In this series of posts, we're looking at how your can draw up a retirement savings plan, with the aim of enjoying comfortable and secure lifestyle later in life.

In this series of posts, we're looking at how your can draw up a retirement savings plan, with the aim of enjoying comfortable and secure lifestyle later in life.

We started by looking at the first two steps of creating a retirement savings plan and the importance of factoring in inflation. We then reviewed the third step, which is how to calculate the growth rate you'll need on your investments to reach your goal. We concluded that post by asking the question, what can you do if there's a difference between your expected income in retirement and what you'll need? What can you do if you have a shortfall?

If you have a shortfall, you have four options

Your four options are:

- extend your deadline

- add more capital each year

- reduce your intended lifestyle goal

- aim for a higher annual return

Staying with this example and looking at these options, a client could extend their time line from 7 years to, perhaps, 8 years, 9 years or even 10 years. Another thing they could do is plan to add more capital each year. In this case, instead of adding £20,000 per year, they could aim to add £30,000. They could also slightly reduce their intended lifestyle aims by, say, 5% per year. Finally they could aim higher with their expected annual returns, which would mean taking on more risk but with potentially greater reward.

With these things in mind, let’s have another play with the calculator and punch in some different variables to the ones we entered last time.

To access our calculator, simply go to the top of this page and type in ‘plan’ as your username and ‘plan1234’ as your password. You’ll then get access to part of our members area which includes the use of our compounding calculator.

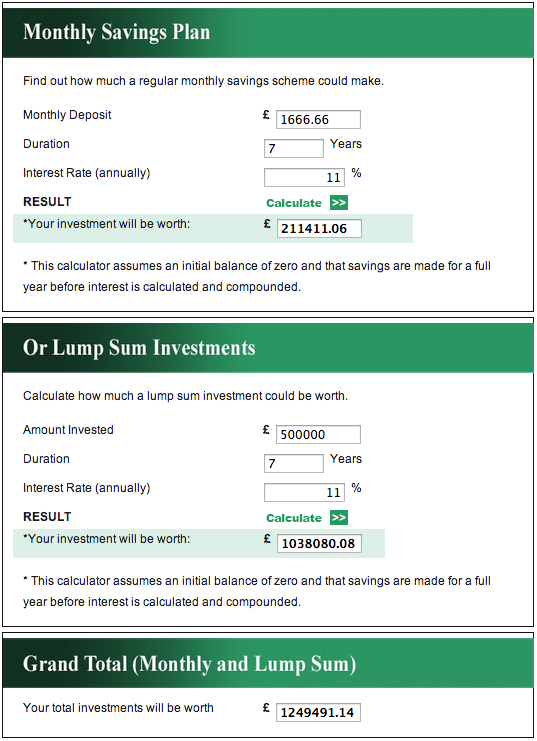

Even though you’ve just seen it’s possible to make changes to four different variables, the only thing we are going to alter is the projected annual percentage rate of return over the 7 year term. This time we are going to use an annual return rate aim of 11%. In the top half of the calculator, because we know our client wants to add £20,000 per year, we will divide £20,000 by 12 again and get a figure of £1,666.66. In the duration field we can enter 7 which represents 7 years and in the interest rate field we can enter 11 which represents an 11% annual return aim.

In the second section of the calculator, the section where we enter the starting lump sum, we can enter £500,000 as the amount invested, 7 for the duration of 7 years and 11 for the annual rate of return aim. When we click on the two calculate buttons, the monthly savings plan of £20,000 per year at 11% annual return for 7 years results in £211,411. The lump sum of £500,000 at an 11% annual return for 7 years results in £1,038,080. The grand total is £1,249,491. By increasing the projected return rate from 6% to 11%, the client’s target would be achieved. Withdrawing 5% from £1,249,491 would result in £62,246, which is just above what the client was looking for in future annual income.

- saving £20,000 per year at an 11% annual return for 7 years = £211,411

- £500,000 at an 11% annual return for 7 years results in £1,038,080

- grand total is £1,249,491

- target was £1.23 million

- withdrawing 5% results in £62,246 future annual income

- target was £61,500

- target income achieved

It’s interesting to see what a 5% difference in the annual rate of return can make. That’s why we always encourage our clients to aim high and I encourage you to do the same.

Of course, aiming higher involves taking on more investment risk. However, many of our clients have longer time frames for their retirement plans. Some clients are in their forties, have a fairly decent sum already built up in their ISAs and pension and are currently earning a good income. These people are usually business owners, self-employed professionals or corporate executives. If we go back to the calculator for a final time and punch in a few numbers, you’ll see that by having time on your side and committing to adding capital each and every month, you can build up a significant nest egg over the long term.

