In our Daily Market Update on Tuesday January 8th 2019, we wrote:

‘Here’s what we noticed that was good and not so good.

The good

- A new bull market may have begun January 4th.

- Trading volume has started to pick up – and above average – as the main US indexes have climbed higher.

- No leading stocks falling yesterday in heavy trade.

- Seven days of gains in the last eight trading days for US technology and small cap equities.

- Nvidia, one of our leading bellwether stocks, had a day eight follow through.

The not so good

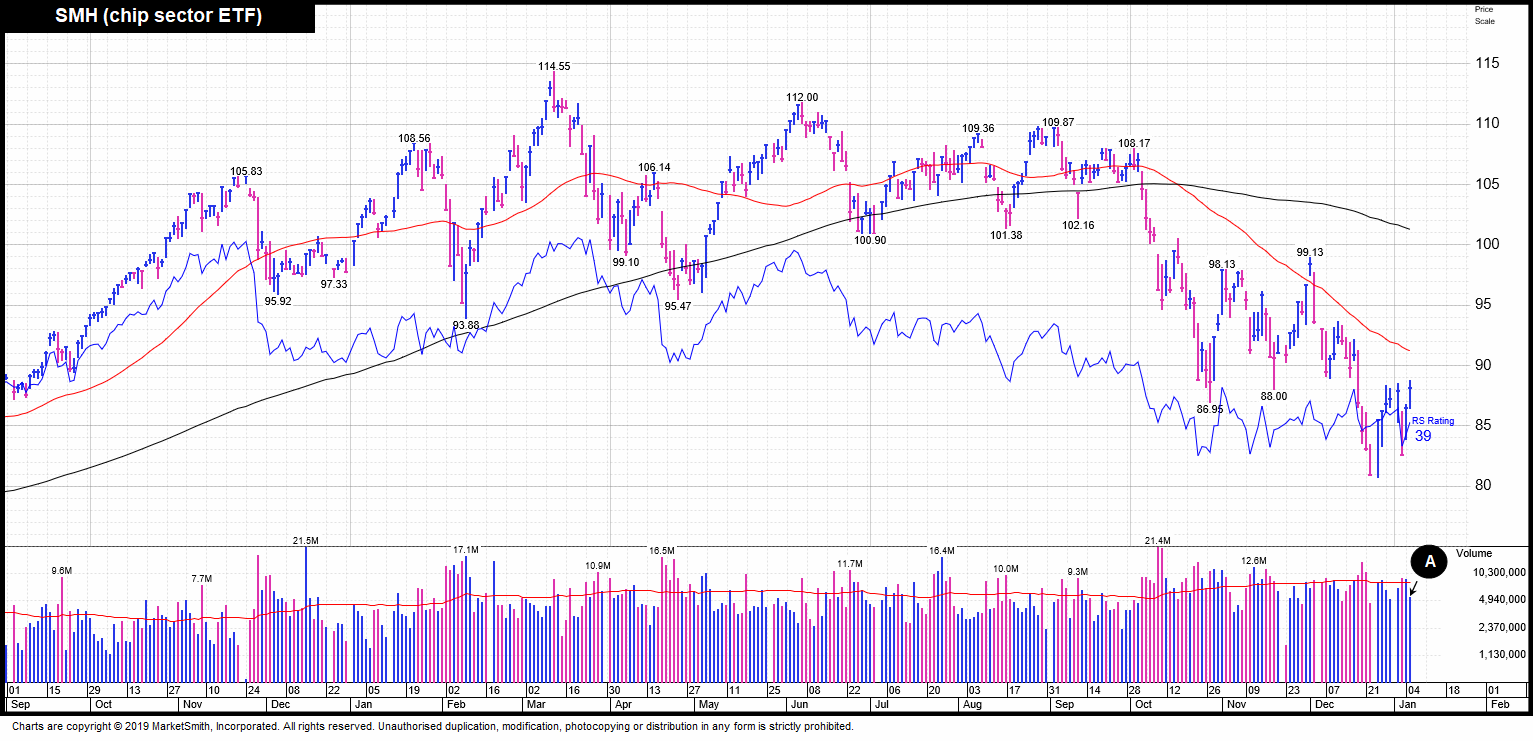

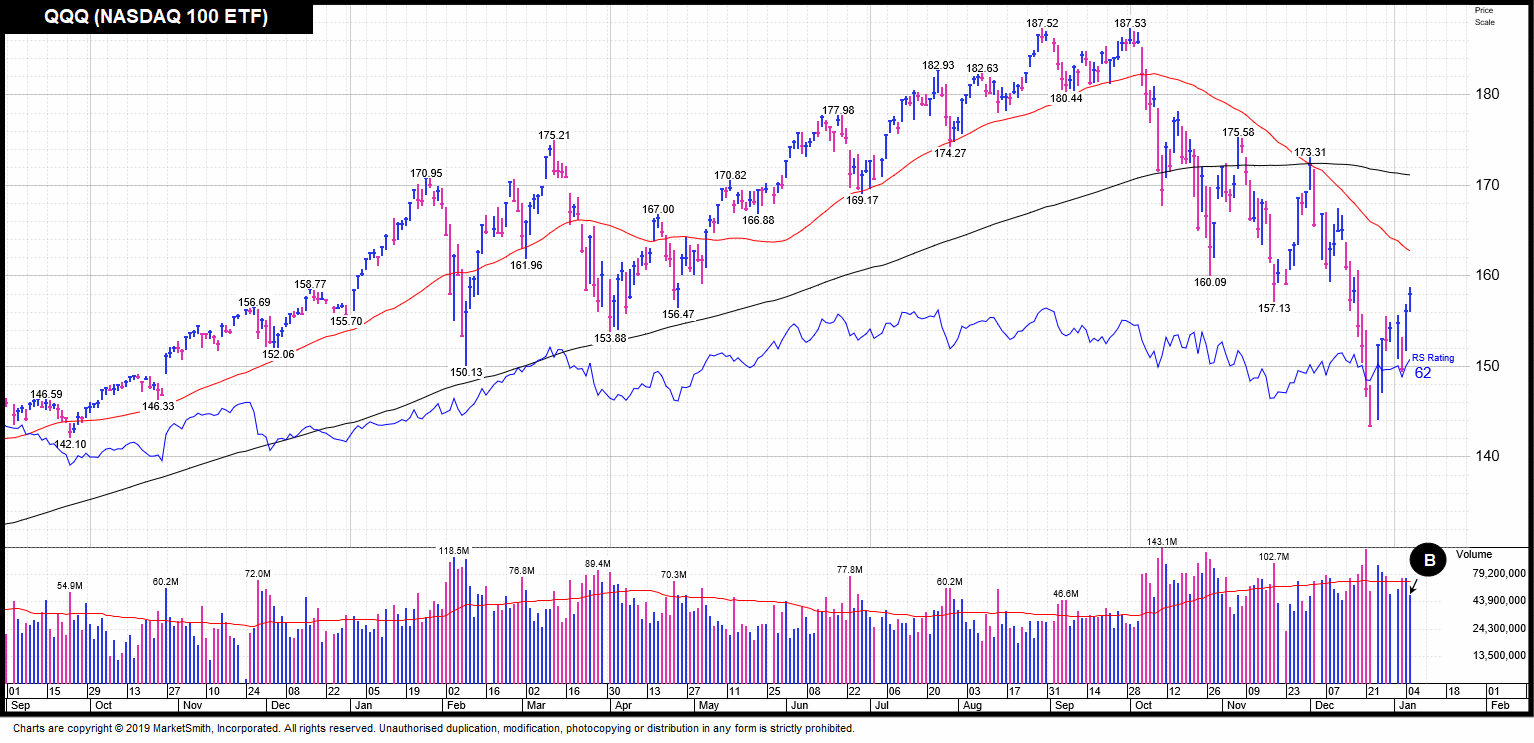

- Low volume rises in the chip sector (Point A) and on the QQQ’s (NASDAQ 100 tracker) (Point B).

- US indexes all approaching a tough area of resistance.

- Market was due a bounce.

