and 12 monthly editions of ‘The Big Picture’.

- ISACO co-founder Paul Sutherland acting as your direct contact and client manager.

- Shadow Investment Service Manual.

- 365 days per year of unlimited help and support..

How much do I need to invest?

It’s a personal decision and there is no set minimum limit. The good news is that because you are controlling your own investment account, you have the freedom to invest as little or as much money as you like. You can start small and increase the amount as your confidence grows.

Clients who benefit most from our service have over £250,000 actively invested however when you start off, you might decide to use just a portion of your overall portfolio and when you see a confirmation of our excellent abilities, you’ll have the opportunity to invest more.

What is the minimum investment period?

If you follow our guidance, you will be investing in equity based funds linked directly to the stock market and as all advisers will tell you, a five-year term should be your absolute minimum. Investment professionals1 say that to reduce risk of loss, a seven-year investment horizon is better than five and ten years, better still. Investing over the long-term can help reduce – and possibly eliminate – the risk of loss to your starting capital.

For example, Fidelity conducted a study1 and discovered that when investing in international markets, if you invested over a one-year period, there was a 24.9% chance that you’d lose some of your initial investment. However, if you invested over a ten-year period, there was a 0% chance of losing anything from your initial investment. As you can see, the possibility of losing money decreases the longer the investment time frame.

1.Source: Fidelity’s research 1.06.83 to 2.06.08. Morningstar. FTSE-A All Share Index with net income reinvested and MSCI World Index-£ with net income reinvested. Basis: bid-bid net of UK basic rate tax. Cumulative returns over 1, 5 and 10 years on all eligible time periods at one month start intervals.

Who would be my dedicated contact at your firm?

Paul Sutherland, ISACO's managing director and co-founder would be your dedicated contact. You'd also have full access to Stephen Sutherland, ISACO's other co-founder who heads up our investment team. Our take is, rather than being passed onto a junior member, you will always be able to speak to somebody senior. If you ever had a question, a concern or a comment, you’d simply contact Paul who like his brother Stephen, is fanatical about customer care. Paul's personal telephone number is 01457 831 642.

Our investment track record

What is your track record?

Beaten the FTSE 100 by 3.0% per year

The FTSE 100, our benchmark, has annualised 5.1% since its inception 40 years ago4. That tells us that if we can beat the FTSE 100 over the long term, we’re going to be blessed with a reasonable rate of return.

We are delighted that since beginning investing back in 19975, to the close of 2023, we’ve beaten the FTSE 100 on average by 3.0% per year. Past performance is no guarantee of future performance.