Let’s say a 45 year old approached us with £120,000 in ISAs and pensions and was happy adding £2,000 per month to their capital. Let’s also imagine that they were a long-term thinker, happy in the field they were in and happy to work until they were 70.

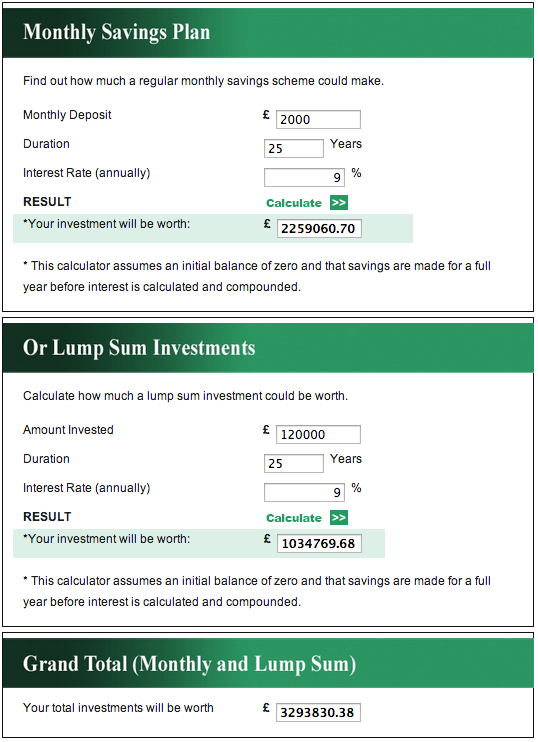

Because of their long-term mindset, they may be happy to take on more risk in exchange for more reward and aim for an annual rate of return over their 25 year plan of 9%. They had no fixed amount of lifestyle in their head but just wanted to see how much they could get to if they followed through with their plan and were successful in hitting their return targets. Let’s look at the facts before we punch in the numbers:

- 45 years old

- 25 year investment plan

- starting amount £120,000

- adding £2,000 monthly

- annual return aim of 9%

In the calculator we will punch in the monthly deposits of £2,000, tap in 25 years as the duration and use 9% as our return aim. In the lump sum section, we’ll enter £120,000, a 25 year duration and an annual return aim of 9%. When we click on the two calculate buttons, the monthly savings plan of £20,000 per year at 9% annual return for 25 years results in £2,259,061. The lump sum of £120,000 at 9% annual return for 25 years results in £1,034,770. The grand total is £3,293,830.

This example really does demonstrate the power of compounding. We know that £3.3 million in 25 years’ time is not going to be worth what it is in today’s terms, but what we do know is that after inflation has been factored in it would represent approximately £1.58 million. Drawing down 5% from £1.58 million would result in approximately £79,000 of income per year. For most people that would be enough to fund a fairly reasonable lifestyle.

My suggestion to you would be to keep having a play with the figures until you arrive at something you feel comfortable with. Achieving double digit growth such as 10%, 12% or 15% is really going to help boost your returns if achieved, but it’s also going to be extremely difficult to do and will involve taking on more risk.

If you’re interested in working with an ISA and SIPP Investment Specialist, please just click here to arrange a confidential, no obligation review. We would be happy to give you an independent view on your portfolio, as well as guidance around how your investments could be working harder for you.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO is a specialist in ISA and SIPP Investment and the pioneer of ‘Shadow Investment’, a simple way to grow your ISA and SIPP. Together with our clients, we have £57 million actively invested in ISAs and pensions*.

Our personal investment service allows you to look over our shoulder and buy into exactly the same funds as we are buying. These are investment funds that we personally own and so you can be assured that they are good quality. We are proud to say that by ‘shadowing’ us, our clients have made an annual return of 12.5% per year over the last four years** versus the FTSE 100’s 7.4%.

We currently have close to 400 carefully selected clients. Most of them have over £100,000 actively invested and the majority are DIY investors such as business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector such as IFAs, wealth managers and fund managers. ISACO Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Our firm reference number is 525147.

* 15th November 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

** (31st December 2008 - 31st December 2012).

ISACO investment performance verified by Independent Executives Ltd.

To download our free report 'A Golden Opportunity' >>

To download our Shadow Investment brochure >>

To start your 14 day free 'no obligation' trial of Shadow Investment >>