There aren't many ways to keep your money away from the the taxman, but an Individual Savings Account (ISA) is one way of doing it. In this post we'll look at the tax advantages of ISAs and how they can dramatically benefit investors.

There aren't many ways to keep your money away from the the taxman, but an Individual Savings Account (ISA) is one way of doing it. In this post we'll look at the tax advantages of ISAs and how they can dramatically benefit investors.

An ISA isn’t an investment itself, but a special type of savings & investment account that acts as a protective wrapper, so your money is immune from both Income and Capital Gains Taxes.

As long as your money remains in an ISA, you won't have to pay any tax on it. However, once you withdraw it, or if you close the account entirely, then it becomes taxable again. In other words, you'll want to keep your money inside the ISA wrapper for as long as possible. To maximise the tax advantages of ISAs, it's worth thinking of them as investments for life.

Are the tax advantages of ISAs worth it?

This depends on your personal circumstances, so only you can answer this question. However, we believe that, for many people, an ISA is one of the most generous handouts they will receive from the Chancellor.

Over the years, investing in an ISA can save you thousands of pounds that you would otherwise have paid in tax. In an era when the upward pressure on tax seems to be relentless, this is doubly important.

Every time taxes rise, the tax advantges of ISAs become even more valuable. In this environment, it's worth taking full advantage of any relief from tax you can get.

How much tax will you save?

If you pay tax at the basic rate, then you'll pay 20% tax on your savings interest if it's not in a tax-free wrapper like an ISA . What's more, if you're a higher rate taxpayer, you'll pay 50% tax on your savings interest.

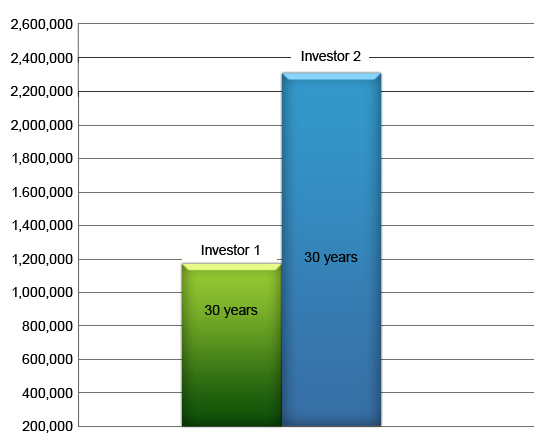

To illustrate how much tax you could save when investing in ISAs, let’s imagine two investors who earn identical amounts of money each and every year.

Investor number 1 decides to invest without using an ISA, while investor number 2 decides to invest using an ISA. For the purposes of this example, we'll assume that both investors make a 7%* return on their portfolio each year.

Investor number 1, who does not use his ISA, has to pay tax on his gain and because he’s a higher rate tax-payer, his gain is reduced to 3.5%.

Investor number 2, on the other hand, keeps all of his 7% gain because his gain is protected from tax by his ISA.

Look at what happens to their trading accounts over various periods of time, assuming that both were investing £1,880 each and every month. We’ve used £1,880 per month in our example because it is the equivalent of the maximum that a couple could invest using an ISA for the tax year 2012/13.

Time period invested

|

Investor 1 - (no ISA)

|

Investor 2 - (ISA)

|

10 years |

£270,440

£327,298

15 years

£445,514

£599,365

20 years

£654,016

£985,056

25 years

£902,331

£1,531,819

30 years

£1,198,060

£2,306,924

As you can see on this chart, by investing over the long-term using an ISA, Investor number 2 ends up with £2.3 million pounds after 30 years – more than double the amount of the other investor.

About ISACO

We specialise in providing a premium Investment Guidance Service for ISA and SIPP investors with portfolios in excess of £100,000.

Our mission is to help investors achieve better performance over the long-term, better protection in falling markets and at a better price.

For more information about ISACO and our Investment Guidance Service, please read our free brochure.

If you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.