It has been a while since we posted our last blog and so we felt it fitting to get you up to speed with our latest thoughts on the market.

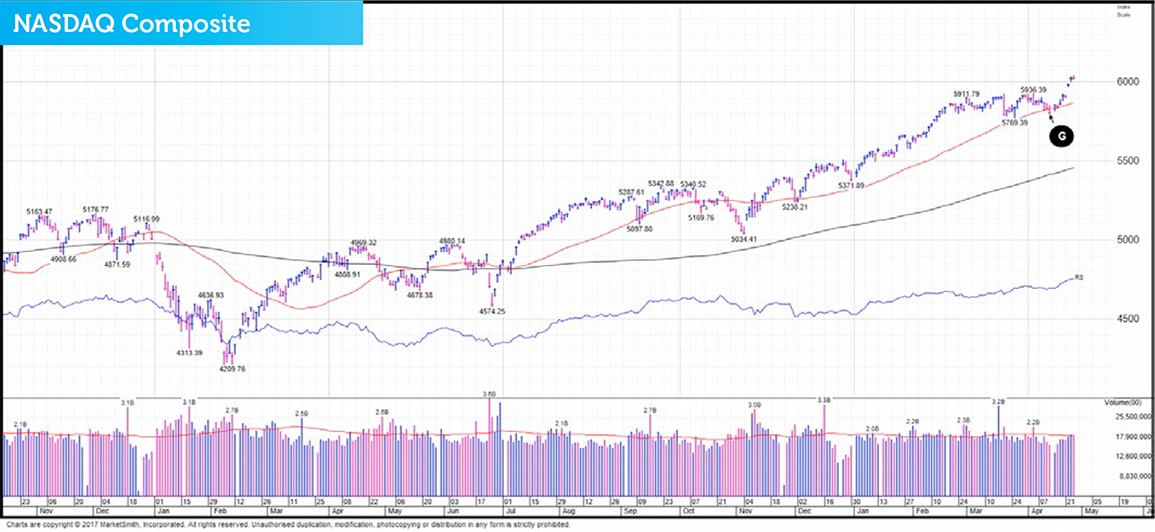

Let’s begin with looking at what we were saying in our Daily Market Update on Thursday April 27th 2017. In that update we said…

Great news for ISA and SIPP Investors - stock market’s next leg up may have just begun

Tags: Investment outlook

In this post we'll take a look at what has been happening in the market since early May.

This information is taken from The Big Picture, to download a sample copy please just click here.

The way we use to check if the market is behaving as it should is to look at the trading action (price and volume activity) of institutional investors. Why do we do this? The stock market is about six month forward looking and its daily activity is the consensus conclusion whether institutional investors like or don’t like what they see happening down the road. By watching what the big players are doing (buying or selling) each and every day, it can provide essential clues to which way the market is likely to head.

