In the fourth of our posts on behavioural finance, we'll look at herd behaviour and the dangers for investors.

In the fourth of our posts on behavioural finance, we'll look at herd behaviour and the dangers for investors.

One of the most infamous financial events in recent memory would be the bursting of the Internet bubble. However, this wasn't the first time that events like this have happened in the markets. How could something so catastrophic be allowed to happen over and over again? The answer to this question can be found in what some people believe to be a hardwired human attribute: herd behaviour, which is the tendency for individuals to mimic the actions (rational or irrational) of a larger group. Individually, however, most people would not necessarily make the same choice.

Herd behaviour during stock market cycles

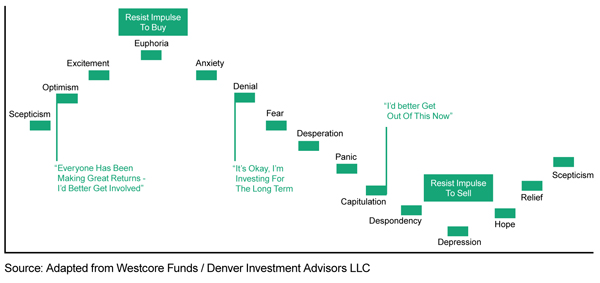

We can all agree that the point of maximum financial opportunity is right at the bottom of the market and the point of maximum financial risk with the greatest dangers for investors is right at the top of the market. The challenge investors’ face is that when the market is at its bottom, no investors ‘feel’ like investing. And when the market is at its top, most investors find it hard not to buy, again because of how they ‘feel.’ All too often investors are influenced by short-term market movements rather than focusing on the longer-term trend and how this fits with their own investment objectives.

As the chart illustrates, many investors go through a range of emotions at different points of a market cycle. Unfortunately, all too often this can result in large numbers of investors entering or exiting the market at precisely the wrong time. As markets peak, investor sentiment is running high with emotions of excitement, thrill and euphoria, tempting investors to flood into highly priced markets. But as markets dip, sentiment begins to run low and negative emotions of panic, despondency and depression lead investors to exit the market and realise a loss.

Buying high and selling low

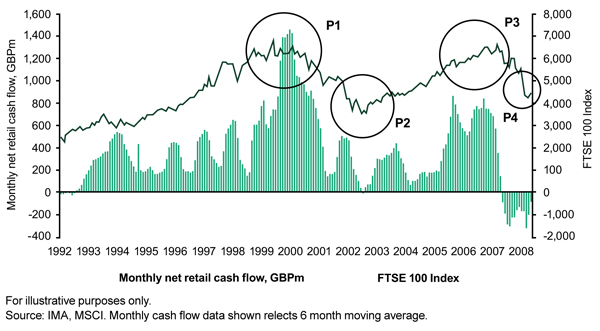

To support the theory that retail investors buy and sell at the wrong time, the next chart shows historic net investment flows (investment purchases minus investment sales by retail clients) into equity funds by UK investors alongside movements of the FTSE 100 Index, between 1992 and 2009.

As can be seen, investment flows increase significantly as markets peak, especially during P1 in 2000 and P3 in 2006/2007, and conversely decrease during market dips, especially during P2 in 2002 and P4 in 2008 when we see net outflows (i.e. more sales than purchases by investors) from funds.

Avoiding the herd mentality

While it's tempting to follow the newest investment trends, an investor is generally better off steering clear of the herd. Just because everyone is jumping on a certain investment ‘bandwagon’ doesn't necessarily mean the strategy is correct. Therefore, the soundest advice is to always do your homework before following any trend and aim to attain a thorough understanding of stock market cycles and investor psychology.

As always, if you have any questions or thoughts on the points I've covered, please leave a comment below or connect with us @ISACO_ on Twitter.

In the final post in this series, we'll look at overconfidence and the detrimental affect it can have on investors' decision making.

Please note past performance should not be used as a guide to future performance, which is not guaranteed. Investing in Funds should be considered a long-term investment. The value of the investment can go down as well as up and there is no guarantee that you will get back the amount you originally invested.

About ISACO

ISACO was established in 2001 by brothers Stephen and Paul Sutherland. Our personal investment service allows you to buy the same funds as our star-performing investor. You find out where he invests, keep full control of your account, enjoy a close relationship with a trusted expert, and benefit from the potential for attractive long-term returns.

For more information about ISACO and our personal investment service, please read our free brochure.