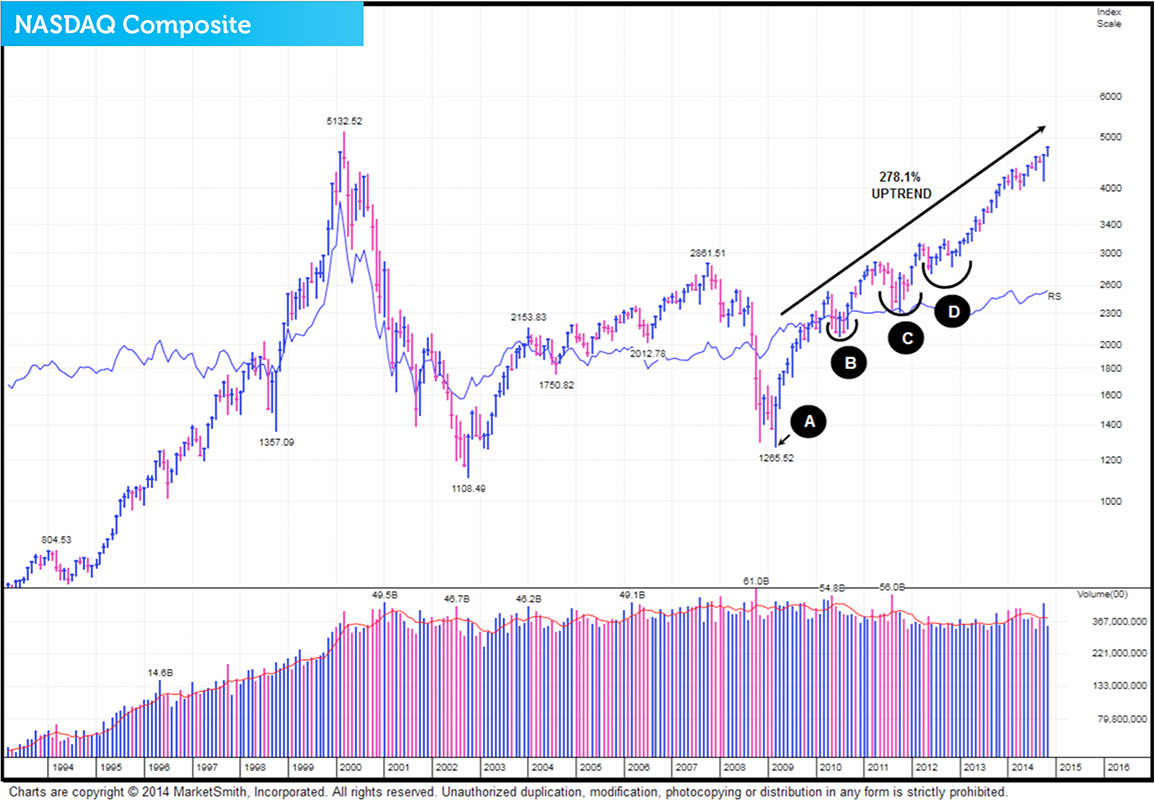

This is the second in a new series of posts, where we're looking at gauging the stock market's direction. In this post we'll look at a 'buy and hold' investment strategy and discuss whether this approach is broken.

How to gauge the stock market's direction

This is the first in a brand new series of posts, where we're going to be looking at gauging the stock market's direction.

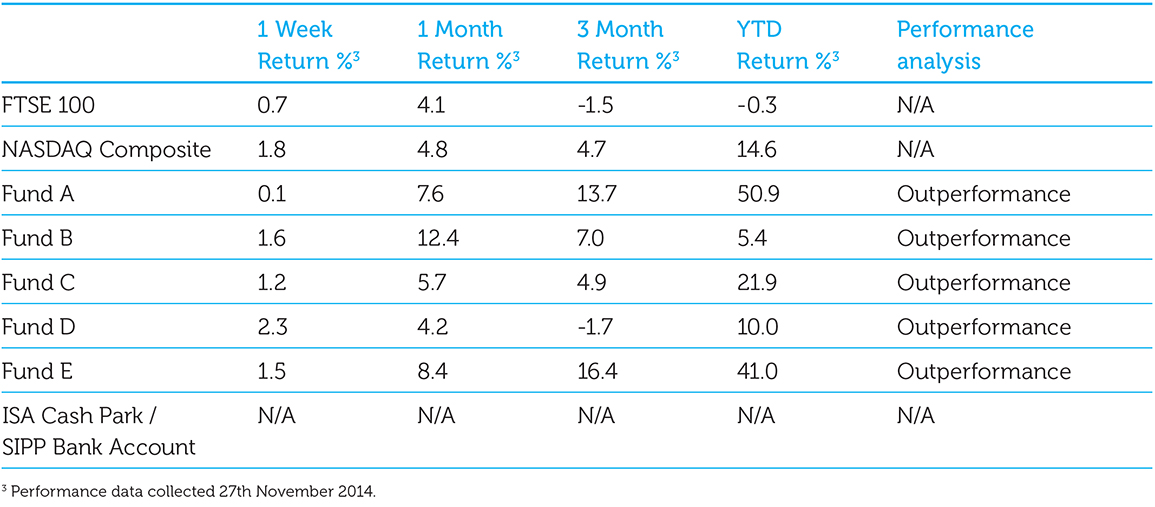

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as the long-term performance of the present fund manager being a key factor in fund selection, the short-term performance of the fund manager is very important too. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

This is our fourth and final post in a series of posts where we're looking in detail at timing your fund investments. In our last three posts we discussed the importance of recognising chart patterns when timing buys. In this post we'll go on to look at when to sell a fund.

Tags: Fund timing, Investment strategy, Investment tutorials