How to know if your fund is acting right

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

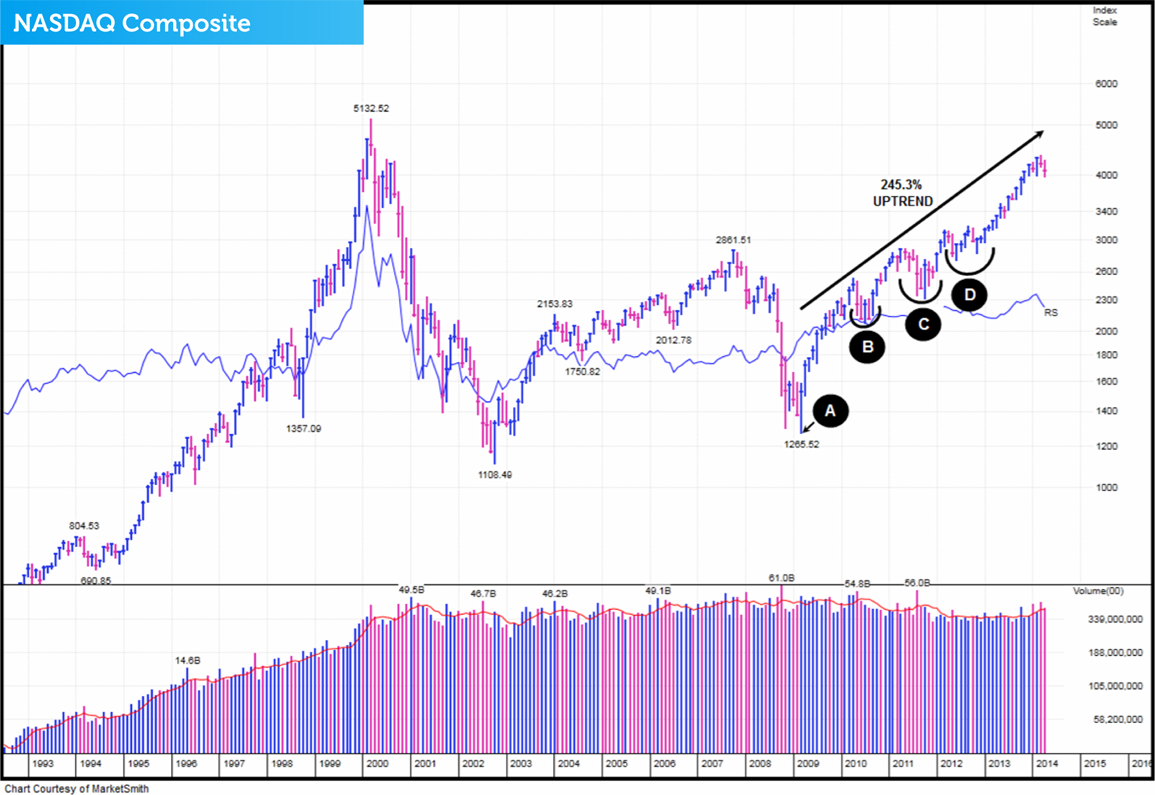

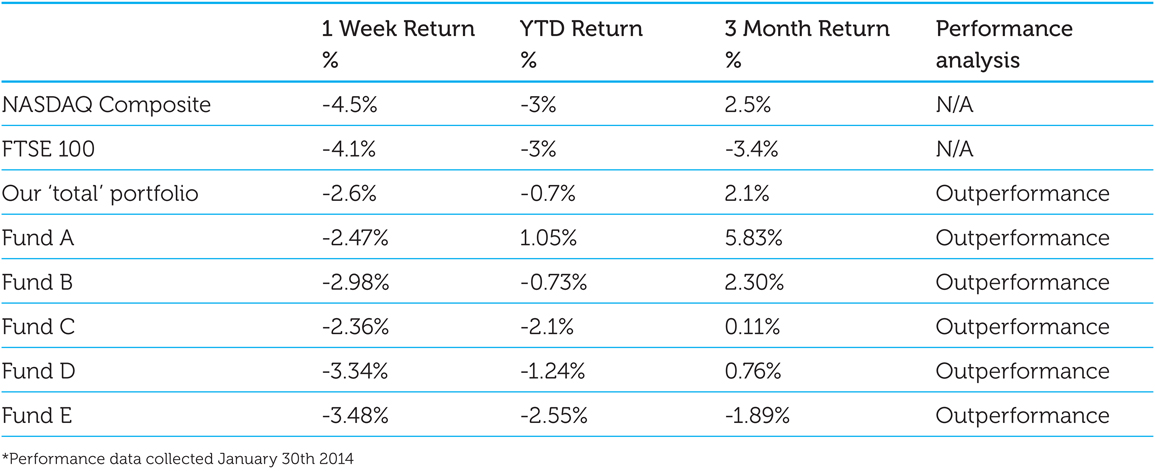

Have we just entered a new bear market?

In this post we'll take a look at what has been happening in the market since the beginning of March.