- Indian and Chinese equities (two of the recent leaders) have been underperforming since December 24th.

- Chinese equities not yet followed through.’

We also told our clients what our latest thoughts were:

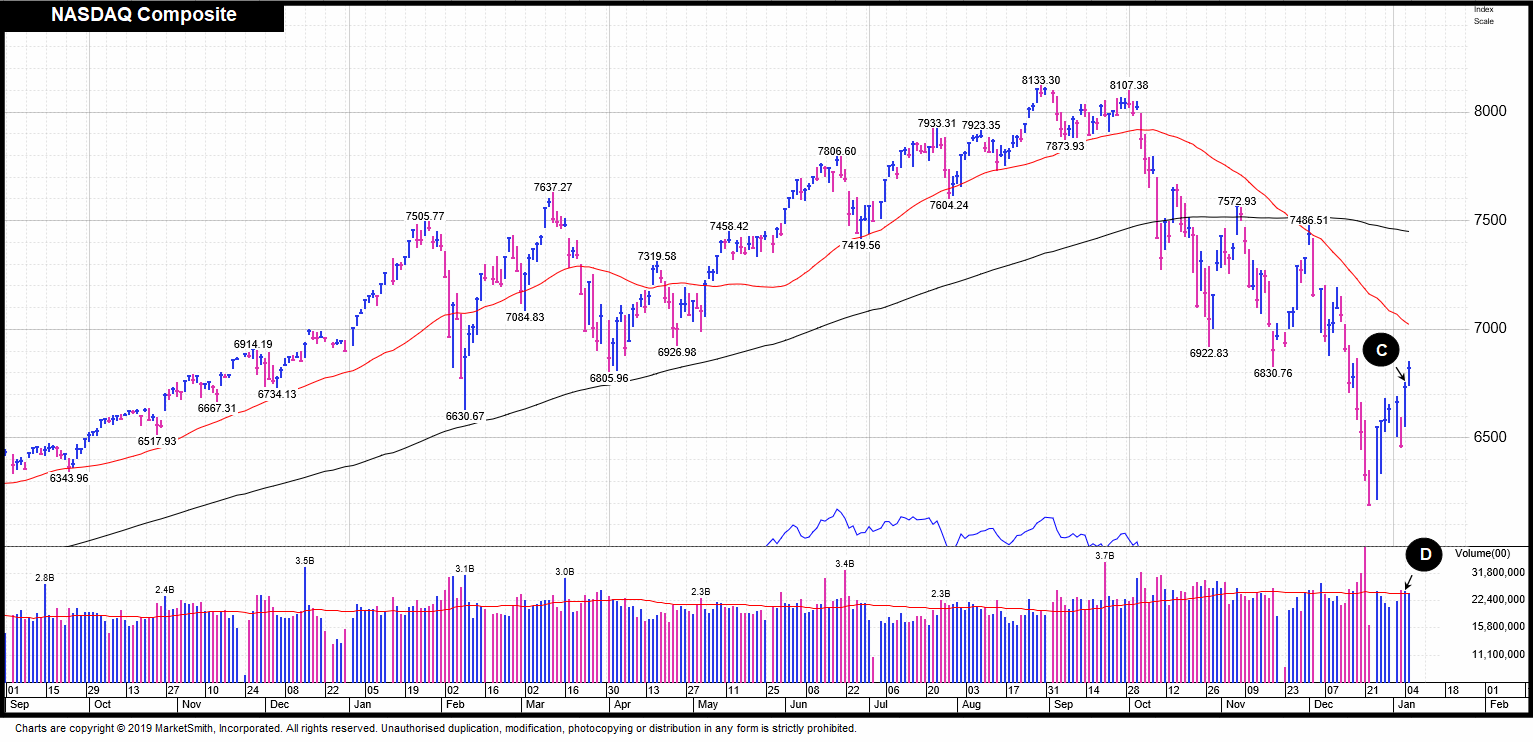

‘The good news is that a brand-new bull market may have started January 4th. On that day all the US market indexes followed through including the US chip sector. Follow throughs do not guarantee that a new bull market has started however a new bull market has never begun without one. That’s why we pay close attention to them when they occur.

