Are you looking for impressive ISA investment returns over the long-term? If so, it’s important to know that, when investing for growth, the size of your annual returns will always depend on four factors. These form The Performance Quadrant.

Are you looking for impressive ISA investment returns over the long-term? If so, it’s important to know that, when investing for growth, the size of your annual returns will always depend on four factors. These form The Performance Quadrant.

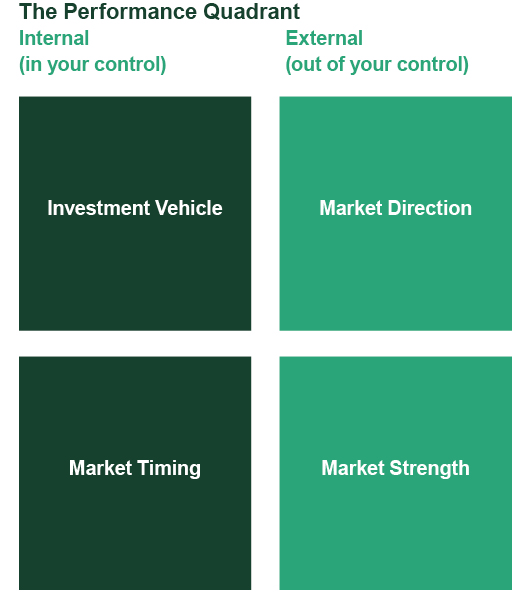

I created The Performance Quadrant to highlight these factors and it’s based on the notion that, when investing in the stock market, there are some things that are in your control and some things that aren’t.

The Performance Quadrant is made up of four parts, with two of the components being in your control and two being out of your control. As there are two components that are out of your control, it's unfortunately impossible to predict the exact size of the returns you are likely to make.

However, as you will soon see, because you do have two elements within your control, if you handle those two parts well, it could increase your chances of achieving attractive ISA investment returns over the long-term.

Investment Vehicle

The first part of the quadrant is the Investment Vehicle and in this example we are going to use a favourite of mine; investments funds. It’s common sense that if you choose well, it will have a positive effect on your ISA investment returns and if you choose badly, it will have a negative effect. But what should be your buying criteria?

If you are an adventurous investor like me with a long-term time horizon, your aim would be to choose high quality investment funds – growth funds that have the greatest potential for swift price rises from the moment they are purchased. This is a difficult task but made easier with knowledge and lots of practice.

Your objective would be to buy 'best of breed' growth funds that exhibit superior sustainable growth potential and hold them for as long as they demonstrate outperformance.

Market Timing

The second part of The Performance Quadrant is Market Timing. The timing of your buys and exits are also in your control. Because three out of every four funds move in the same direction as the general market, your aim should be to invest in rising markets and stay on the sidelines in falling markets. When a major downtrend is triggered, the objective is to switch out of equity funds and into cash by using cash parks to preserve your wealth. This sounds easy in practice, however it's very difficult. Market timing is made easier by daily studying of the price and volume activity of institutional investors.

Direction

The third part of The Performance Quadrant is Market Direction. Market direction is out of your control and it's impossible to ‘will’ the market upwards. And if the market does not go up, funds are not going to go up either. As I previously mentioned, three out of every four investment funds move in the same direction as the market.

That tells you that the annual returns of the funds you choose throughout your investing career will be directly linked to the market’s direction. If the market is trending upwards, three out of every four funds will move up. If the market is trending downwards, funds are going to move down. And if the market is trending sideways they are going to move sideways.

Market Strength

The fourth and final part of The Performance Quadrant is Market Strength. The strength of the market's trend is also out of your control. If the market is trending upwards and the trend is strong, fund performance will be impressive. For example in 1999, the Nasdaq Composite, the index I benchmark against went up 86% in one year! During that year, investment funds were moving up 100%, 200%, 300% and even 400% – over a short 12 month period. The rule is: quality investment funds make substantial gains when the market is strong.

Hopefully you will now be able to see the link between the funds you buy, the market's direction, the market’s strength and the ISA investment returns you achieve. With this in mind I suggest you set different aims for different market environments. For example my aims are based on a period of between five and fifteen years.

- Sideways trending market: The aim is 3%-5% per annum.

- Upwards trending market: The aim is 12%-15% per annum.

- Very strong upwards trending market: The aim is 15%-20% per annum.

My take on the next decade

From the numerous reports, graphs, studies and data I’ve read and analysed, my belief is that over the next decade we are going to experience a very strong upwards trending market, which could result in 15%-20% annual growth. If you are interested in knowing what my estimations are based on, take a look at a previous blog called Is now a good time to invest? In this blog I fully explain why I believe the up and coming decade will be one of outperformance.

I hope you've found this post useful. As always, if you have any questions or thoughts on the points I've covered, please leave a comment below or connect with us @ISACO_ on Twitter.

Please note past performance should not be used as a guide to future performance, which is not guaranteed. Investing in Funds should be considered a long-term investment. The value of the investment can go down as well as up and there is no guarantee that you will get back the amount you originally invested.

About ISACO

ISACO was established in 2001 by brothers Stephen and Paul Sutherland and is the first financially regulated firm to offer adventurous ISA and SIPP investors a unique personal investment service that shares on a daily basis our star-performing investor’s thoughts, personal insights and investment decisions.

Clients enjoy being informed throughout the year what ‘best of breed’ funds our premier investor currently owns, when he’s buying and when he’s moving into the safe harbour of cash – helping clients enjoy more control, manage their portfolio more effectively and benefit from the potential of outstanding long-term returns.

For more information about ISACO and our Investment Guidance Service, please read our free brochure.