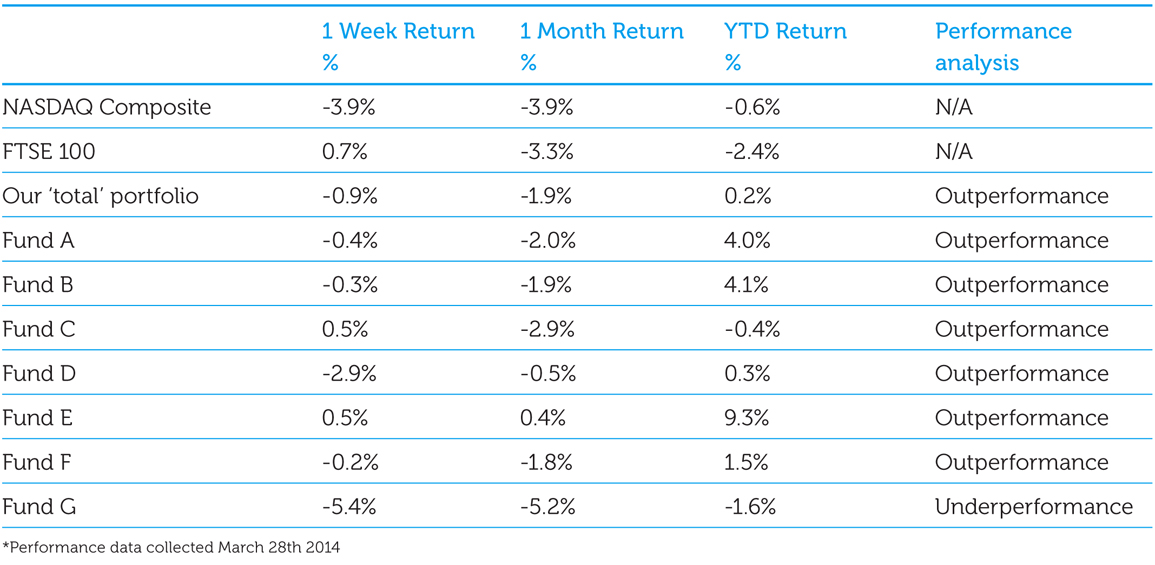

How have the funds in our portfolio been performing?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

