My new book How to Make Money in ISAs and SIPPs will be available to buy from March 1st. Over the last few weeks we've shared some of the reviews the book has received and in this post we'll add the thoughts of three of our Premium Clients.

The latest reviews of How to Make Money in ISAs and SIPPs

Tags: ISA investing tips, How to Make Money in ISAs and SIPPs, Investment strategy

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being an important factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

Where could the market be heading next?

In The Big Picture each month, we look at where the market could heading next. This post is an extract from our January 2014 edition. To download a sample copy please just click here.

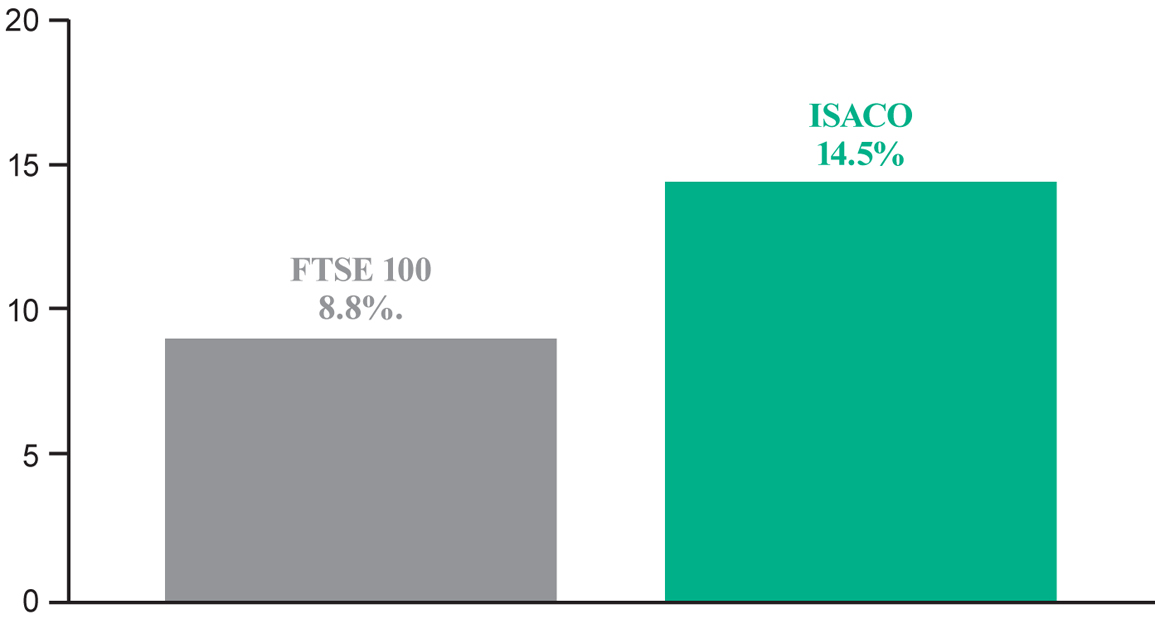

Our 2013 return was 23.1% compared to 14.4% from the FTSE 100

We are proud of our 23.1% 2013 return, which some would say is impressive and even more so when compared to the FTSE 100’s 2013 return of 14.4%.

Tags: Investment funds, Investment strategy, Investment news

Grow your wealth in 2014 with How to Make Money in ISAs and SIPPs

Happy new year from everyone here at ISACO.

The reviews continue to come in for How to Make Money in ISAs and SIPPs and we're happy to share more of these '5 out of 5 star' reviews with you.

Tags: ISA investing tips, How to Make Money in ISAs and SIPPs, Investment strategy