In this series of posts we are looking at how understanding behavioural finance can help you make better investment decisions. In this post we'll look at the dangers of overconfidence.

The dangers of overconfidence for ISA and SIPP Investors

Tags: Investment strategy, Behavioural Investing, Investment mistakes

Common mistakes ISA and SIPP investors make

In this series of posts we are looking at how understanding behavioural finance can help you make better investment decisions. In this post we'll look at some of the most common mistakes investors make and how to avoid them.

Tags: Investment strategy, Behavioural Investing, Investment mistakes

Mistakes ISA and SIPP investors make and how to avoid them

In this new series of posts we are going to look at how understanding behavioural finance can help you make better investment decisions and the process starts with getting a good grip on your financial personality. The key is to try becoming aware of the decisions you make and how you are likely to react to the uncertainty that comes with investing in the stock market. Understanding your financial personality can also help to control the irrational and illogical elements of your investment decisions.

Tags: Investment strategy, Behavioural Investing, Investment mistakes

In this series of posts we've been looking in detail at 7 of the most common mistakes that investors make. In this post, we'll conclude with our nine investment lessons for success. By trying to avoid the mistakes and adhering to the lessons, you are probably going to have a much better chance of reaching your goals.

The 7 most common mistakes investors make: Mistakes number 6 and 7

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 6, 'not keeping score' and mistake number 7, 'investing too conservatively'.

The 7 most common mistakes investors make: Mistakes number 4 and 5

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 4, 'Concentrating too much on fundamentals' and mistake number 5, 'Playing ‘buy and hold'.

Tags: Investment strategy, Investment mistakes, Investment charges

The 7 most common mistakes investors make: Mistakes number 2 and 3

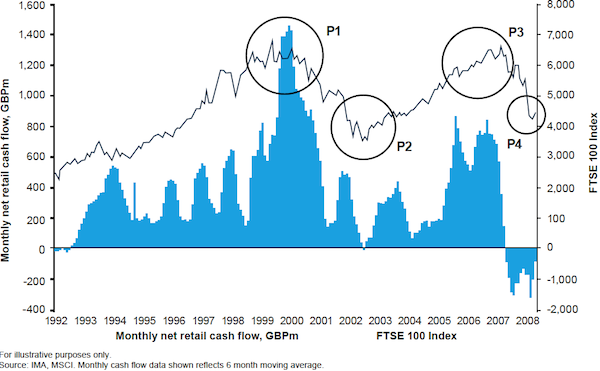

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 2, 'Choosing funds that own underperforming stocks' and mistake number 3, 'Buying at marketing tops'.

Tags: Investment strategy, Investment mistakes, Investment charges

The 7 most common mistakes investors make: Mistake number 1

In this new series of posts we're going to look at 7 of the most common mistakes that investors make. In this post, we'll start by looking at maistake number 1, 'Making 'low fees' the highest priority'.

Tags: Investment strategy, Investment mistakes, Investment charges

The 5 most popular ways of getting investment tips, advice and ideas

There are many ways to get advice and investment tips and in this post I’m going to focus on the most popular. For most people, advice on what to invest in and when to invest tends to come from one of five sources:

Tags: Investment strategy, Investment Guidance, Investment mistakes

In this series of posts we've been looking at some mistakes that fund investors often make. By avoiding these, you'll give yourself a much better chance of achieving your financial goals.

Tags: Investment risk, Achieving your investment goals, Investment mistakes