In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 2, 'Choosing funds that own underperforming stocks' and mistake number 3, 'Buying at marketing tops'.

If you would like to know more about this and other investing mistakes to avoid, please just download our free report The 7 Biggest Mistakes That Investors Make.

What are laggard stocks and why it matters

Many rookie investors unfortunately buy funds that own laggard stocks. We class a laggard as an equity that is currently underperforming the general market. Since we began investing back in 1997, we’ve noticed time and time again that the strongest stocks tend to get stronger and the weakest ones tend to get weaker. This is why we pay a lot of attention to funds that own stocks making new highs.

Buying a fund that owns companies making new price highs is psychologically challenging for most investors. It just doesn’t feel right due to our make-up. Most of us would rather buy something when it’s cheap and beaten down. Why? It’s because when a stock is well off its highs, it feels as if we are getting a bargain and as human beings, most of us love a bargain. But beware because when equities are beaten down, nine times out of ten we find that they are low in price for a good reason.

On the flip side, when a stock is breaking into new high ground, there’s a good reason for that too. When stocks are trading near their lows, it’s usually because the company is going through a bad time financially. Sales are usually on the slide with no indication of a turnaround. And when companies are hitting fresh highs, it’s usually because the company is breaking sales and profit records.

Let me ask you a question. Which fund would you like to own? Fund A, that owns companies with record sales and profits, or Fund B, one that owns companies with serious financial difficulties? Most investors are familiar with the adage ‘buy low, sell high’ but is this a sound investment strategy? Are low priced 'bargain' stocks really a bargain if their performance continues to lag behind the rest of the market? The task for astute investors is to locate funds that own strong, leading companies and avoid funds that own weak, laggard performers.

What makes a leading stock?

Just so that you are clear, a leading stock is not necessarily the biggest company in its market. We class a leading stock as one that has an RS (relative strength) rating of 80 or above and an EPS (earnings per share) rating of 80 or above. Some companies that have huge market capitalizations are titans in their industries but laggards when it comes to their earnings per share and relative strength ratings. In our view, if you want to improve your odds of buying a fund that becomes a big winner, stick to the ones that own leading stocks, not laggards.

Avoid buying funds at market tops

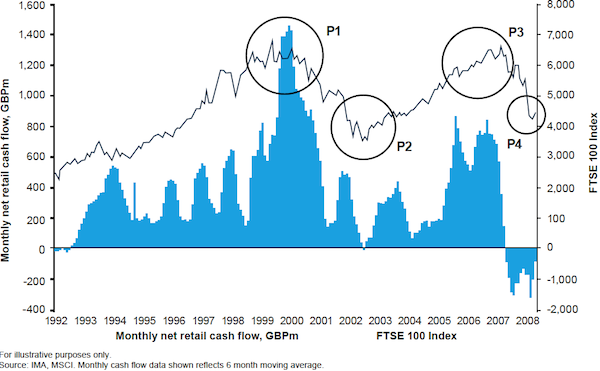

Investors realise the importance of aiming to buy when the market is low and sell when the market is high, however evidence suggests that they struggle to put this concept into practice. The chart below shows historic net investment flows (investment buying minus investment selling by retail clients) into equity funds by UK investors alongside movements of the FTSE 100 Index, between 1992 and 2009.

As can be seen, investment flows (buying) increase significantly as markets peak, especially during P1 in 2000 and P3 in 2006/2007, and decrease during market dips, especially during P2 in 2002 and P4 in 2008, when we see net outflows (selling) from funds. The challenge investors face is when the market is at its bottom, no investors feel like investing.

And when the market is at its top, most investors find it hard not to buy, again because of how they feel. Investors go through a range of emotions at different points of a market cycle. Unfortunately, as you’ve just seen, all too often this can result in investors entering or exiting the market at precisely the wrong time. As markets peak, investor sentiment is running high with emotions of excitement, thrill and euphoria, tempting investors to flood into highly priced markets.

But as markets dip, sentiment begins to run low and negative emotions of panic, despondency and depression lead investors to exit the market and realise a loss. Our suggestion to avoid this happening to you would be to try not to let your emotions get in the way. How do you do that? We like to use rules rather than relying on emotions. Our rules are very contrarian and similar to Warren Buffett’s. Warren says that when the crowd is greedy, get fearful, and when the crowd is fearful, get greedy.

Remember, if you would like to know more, please just download our free report The 7 Biggest Mistakes That Investors Make.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO specialises in ISA and SIPP Investment and is the pioneer of ‘Shadow Investment’; an easy way to grow your ISA and SIPP at low cost. Together with our clients, we have an estimated £57 million actively invested in ISAs and pensions*. Clients like us because we have a great track record of ‘beating’ the FTSE 100**. Over the last 16 years, we’ve outperformed the Footsie by 60.2% and over the last 5 years, we’ve averaged 14.5% each year versus the FTSE 100’s 8.8%. You can find us at www.ISACO.co.uk.

What is Shadow Investment?

Picking the right fund for your ISA and SIPP is not exactly the easiest job in the world. And knowing 'when' to buy and 'when' to exit is even more difficult! Our ‘Shadow Investment’ Service is here to help. Our service allows you to look over our shoulder and buy the same funds that we are buying.

When we are thinking of buying a fund, we alert you so that you have the opportunity to buy it on the same day that we buy it. We also tell you about when we are planning to exit the fund. You control your investment account, not us. You can start small and invest as little or as much money as you like.

By knowing what we are buying, when we are buying and when we are exiting, throughout the year you can mirror our movements and in effect replicate our trades. This means you have the opportunity to benefit from exactly the same investment returns that we get. Our investment aims are 10–12% per year.

We are totally independent, fully transparent and FCA compliant. We’re warm, friendly and highly responsive and it’s a very personal service that gives you direct access to the Sutherland brothers; ISACO’s two founders.

Who are ISACO’s clients?

Clients who benefit most from our service have over £250,000 actively invested and the majority of them are wealthy retirees, business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector, such as IFAs and wealth managers.

Do you have questions?

To have all your questions answered, call 0800 170 7750 or email us at: info@ISACO.co.uk.

*November 15th 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

**Long-term performance: December 31st 1997 - December 31st 2013 ISACO 91.3%, FTSE 100 31.1%. 5 year performance: December 31st 2008 - December 31st 2013. ISACO Investment performance verified by Independent Executives Ltd.

> " target="_self"> To download our free report 'A Golden Opportunity' >>

>" target="_self"> To download our Shadow Investment brochure >>

> " target="_self"> To start your 14 day free 'no obligation' trial of Shadow Investment >>