4 January 3rd 1984 - December 31st 2023.

5 January 1st 1998 - December 31st 2023.

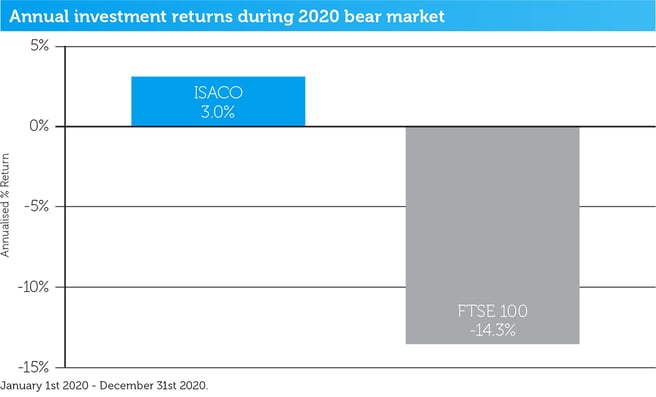

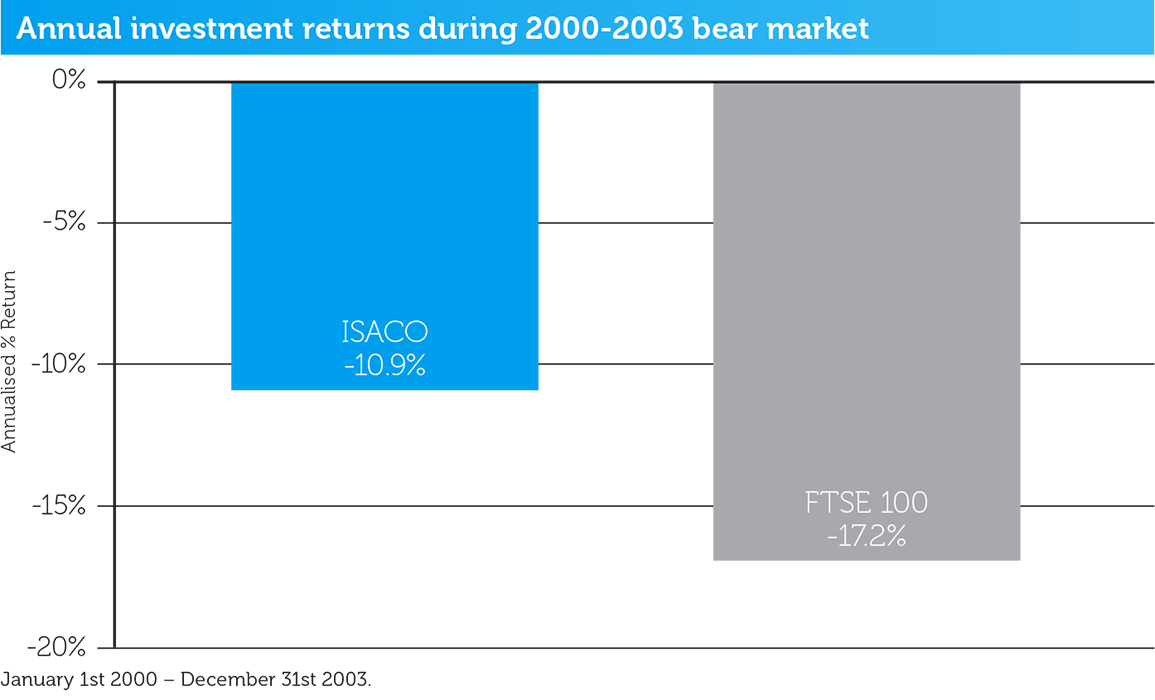

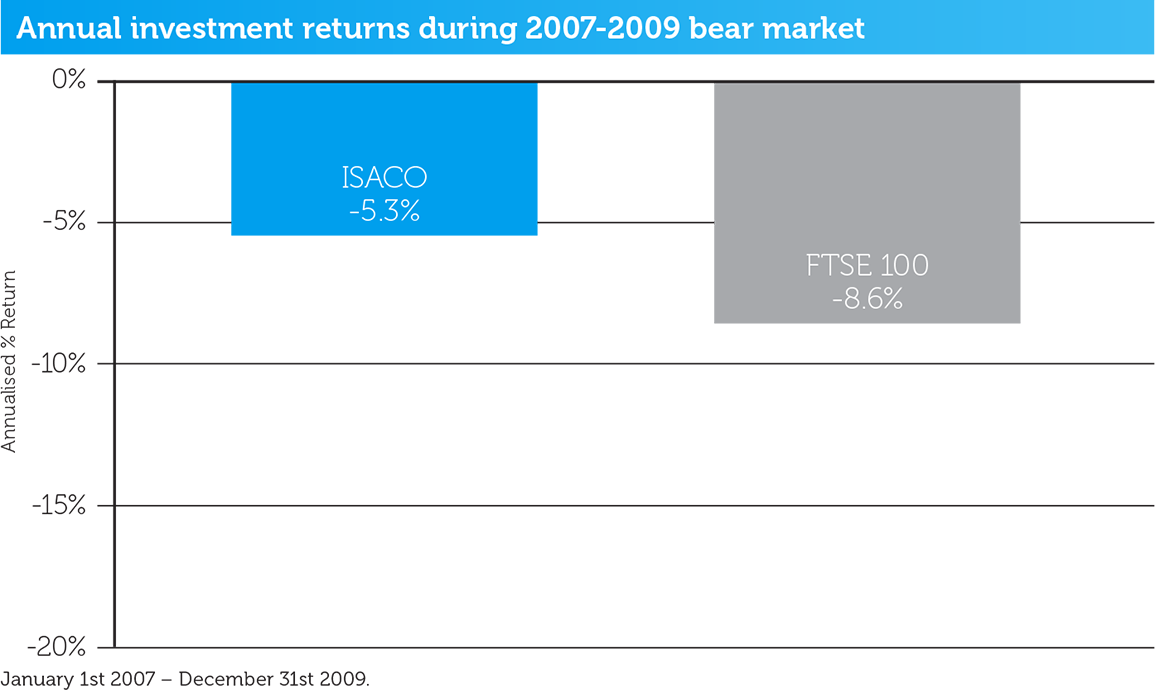

How have you performed in bear markets?

It's impossible for the stock market to rise (bull market) every single year. This means that bear markets (down markets) are normal, natural and needed. It also means that they are an essential part of the stock market cycle. The worst two bear markets over the last twenty years were the 2000-2003 tech crash and the 2007-2009 sub-prime crash. But we also had a bad bear market in 2020, due to the spread of Covid-19.

Below the three bar charts illustrate how we performed during those three very nasty periods versus our benchmark, the FTSE 100.

In the three year ‘tech crash,’ over the period 31st December 1999 to 31st December 2002 our average annual return was -10.9% versus the FTSE 100’s -17.2%. In the 2 year ‘sub-prime’ bear market, over the period 31st December 2007 to 31st December 2009 our average annual return was -5.3% versus the FTSE 100’s -8.6%. Finally, in the one year ‘Covid-19’ bear market of 2020, our return was +3.0% compared to the FTSE 100’s -14.3%. Past performance is no guarantee of future performance.

Due diligence, compliance and governance

What are the risks?

Nothing is guaranteed and the value of investments can go down as well as up and you may get back less than you invest.

Are you authorised and regulated by the Financial Conduct Authority (FCA)?