On the 4th of January 2019, on what was day seven of a new rally attempt, the NASDAQ Composite surged 4.28% (Point C) in volume 9% above average (Point D).

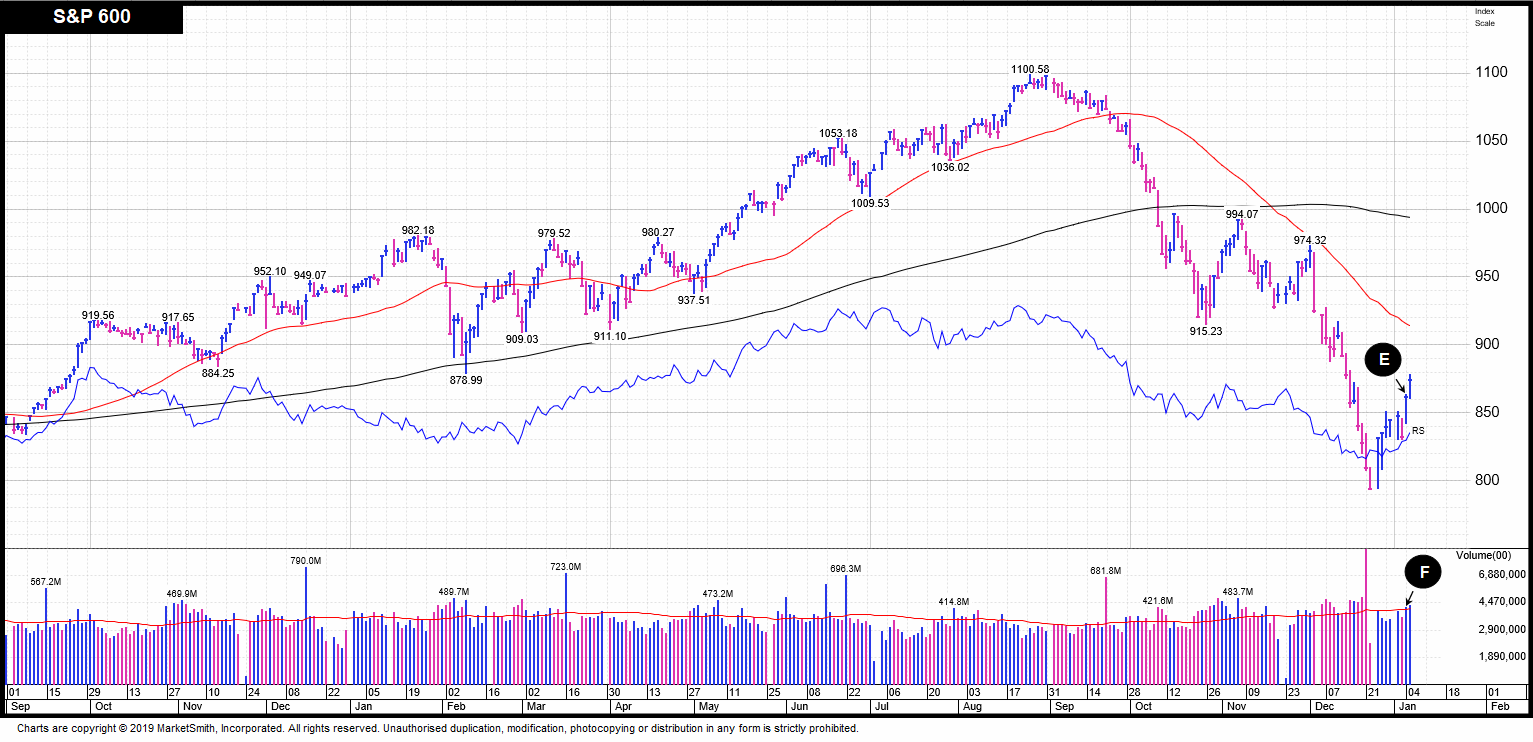

Other key US indexes followed suit such as the S&P 600 vaulting 3.54% (Point E) in volume (Point F) 5% above its average.