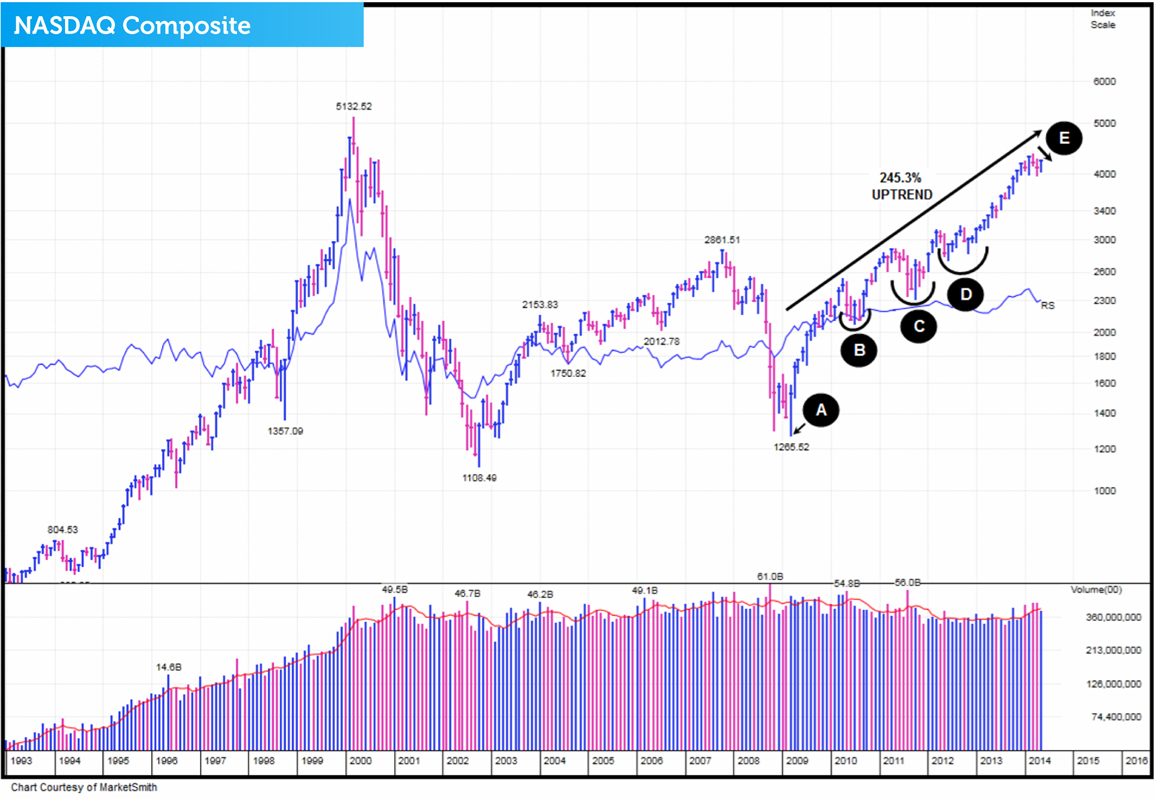

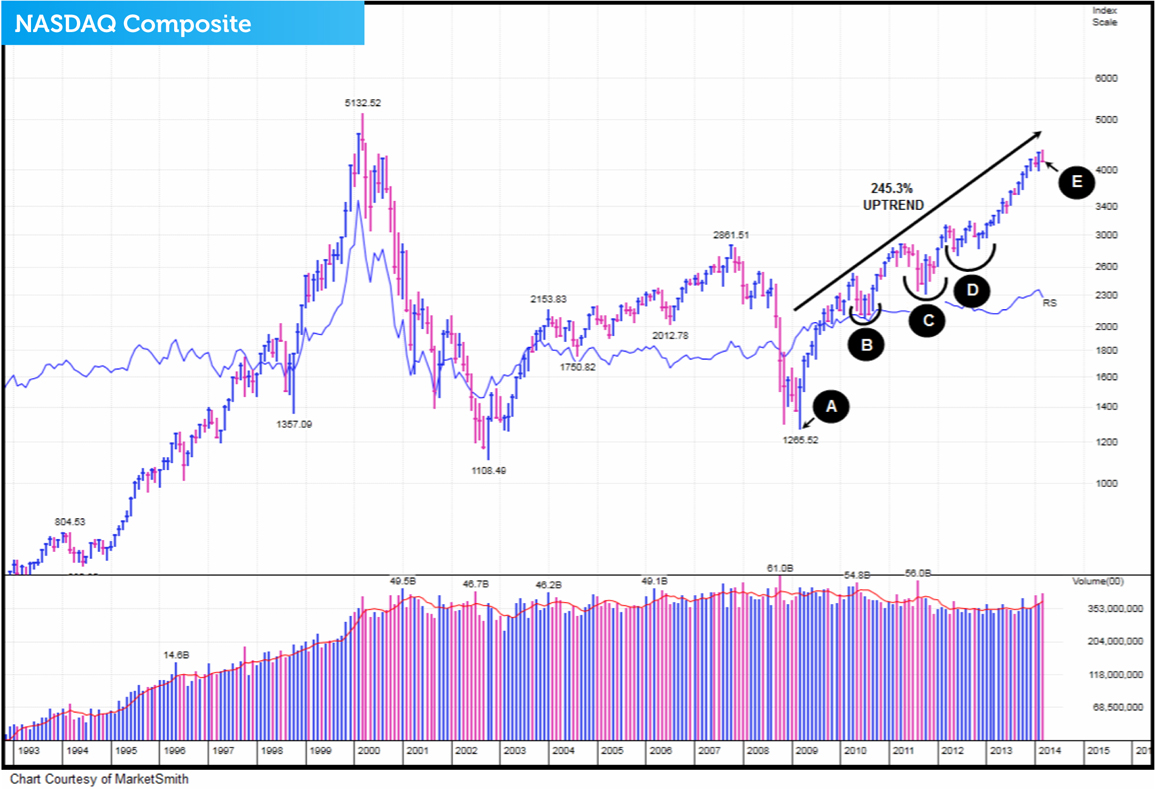

Does the bull market have further to run?

In this post we'll take a look at what has been happening in the market since the beginning of February.