Yes, ISACO is authorised and regulated by the Financial Conduct Authority (FCA). Our firm reference number is 525147. This means you have peace of mind knowing you are protected as a consumer. It means ISACO are policed by the UK’s main financial watchdog. Regulation by the FCA means the highest level of governance and transparency. It also means you are covered by the Financial Services Compensation Scheme (FSCS) which means you may be entitled to compensation from the scheme if we cannot meet our obligations. This will depend on the type of business and the circumstances of the claim.

Are you covered by the Financial Ombudsman Service?

Yes, so if you complain and we cannot settle this to your satisfaction, you may be entitled to refer it to the Financial Ombudsman Service, Exchange Tower, London, E14 9SR. Tel. 0800 0234567. More information can be found at the Ombudsman web site www.financialombudsman.org.uk.

Do you offer ‘personalised investment advice’?

No, even though we are regulated by the FCA, our service does not offer personal recommendations. Instead, the service allows you to ‘see’ what we are doing with our money which means you have the opportunity to copy our trades within your own investment account.

Has any of your clients ever complained to the FCA about you?

No. Please go the FCA’s site http://www.fsa.gov.uk/register/firmSearchForm.do and check for yourself. You will see that we have zero complaints filed against us. Our firm reference number is 525147.

Do you have a ‘code of ethics’?’

Yes. We do, of course, comply with all applicable laws and regulations when carrying out our business activities, however, we see this as a starting point rather than a ceiling for our approach to treating our clients fairly. For ISACO it is not good enough for a business action just to be legal, we always act in a trustworthy and ethical manner.