European markets also on January 4th staged powerful follow throughs. The DAX (German stock market) for example shot up 3.37% marking a day four follow through and the CAC (French stock market) leaped 2.72% which resulted in a day five follow through.

In Asia, we have two indexes that have so far followed through. The SENSEX (Indian stock market) followed through 2nd November 2018 and the Nikkei 225 (Japanese stock market) followed through in yesterday’s overnight session, January 7th.

We are still waiting for the two main Chinese markets to follow through. The Shanghai Composite and SZSE Component are currently on day three of a new rally attempt and so we’d like to see them stage powerful follow throughs ideally either tomorrow (day four), Thursday (day five), Friday (day six) or next Monday (day seven).’

We then went on to say:

‘We still believe that this rally has got a greater chance of success than the previous attempts.

Here’s our six reasons why:

1) So far, since the rally began, we’ve seen only one day of institutional selling – that’s good.

2) Lots of stocks followed through on the 4th of January including leading bellwether stocks Alibaba +7%, Intel +6.14%, Tencent +5.81%, Google +5.13%, Amazon +5.01%, Facebook +4.7% and Microsoft +4.7%.

3) This rally also started with a massive ‘day one’. For example, we had a 5.58% surge on the NASDAQ Composite and volume 3% above average suggesting institutional buying.

4) Two of the days prior to the follow through started down for the day and one of those days, the Composite was down as much as 3.3% intraday, but it remarkably rallied back strong and finished in the black. That’s two big huge bullish reversals in the last eight trading days. That suggests that the big players have been buying into the weakness.

5) The NASDAQ Composites correction from top to floor has been 22.5% which in our eyes constitutes a solid ‘reset’ amount.