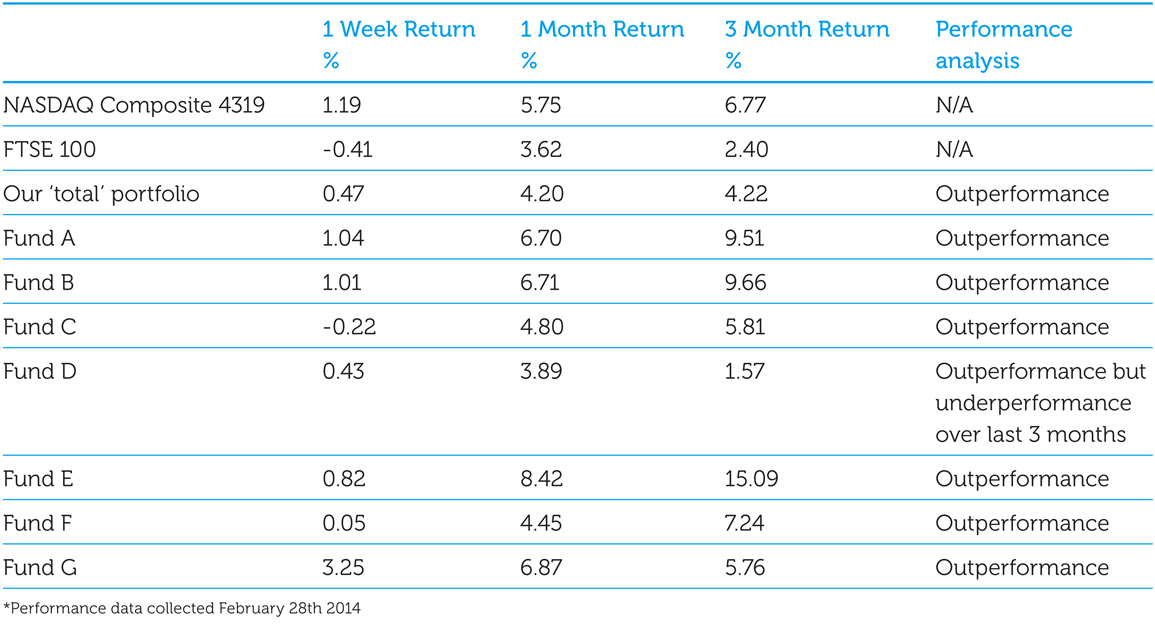

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being an important factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

On January 30th 2014, we took a good look at the performance of the five funds that we own, our ‘total’ portfolio's performance, the performance of the FTSE 100 and performance of the NASDAQ Composite. This is what we discovered:

