I recently read a great book called Behavioural Investing written by James Montier and I learned something I would like to share with you. Psychologists have suggested that we have two different systems embedded within our minds. One system is emotional, and the other logical. In this post, we'll look at behavioural investing and the dangers of letting your emotions get in the way of your investment decisions.

I recently read a great book called Behavioural Investing written by James Montier and I learned something I would like to share with you. Psychologists have suggested that we have two different systems embedded within our minds. One system is emotional, and the other logical. In this post, we'll look at behavioural investing and the dangers of letting your emotions get in the way of your investment decisions.

Of course, we all use both systems at various points. Indeed, the evidence suggests that those with severely impaired emotional-systems can't make decisions at all. They end up spending all day in bed pondering the possibilities, without actually engaging in any action.

However, from an investment perspective we may well be best served by using our logical system. Lucky for us, we can test how easy it is to override the emotional system. Shane Frederick of Yale (formerly of MIT) has designed a simple three-question test which is more powerful than any IQ test or SAT score at measuring the ability of the logical system to check the output of the emotional system. Together these three questions are known as the Cognitive Reflection Task (CRT).

Consider the following three questions:

- A bat and a ball together cost £1.10 in total. The bat costs £1.00 more than the ball. How much does the ball cost?

- If it takes 5 minutes for 5 machines to make 5 widgets, how long would it take 100 machines to make 100 widgets?

- In a lake there is a patch of lily pads. Every day the patch doubles in size. If it takes 48 days for the patch to cover the entire lake, how long will it take to cover half the lake?

Each of these questions has an obvious, but unfortunately incorrect answer, and a less obvious but nonetheless correct answer. In question #1 most people who take the test answer 10p. However, a little logic shows that the correct answer is actually 5p. If the ball costs 5p and the bat costs £1.05p, there is £1.00 difference between the two and the total of the two items is £1.10.

In question #2 the gut reaction is often to say 100 minutes. However, with a little reflection we can see that if it takes 5 machines 5 minutes to produce 5 widgets, the output is actually 1 widget per machine per 5 minutes. As such, it would take 100 machines 5 minutes to make 100 widgets.

Finally, in question three, the most common incorrect answer is to halve the 48 days and say 24 days. However, if the patch doubles in size each day, the day before it covers the entire lake, it must have covered half the lake, so the correct answer is 47 days.

Don't worry if you got one or all three of those questions wrong as you aren't alone. In fact, after giving the test to nearly 3,500 people, Frederick found that only 17 per cent of them managed to get all three questions right. 33 per cent got none right!

The best performing group were MIT students; 48 per cent of them managed to get all three questions correct, but that is still less than half of some of the best students in the world. The author also had 600 professional investors (fund managers, traders and analysts) take these questions and only 40 per cent managed to get all three questions correct, while 10 per cent didn't get any right.

It’s clear from this simple test that if we rely too much on our emotions to make our investment decisions, we could make unfortunate errors.

Emotions experienced during a full market cycle

Understanding how emotions can kill investment returns has helped me to make better choices. Since beginning my investment career in 1997, I’ve discovered that the best investors don’t let their emotions get in the way of their decisions. They understand that when most people are scared and panic selling, that’s usually the time when you should be buying – even though your emotions are telling you the opposite. That alone is a valuable piece of information.

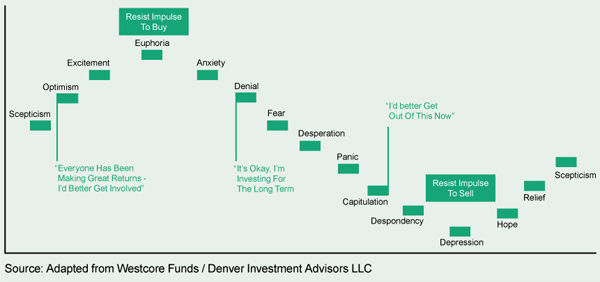

For a visual example, take a look at this chart which shows the emotions experienced during a stock market cycle. A typical cycle lasts approx five years and consists of a bull market (up market) and a bear market (down market).

Moving from left to right, you can see that as the market gets closer and closer to the top, optimism increases until it finally becomes euphoria. This is when everybody including your local taxi driver and all your friends are stating ‘now’ is the time to become invested. It’s when people who have no idea how the stock market works are giving you ‘hot tips’ and talking about packing in their full time jobs because they have made so much money.

At this stage people are delusional and have no idea that it's probably going to end in tears. A perfect example of this ‘euphoria’ stage occurred in 1999. It was the tech bubble and in March 2000, the market stopped going up and started to head south and didn’t stop until October 2002. The Nasdaq lost 78% of its value. When the Nasdaq bottomed in October 2002, investors experienced the feeling of depression.

The two lessons here are:

- When everybody is positive and excited about the market, the market could be close to a top. That means it could be time to move into a cash park.

- When everybody is negative and depressed about the market, the market could be close to a bottom. That means it could be time to invest in quality investment funds.

My goal with this blog has been to make you more aware of the dangers of letting your emotions get in the way of your investment decisions. I also wanted to help you understand that having rules for your investing could improve your long-term returns. As always, if you have any questions or thoughts on the points I've covered, please leave a comment below or connect with us @ISACO_ on Twitter.

If you enjoyed taking the 3 question test as much as I did, please forward this blog post to your friends, family or work associates and ask them to take the test..Enjoy!

Please note past performance should not be used as a guide to future performance, which is not guaranteed. Investing in Funds should be considered a long-term investment. The value of the investment can go down as well as up and there is no guarantee that you will get back the amount you originally invested.

About ISACO

ISACO was established in 2001 by brothers Stephen and Paul Sutherland and is the first financially regulated firm to offer adventurous ISA and SIPP investors a unique personal investment service that shares on a daily basis our star-performing investor’s thoughts, personal insights and investment decisions.

Clients enjoy being informed throughout the year what ‘best of breed’ funds our premier investor currently owns, when he’s buying and when he’s moving into the safe harbour of cash – helping clients enjoy more control, manage their portfolio more effectively and benefit from the potential of outstanding long-term returns.

For more information about ISACO and our Investment Guidance Service, please read our free brochure.