We can all agree that the best time to invest is right at the bottom of the market and the point of maximum financial risk is right at the market's top.

We can all agree that the best time to invest is right at the bottom of the market and the point of maximum financial risk is right at the market's top.

The challenge investors face is that when the market is at its bottom, people don't ‘feel’ like investing. And when the market is at its top, most investors find it hard not to buy – again because of how they ‘feel.’ All too often investors are influenced by short-term market movements rather than focusing on the longer-term trend and how this fits with their own investment objectives.

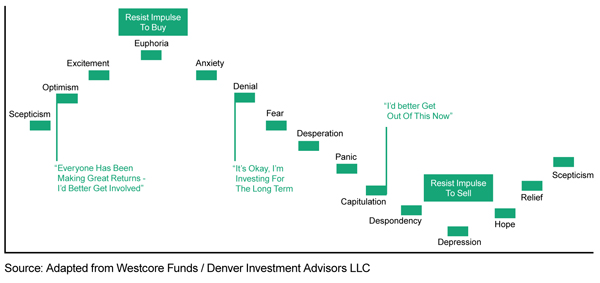

As the chart below illustrates, many investors go through a range of emotions at different points of a market cycle.

Unfortunately, all too often, this can result in investors entering or exiting the market at precisely the wrong time and missing the best time to invest. As markets peak, investor sentiment is running high with emotions of excitement thrill and euphoria, tempting investors to flood into highly priced markets. But, as markets dip, sentiment begins to run low and negative emotions of panic, despondency and depression can lead investors to exit the market and realise a loss.

The best time to invest is often when it feels most difficult

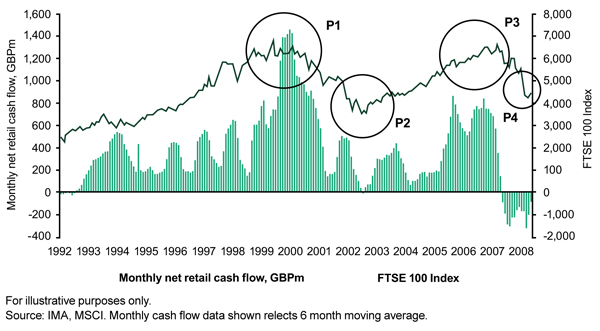

To support the theory that most retail investors buy and sell at the wrong time, the next chart shows historic net investment flows (investment purchases minus investment sales by retail clients) into equity funds by UK investors alongside movements of the FTSE 100 Index, between 1992 and 2009.

As can be seen, investment flows increase significantly as markets peak, especially during P1 in 2000 and P3 in 2006/2007, and conversely decrease during market dips, especially during P2, 2002 and P4 in 2008 when we see net outflows (i.e. more sales than purchases by investors) from funds.

It’s clear to see that most investors experience a whole range of emotions during different points of a market cycle. Unfortunately, all too often, this can result in investors entering or exiting the market at precisely the wrong time. It seems that the best time to invest can be when it feels most difficult to do so.

As always, if you have any questions or thoughts on the points I've covered, please leave a comment below or connect with us @ISACO_ on Twitter.

Please note past performance should not be used as a guide to future performance, which is not guaranteed. Investing in Funds should be considered a long-term investment. The value of the investment can go down as well as up and there is no guarantee that you will get back the amount you originally invested.

About ISACO

ISACO was established in 2001 by brothers Stephen and Paul Sutherland and is the first financially regulated firm to offer adventurous ISA and SIPP investors a unique personal investment service that shares on a daily basis our star-performing investor’s thoughts, personal insights and investment decisions.

Clients enjoy being informed throughout the year what ‘best of breed’ funds our premier investor currently owns, when he’s buying and when he’s moving into the safe harbour of cash – helping clients enjoy more control, manage their portfolio more effectively and benefit from the potential of outstanding long-term returns.

For more information about ISACO and our Investment Guidance Service, please read our free brochure.