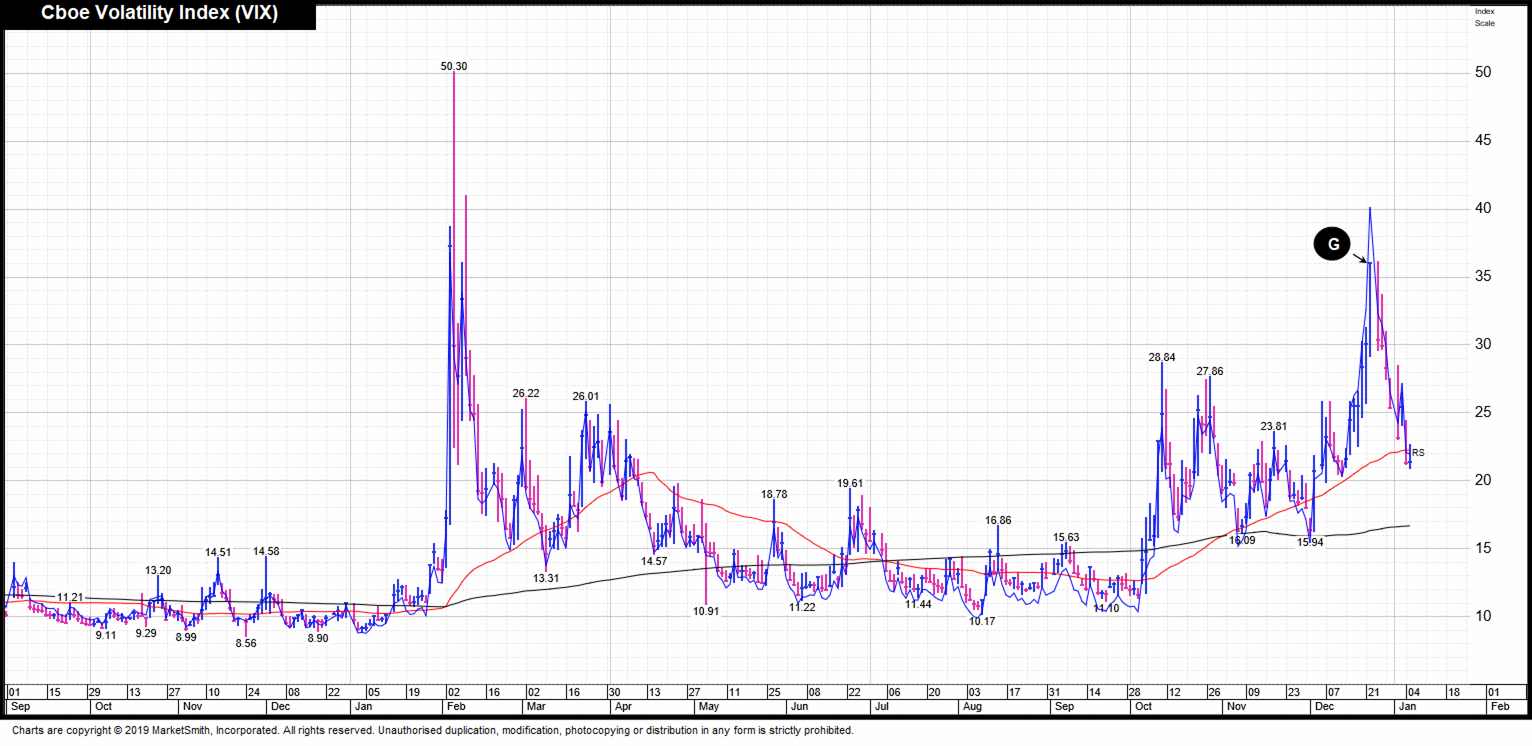

6) We also like that on the day the market hit a bottom, investment fear was high. On December 24th the VIX hit 32.5 (Point G) which is a level that we often see at market bottoms.’

Next, we said…

‘But we do still have a few concerns. All of the main US indexes are still trading below their all-important 50 and 200-day moving averages. We are also wondering why we saw low volume rises yesterday in the chip sector and on the QQQ’s (NASDAQ 100 tracker). With the NASDAQ Composite climbing in heavy trade, why was volume in the big tech stocks and the semiconductor sector below average?

We are also aware that the US indexes are all approaching very tough areas of resistance. That means the sellers could very soon rush in. What’s more, the market was due a bounce and so the recent big move to the upside was expected. We also can’t understand why Indian and Chinese equities (two of the recent leaders) have both been underperforming since December 24th?

And so, for now we are more bullish than bearish about this latest rally attempt. In our eyes, it’s so far so good. With us being encouraged by this latest behaviour, we have started to search for possible investment opportunities should the market continue to act well.’

As always, if you have any questions or thoughts on the points covered in this post, please call Mr Paul Sutherland, ISACO’s co-founder and Managing Director on his personal telephone number which is 01457 831 642. His email is Paul@isaco.co.uk. You could also leave a comment below or connect with us @ISACO_ on Twitter.

A specialist in ISA and SIPP Investment

ISACO are a specialist in ISA and SIPP investment and together with our clients have an estimated £75 million actively invested1. Our flagship service is called ‘Shadow Investment.’ ‘Shadow Investment’ is a unique service which gives you the opportunity to look over our shoulder and buy the same actively managed funds that we personally own, effectively piggybacking on our expertise.

Put our money where our mouth is

The key difference with our service is that we put our money where our mouth is. And as an ISACO premium client, you’ll have the opportunity to mirror our ‘market–beating2. investment portfolio throughout the year. This gives you the potential for achieving almost identical returns to the ones we make. Past performance is not a guide to future performance.

Shadow Investment benefits:

- Low cost (typically 1% per year)

- Saves you time

- Offers the potential for superior ‘tax-free’ growth (8% annual aims).

The Shadow Investment Service has been created to save you the hassle of having to become an investment expert and allows you to keep full control of your investment account. It takes the hard work out of investing and helps to remove the uncertainty of knowing what investment funds to buy, when to buy, if to hold and when to sell.

Get in touch

If you have over £250,000 actively invested, click here to arrange a free financial review (valued at £495) with Paul Sutherland, ISACO’s Managing Director.

1 Internal estimation taken January 1st 2015 of total ISA and pension assets owned by the ISACO Investment Team and ISACO premium clients.

2 January 1st 1998 - December 31st 2018 ISACO 163.3%, FTSE 100 30.7%.