Specifically this means that we will always adhere to the following standards.

- We provide a complete and truthful picture of the service we provide, including the limits on our activity and your responsibilities as our client.

- We never accept any inducements (such as services or hospitality) from fund or platform providers.

- We are fully transparent about the costs of our service – there are no hidden or additional costs.

- All our clients have the opportunity to invest in the same funds that we personally own and buy them at the same price that we buy at.

- We fully and clearly explain the reasons for all of our investment decisions.

- We always measure our performance against the most relevant benchmark, the FTSE 100, so that clients receive a consistent and clear picture of our results.

- We deal with all client enquiries promptly.

- We treat client information confidentially and do not share it with anyone outside of ISACO.

- We undertake a regular programme of continuous professional development in order to maintain and enhance our knowledge so as to provide you with a highly informed service.

- We use external assistance where we feel this will enhance the service we provide, but we monitor and take full responsibility for all such third party services.

We undertake, and report on, an independent audit each year to ensure that our business activities continue to comply with this code of ethics.

Does your company have professional indemnity insurance?

Yes, we do hold professional indemnity insurance.

What are your investment team’s qualifications?

Our investment team consists of Stephen Sutherland, Paul Sutherland and Steve Todd who together have a combined investment experience of over 50 years. Stephen, Paul and Steve are highly experienced investors and have all passed the IFS Level 3 Certificate for Financial Advisers examinations prescribed by the IFS School of Finance. Stephen and Paul are personally regulated by the Financial Conduct Authority (FCA).

Due to successful completion of the IFS Level 3 Certificate for Financial Advisers qualification, they can all use the designation ‘CeFA’ after their name. Stephen Sutherland, the head of our investment team is also a bestselling author of the highly acclaimed Liquid Millionaire and the very popular How to Make Money in ISAs and SIPPs. Stephen is known as an ISA and SIPP investment expert and has been personally investing in ISAs since 1997, when they were called PEPs.

Do you have any reviews or testimonials from satisfied clients?

Yes, we have over 100 reviews and you can see a large sample of them by clicking here. Here’s some that may be of interest:

"I have been a client of ISACO for several years and have been strengthened in confidence, not only by their professional skills but by their total honesty and integrity."

Bob Sweeney, Retired Business Owner

"The Daily Market Updates and The Big Picture are both superb. Stephen is a genius. I am so excited by this opportunity and can't wait to get started. Stephen and Paul are an inspiration to me and I know I have made the right decision in joining ISACO."

Simon Webb, Bridge Engineer

"Having taken the decision to consolidate all my legacy pensions into a SIPP, I remained frustrated that my IFA sat firmly on the fence in terms of recommending funds despite being aware of my risk profile. Discovering ISACO was a breath of fresh air – an organisation that believed so much in their own expertise that they actually put their money where their mouth is.

In many ways it looked too good to be true. However, after long discussions with Paul & Stephen, two straight talking astute & knowledgeable northern guys, I took the plunge and invested 100% of my significant SIPP in a way that modelled ISACO's investment profile. Thank goodness I did, 6 months later the fund is up 8%, my financial investment stress levels are down 100% and I have made 2 new friends who I can trust to use their considerable expertise to manage their investments and as my SIPP is aligned I benefit.

This service is unconventional and the decision to sign up was not easy, but 'fortune follows the brave ' and hopefully my faith in following simple logic, that an expert with skin in the game will deliver outstanding performance over the long-term will continue to be borne out."

Richard Hetherington, Director RJH Business Services

"When it comes to investment, it is hard to tell who is good - but I have been very impressed with Stephen and his record and the logic of his approach."

Richard Koch, Sunday Times Rich List Member and bestselling author of The 80/20 Principle

"Most people who write market reports just touch on what most of us already know, and certainly none of it has any really logical thinking, unlike your comments."

Lee Clarke, author of The Trusted Financial Adviser