In this latest series of blogs we'll look at how you can create an income for life and enjoy a more comfortable retirement.

In this latest series of blogs we'll look at how you can create an income for life and enjoy a more comfortable retirement.

Imagine sitting down on the day of your retirement to plan your financial future. You know what your annual expenses have been and you want to maintain your current standard of living. So, you consult a recent mortality table and find that if you’ve made it to your 65th birthday, you can expect to live to 85 years old. You perform a little calculation and find that, together with your State Pension entitlements, you have just enough savings to maintain your current standard of living and spend all of your savings and future expected earnings by the time you die at the age of 85.

But, what if you live longer? Will you be reduced to eking out an existence on State Pension entitlements alone? Many observers today are actively discussing the ‘retirement crisis’, noting that people do not save enough and will not accumulate sufficient assets to create an income for life and retire comfortably.

But there is another looming crisis that is quickly attracting attention: post-retirement. While the retirement crisis centers on the financial struggles of people saving for retirement, the post-retirement crisis focuses on the financial difficulties of people near or in retirement.

Running out of money during retirement

To illustrate the unique financial complexities facing retirees, consider 10 school friends who decide to retire at age 65. Now, guess when the first of these friends will die. As it turns out, the first death is likely to occur only 8 years into retirement at age 73. Next, try guessing when the last person will die. The answer is 36 years into retirement, at age 101*. Put differently, one retiree needs to pay for just 4 years of expenses whereas another has to pay for 34 years of expenses. Thus, the risk of retirees outliving their money and not having an income for life is significant.

**Source: Allianz Global Investors - According to calculations by Allianz Economic Research based on the 12th population projection of the Federal Statistical Office of Germany

One might also argue that this ‘longevity risk’ is actually far greater than investment risk, since the variability of longevity seems far greater than the variability of investment returns. Unfortunately a common mistake investors make when approaching retirement is they think too short-term and invest too conservatively, often resulting in a financial condition referred to as ‘aged poverty.’ This subject was also featured in Common investing mistakes when approaching retirement.

In this latest blog series we aim to find solutions to this challenge investors face and look at ways that you can counter the risk of running out of capital during retirement and secure an income for life. One way to reduce this risk is to invest for growth. To achieve this aim, the key is to invest for growth and use investment vehicles which have the potential to help investors reap attractive returns over the long-term.

Investing for growth & an income for life

Investing for growth is certainly not a strategy for the faint-hearted, but as a way to potentially generate high returns (in exchange for taking a relatively high risk) it can be an exciting prospect. Attractive returns can be made and you could enjoy the excitement of being in a fast-growing area. However, returns are volatile and there's a chance of capital reducing in value, especially over the short-term. Most investors with a life expectancy of 20 years or more are likely to need at least some growth.

To help your portfolio survive the long haul, you are likely to need to hold some portion of your portfolio in equities most of the time. And you can do that by buying quality growth funds and holding them over the long-term. When you have a long-term horizon, the odds are in your favour when investing in equity funds. The longer your horizon, the better the odds that equities will treat you better than cash or bonds – and by a wide margin.

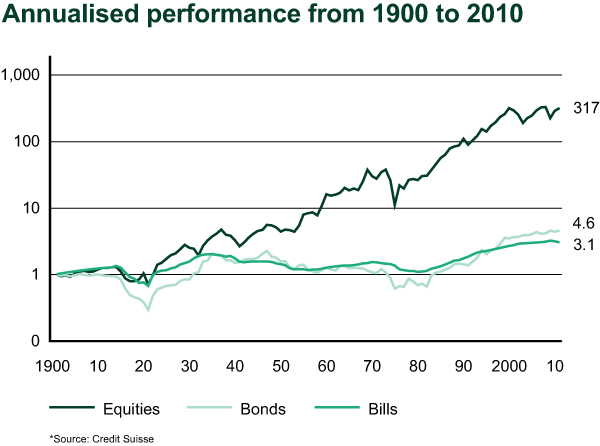

Capital market returns for the United Kingdom

The chart below shows that over the last 111 years, the real value of equities, with income reinvested, grew by a factor of 317.4 as compared to 4.6 or bonds and 3.1 for bills. Since 1900, equities beat bonds by 3.9% and bills by 4.3% per year. The long-term real return on UK equities was an annualised 5.3% as compared to bonds and bills, which gave a real return of 1.4% and 1.0% respectively.

When an investor seeks outstanding long-term returns, they normally set a goal to ‘beat’ the market.

What exactly does ‘beat’ the market mean?

There are many names and phrases to describe beating the market such as outperforming the market, beating the indexes and staying ahead of the indices. But even though people say the term beating the market in different ways, they all mean the same thing which is ‘doing better’ than a particular benchmark. Where peoples' opinions do differ is in the area of what benchmark they are measuring their performance against. In other words, which market, index, or indices are they trying to beat? For example, my aim is to help our clients beat the Nasdaq Composite. The Nasdaq Composite is the main US technology index and arguably one of the strongest market indexes in the world. Over the long term, the Nasdaq has made an average yearly gain of 18.3%*.

*Source: Yahoo/Finance.: Period taken January 1st 1975 to December 31st 1999.

A difficult but worthy objective

With the Nasdaq being a powerful index, it means it’s a difficult task to beat it. Look at this chart displaying how the Nasdaq Composite has performed versus the FTSE 100. As you can see, since 1984 the FTSE 100 made just over 400%. However, the Nasdaq is the clear winner after making close to a 1000% gain over the very same period.

Aiming to beat the Nasdaq would therefore be a tough goal for an investor but, as many of our clients agree, it is a worthy goal for those who seek attractive returns.

In the next post in this series we'll look at investing in growth funds in more detail.

As always, if you have any questions or thoughts on the points I've covered, please leave a comment below or connect with us @ISACO_ on Twitter.

Please note past performance should not be used as a guide to future performance, which is not guaranteed. Investing in Funds should be considered a long-term investment. The value of the investment can go down as well as up and there is no guarantee that you will get back the amount you originally invested.

About ISACO

ISACO was established in 2001 by brothers Stephen and Paul Sutherland. Our personal investment service allows you to buy the same funds as our star-performing investor. You find out where he invests, keep full control of your account, enjoy a close relationship with a trusted expert, and benefit from the potential for attractive long-term returns.

For more information about ISACO and our personal investment service, please read our free brochure.