In this series of posts, I'm taking you through an outstanding ISA and SIPP investment opportunity. Quite simply, the next 5-10 years could see the market outperform and I'm going to explain how you could benefit. For more on this investment opportunity, please just download our latest report, A Golden Opportunity.

In this series of posts, I'm taking you through an outstanding ISA and SIPP investment opportunity. Quite simply, the next 5-10 years could see the market outperform and I'm going to explain how you could benefit. For more on this investment opportunity, please just download our latest report, A Golden Opportunity.

Last time we looked at the market's trend over the last few decades and focused on the recurring pattern of bull markets following bear markets. We also looked at how the market has performed over the last decade.

In this post, I'll move onto talking about funds and also look at the power of tax-free saving with ISAs.

What do you know about investment funds? In case you are unsure, an investment fund is a pooled investment vehicle that allows investors like you and me to invest in the stock market. They are controlled and managed by a professional investor who is called a fund manager. These fund managers buy stocks (companies) that they believe are going to rise in value. If they choose well, the fund’s value will do well and all the people invested in the fund will be rewarded with an increase in their investment portfolio.

Fund managers are like football managers

Investment funds are the investment vehicles that have the power to grow your account at 12-15 per cent each year if you choose well and you have a favourable market environment. Investment fund managers are like football managers. If you can find a fund manager with an outstanding track record you’ve almost cracked it. The challenge is that in the UK there are thousands of funds to choose from and so unless you know what you are doing and how to check various performance gauges, it is very easy to pick a dud fund.

To explain further we shall use Sir Alex Ferguson, the football manager, as an example.

Let me ask you a question.

Sir Alex Ferguson is renowned for having a great track record. What are the chances that he will do well next season?

The answer is, he will probably do well. Of course, there is no guarantee, but the probability of him performing well next season is pretty high. That same principle applies to fund managers. In other words, when fund managers have great track records, they are also likely to keep doing well in the future. However, as I’ve said, just one of the challenges investors face is finding them.

Why I love ISAs

ISAs are fantastic. Yes, they really are the UK’s best-kept secret and it’s not commonly known how they work or how powerful they are. Many people think that when they take out an ISA with a bank, their ISA has to remain with that same bank for life. A few people mistakenly think that they are locked in and can’t move their ISA. Both these myths are utter nonsense.

With your ISAs, you have the power to control where your money is being parked or invested. And you can change your mind at any time. If you have been placed in a Stocks and Shares ISA, perhaps by your bank manager, broker or financial adviser, it’s really easy to check how good their recommendations have been. All you need is a little training.

This is just one of the things I like to teach our clients. I have to say, when they have that knowledge, they tell me that it makes their bank managers, brokers or advisers feel very nervous. Knowledge of the characteristics of a good fund versus those of a bad fund gives you serious power over your adviser.

Real ISA millionaires

Most people in the UK are totally unaware that ISAs can help you accumulate a multi-million pound, tax-free portfolio.

Yes, it’s true, some ISA investors have accounts in the tens of millions.*

*Source: FT.com 8th Oct 2010 -'ISAs’ values rise to £1m for some investors'

Did you know that an ISA is not an investment, but is the name of a wrapper that goes around an investment sheltering it from the Inland Revenue?

Think about a sweet in a wrapper. The investment is the sweet and the ISA is the wrapper. Did you know that there is no limit to how much your tax-free portfolio can grow into?

Yes, it’s true. If you start with say £1000 and eventually over time it grows into, let’s say, £1 million then all of that £1 million would be tax-free.

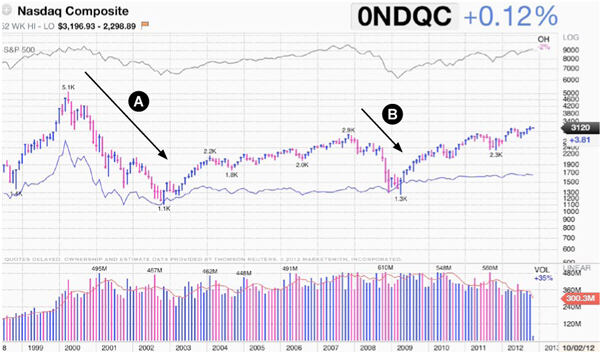

Three out of four stocks move in the same direction as the market

One of the basics that I first learned about how the stock market works is that three out of every four stocks move in the same direction as the market. So if the market is in an uptrend, 75 per cent of stocks move up. And if the market is in a downtrend, 75 per cent of stocks move down. That tells you that when the market had huge corrections between 2000-2002 and 2007-2009, individuals who remained invested in the market’s downtrend will have lost a lot of money.

As author and Wall Street stock wizard Vic Sperandeo states, “The key to building wealth is to preserve capital and wait patiently for the right opportunity to make the extraordinary gains”.

Take a look at this 20 year chart of the Nasdaq. On this chart I am showing you something important. When the market was in a major downtrend from 2000 -2002 (Point A) and the period 2007-2009 (Point B), the smart money was out on the sidelines. This because investment funds own stocks, so funds also move in the same direction as the market.

You see, the market is like a river. If it’s heading downwards, then you don’t want to be in the river trying to swim upstream against a strong current. Your aim should be to stay on the sidelines patiently waiting for the flow of the river to change. You therefore need to swim with the current and not against it.

How to win

To win at ISA and pension investing, your job is to know how to pick a top performing investment fund and then wrap an ISA or pension wrapper around it. You also need to make sure that you accurately ‘time’ the buying of your fund, meaning you buy it when the market is healthy – when the market is in an uptrend. On the other hand, when the market goes into a downtrend, your aim should be to switch out of your fund into a Cash Park.

William J. O’Neil is not well known in the UK, but in the US he is regarded as a stock market master. Back in 2000 and 2001, O’Neil taught me a proven timing system that aims to help you get in and get out of the market at the right time.

It is a method based on how the market actually functions in reality. Bill has commented on how far back they have gone when researching this. He stated in a recent radio interview that they had tracked how the market operates in each of the market cycles over the last 125 years. What's more, using this method of timing the market, in the last 50 years, Bill has not missed the start of a single bull market.

In our next post, we'll look at how investors can capitalise on the investment opportunity that the next 5-10 years could offer. To learn more, please just download our latest report, A Golden Opportunity.

About ISACO

ISACO is a small, warm and friendly ISA and SIPP Investment company who offer an easier way to grow your ISA and SIPP. Together with our clients, we have £57 million actively invested in ISAs and pensions.* Over the last three years, we’ve been fortunate to achieve attractive growth on our assets of 60.2% versus the FTSE 100’s 25.6%.* This means over the last three years, we’ve fortunately helped our clients make a return of 17% per year versus the FTSE 100’s 7.9% per year. As well as being proud of our recent performance, we are also proud of our long-term track record. Since 1997, we have managed to achieve a better annual return than one of the world’s strongest stock market indexes.***

* Estimated: ISACO directors, ISACO team and the clients that invest alongside ISACO's lead investor.

** Dec 31st 2008 - Dec 31st 2011.

*** Source: Yahoo Finance: Cumulative return (Dec 31st 2007 - Dec 31st 2010) Stephen Sutherland 93.3%, Nasdaq Composite 68.9%, FTSE 100 14.6%.

ISACO investment performance verified by Independent Executives Ltd

Look over our shoulder and shadow our ISA and pension investing >>

To download the ISACO Wealth brochure >>

To start your 14 day free trial of ISACO Wealth >>

To discover 'A Golden Opportunity' >>