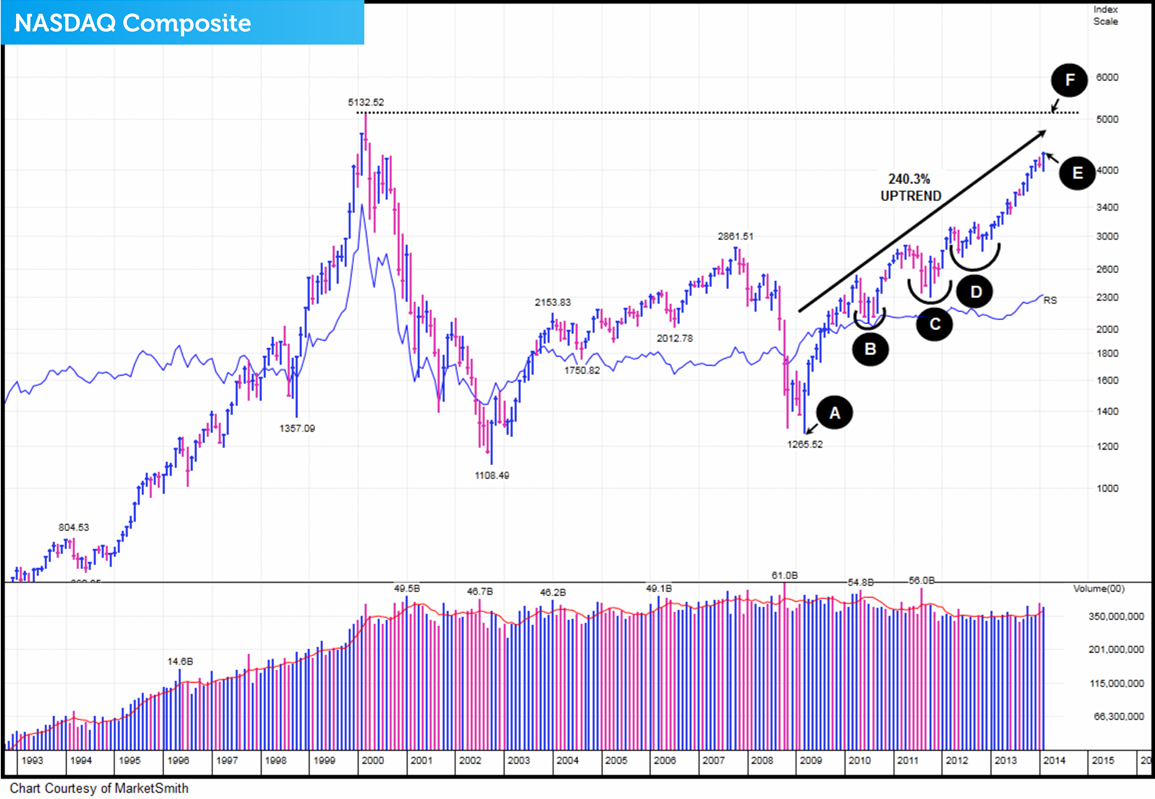

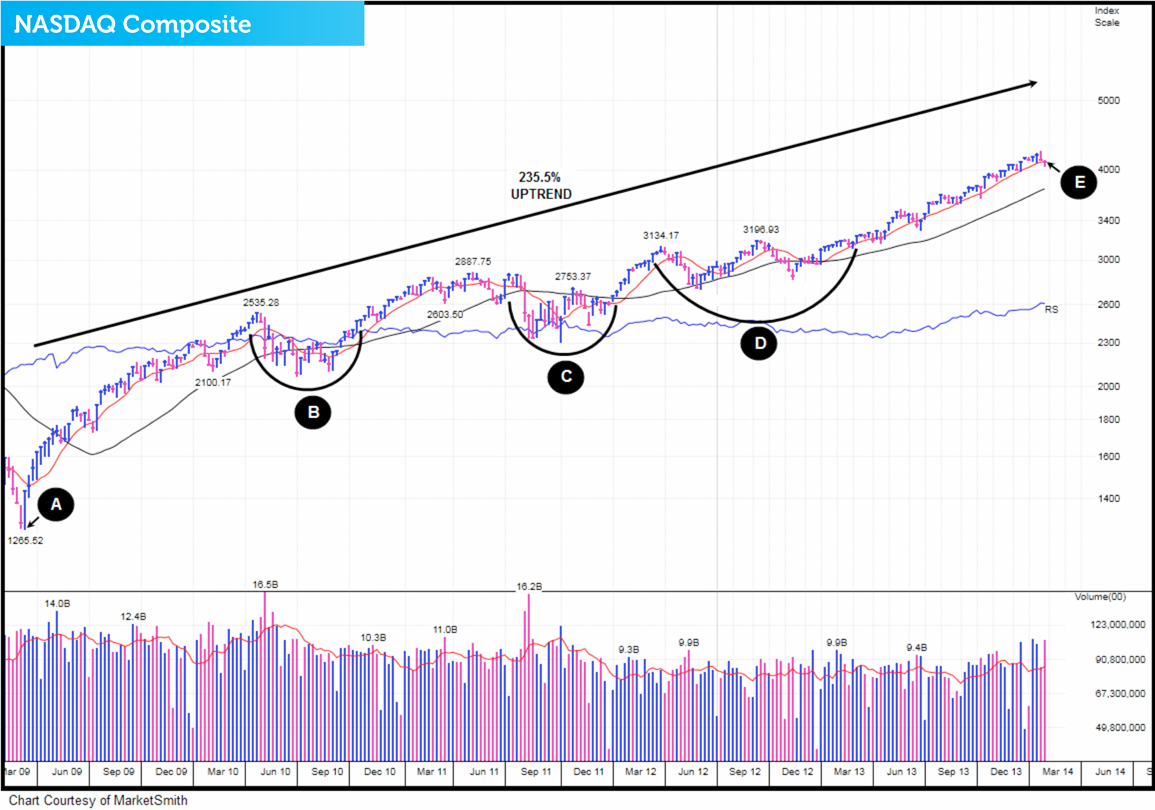

Bull market? Bear market? Where are we?

It's a question we're often asked - are we in a bull market or a bear market? In this post, we'll examine the evidence in more detail.

Tags: Investment outlook, Investment strategy, Investment news

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being an important factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.