In our post on Tuesday, we discussed the outlook for the market in November. Today we'll look more closely at the recent performance of the four funds I currently hold in my portfolio.

In our post on Tuesday, we discussed the outlook for the market in November. Today we'll look more closely at the recent performance of the four funds I currently hold in my portfolio.

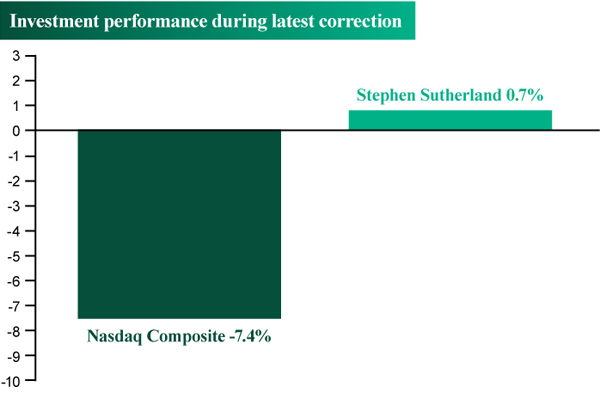

Fighting the correction, a sign of health

The market's latest ‘mini-correction’ began on 21st September when the Nasdaq topped out at 3197. On Friday 26th October, the Nasdaq made a low of 2961, meaning this present retracement is 7.4% in depth. However over this same period, my portfolio has seen a small gain of 0.7%. This means over the present correction period, I’ve fortunately outperformed the Nasdaq by just over 8%. That’s what you call a bullish divergence. It also tells me that I should be staying fully invested in the funds that I currently own because the stocks they own are ‘beating’ the market.

Evidence of how I beat the market by 8%

In our last post we looked at the ‘big picture’ view of the market and that we are currently in a bull market, which began in 2009. We have also seen that the market is currently acting well close to its 200 day moving average. We also looked at a monthly chart that highlighted that, prior to this month’s down month, we had four straight months of gains and therefore the market was due a pullback. The last thing we looked at was my recent performance during this latest correction period.

Next we’ll look at why my portfolio has been rising while the market has been falling by taking a closer look at the two funds I recently purchased.

As a reminder from last month, I bought this fund on 24th July this year at a price of 131. On Saturday 27th October, it was trading at 143.3. That’s a 9.4% gain over the last 14 weeks, easily beating the Nasdaq’s 4.4%. Take a look at the recent 5 week period (Point L). I’ve highlighted this because as you can see, the fund’s price has been moving sideways, while the Nasdaq over the last five weeks has been falling. That’s a really good sign. It means the stocks this fund owns have been outperforming the market and when leading stocks outperform the market, it normally means that the market is about to make a northerly move.

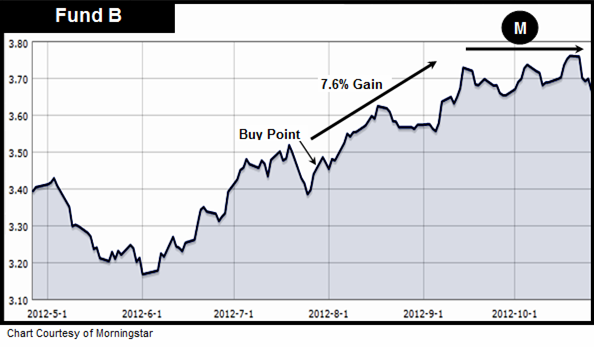

The second fund I recently bought, again on the 24th July this year, was purchased at a price of 3.41. It is currently trading at 3.67. That means so far I’ve made a 7.6% return over the last 14 weeks. Take a look at the recent 5 week period (Point M). I’ve highlighted this because as you can see, just like the last fund, its price has been moving sideways. This means that, just like Fund A, this one has also been fighting the market during this recent correction. That’s a constructive sign.

There is no guarantee that these two funds will continue to perform well, however as I’ve been saying since I bought them, strong performing funds tend to get stronger and weak funds tend to get weaker. A 9.4% and 7.6% return on each fund in three and a half months, especially with the Nasdaq correcting 7% over the last five weeks, demonstrates how strong the investments I choose can be and how quickly they can move once they have upside momentum. This is why I expect both of these funds, as well as the two other ones I own, to perform well over the remainder of this year and beyond. The future continues to look bright.

As always, if you have any questions or thoughts on the points I've covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO Wealth is a premium investment guidance based on what we are personally doing with our own money. Because we aim high, our service offers the potential for outstanding long-term returns combined with a warm, responsive and highly personal service.

To find out where an expert invests >>

To download the ISACO Wealth brochure >>

To start your 14 day free trial of ISACO Wealth >>

To discover 'A Golden Opportunity' >>