Have you ever wondered how you can find a good growth fund? In this new series of posts, I’m going to share the criteria I personally use when searching for the best growth funds and I'll take you through a simple tutorial that’s packed with useful tips and ideas.

Have you ever wondered how you can find a good growth fund? In this new series of posts, I’m going to share the criteria I personally use when searching for the best growth funds and I'll take you through a simple tutorial that’s packed with useful tips and ideas.

In this blog series you’ll be introduced to Morningstar.co.uk, a site that has an extensive fund database and I’m going to demonstrate how best to use it to your advantage. When I take clients through the site and show them what to look for in a potentially winning fund, they find tremendous value – and so I hope you do too.

If you'd like to download our free guide 'Finding a good growth fund', you can find it here.

Finding a good growth fund

After speaking to thousands of ISA and SIPP investors over the last decade, we learned that many of them wanted to know my personal fund picking strategy. My aim when seeking out good funds is to find the best ‘growth’ funds. I aim for growth because of my extremely long-term investment horizon. Having such a long-term horizon allows me to embrace more risk and aim for high returns, classing me as a more adventurous investor.

I am prepared to accept fairly high levels of risk with a portion of my overall wealth, with the aim of achieving higher investment returns in the longer term. I also accept that this may mean that the value of my investments may fluctuate considerably over short periods of time.

My aim is to outperform the market and to make an average annual return over the long-term of between 12 and 15 per cent. I like to aim high so that I stay well ahead of inflation and to help reduce the risk of running out of money during retirement. You may have different aims and a different risk profile to mine and so if you have any doubts as to the suitability of an investment for your circumstances, I suggest you speak to a financial adviser.

Looking for funds with outstanding growth potential

As I just mentioned, the site that I like to use when searching for the best growth funds is Morningstar. You can find it by going to www.morningstar.co.uk. But before we go to Morningstar’s website, let me explain an important point about ‘when’ I do searches. I’m sure you already know this, but it’s worth mentioning because it’s a key point.

One rule of how the stock market works is that 75% of funds will move in the same direction as the general market. This means I only want to be invested in funds during bull markets, the long-term uptrends. In bear markets, when the market is in a downtrend, I see no point in looking for possible buy candidates due to the increased risk of loss. In downtrends, 75% of all funds will be falling in price and that’s why during these periods I switch all my equity holdings into a Cash Park.

Carry out searches after an uptrend has been established

Before you invest, I suggest you find out if we are in a bull market and one way I do this is to look at an index chart. Which index or indexes you choose to look at to help you track ‘the market’ is your own decision, however my favourite is the Nasdaq Composite which is the US technology index. Why do I like the Nasdaq? Its strong long-term price returns have made the Nasdaq one of the strongest indexes in the world and that means when I look for funds, if I can find ones that have ‘beaten’ the Nasdaq, I know I’ve discovered a good fund.

Bull market or bear market? Where are we?

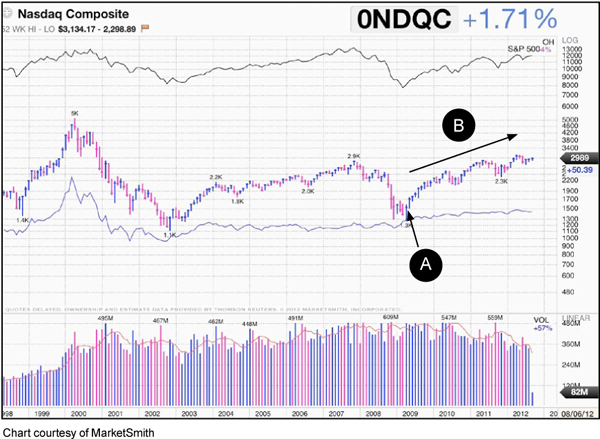

As you can see on this chart of the Nasdaq Composite that stems back to 1998, the latest bull market started back in March 2009 (Point A) and since back then there has clearly been a strong uptrend (Point B).

Keep this in mind because when we do our searches on Morningstar, I will be looking at what funds have performed best over the last three years.

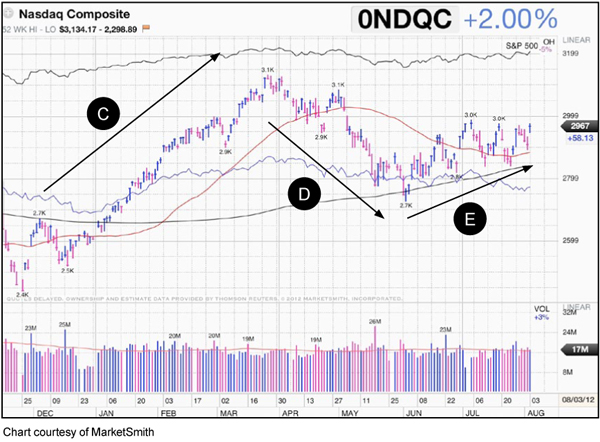

On this chart there are three clear trends. There is an uptrend from 26th November 2011 to the 27th March 2012 (Point C), a downtrend from 28th March 2012 to June 3rd 2012 (Point D) and an uptrend from June 4th 2012 to August 3rd 2012 (Point E).

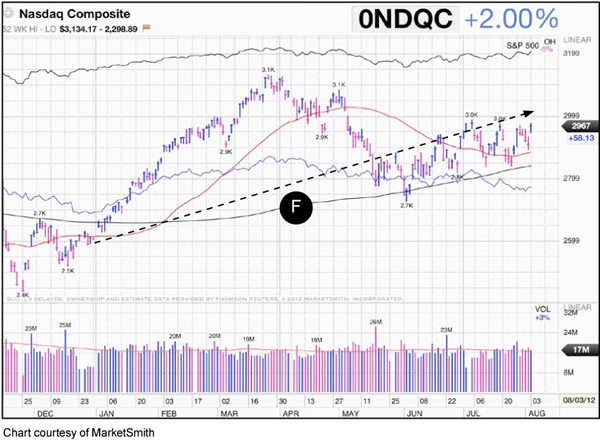

There is also another trend I want to highlight, the year to date trend which is another uptrend (Point F).

The facts so far about the market:

- The market has been in an uptrend for the last three and a half years

- The market has been in an uptrend this year

- The market has been in an uptrend over the last two months

Please make a mental note that the gain made over the last two months was 8.8 per cent. We’ll be using this as a benchmark later so that we can measure the gain against how a fund performed over this same period.

In the next post we will continue this tutorial by taking a look at the Morningstar website. I’ll be showing you and how a few basic rules and principles can have a huge impact on the quality of the funds you discover. In the meantime, if you are interested to find out the funds I hold in my ISA portfolio click here.

As always, if you have any questions or thoughts on the points I've covered, please leave a comment below or connect with us @ISACO_ on Twitter.

Please note past performance should not be used as a guide to future performance, which is not guaranteed. Investing in Funds should be considered a long-term investment. The value of the investment can go down as well as up and there is no guarantee that you will get back the amount you originally invested.

Find out where an expert invests

Are you an ISA or SIPP investor with over £100,000 actively invested? Are you looking for better returns but are unsure which funds to invest in? ISACO Wealth, our personal investment service, allows you to buy the same funds as a star-performing investor. You find out where he invests, keep full control of your account, enjoy a close relationship with a trusted expert, and benefit from the potential for attractive long-term returns.

To find out where an expert invests >>