In this new series of posts we're going to look at how you can manage your investment portfolio more effectively. If you manage your portfolio well, it will play a big part in helping you arrive at your financial goals on time. However, if you neglect your portfolio, your returns will probably suffer and that could result in taking longer than expected to reach your objectives.

In this new series of posts we're going to look at how you can manage your investment portfolio more effectively. If you manage your portfolio well, it will play a big part in helping you arrive at your financial goals on time. However, if you neglect your portfolio, your returns will probably suffer and that could result in taking longer than expected to reach your objectives.

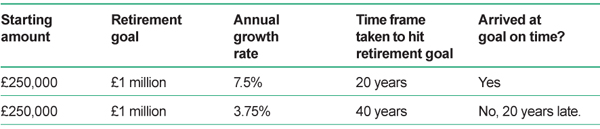

Let's begin by exploring what can happen to your retirement plans if you fail to achieve your target returns. In this example, we'll use an investor with a £250,000 portfolio whose aim is to grow their investment account into a million pounds over the next twenty years.

To be successful, the investor would have to grow their account by 7.5% per year over the twenty year period – which is no easy feat. However, it is possible when you have all the correct components in place, such as knowing how to analyse the market’s health, how to find good funds and knowing when to buy and when to exit.

The compounding rule

The compounding rule is, when you achieve a 7.5% annual return, your money roughly doubles every 10 years. That means by achieving a return of 7.5% each year, £250,000 would turn into £500,000 over the course of the first 10 years, and the £500,000 would grow into £1 million in the final 10 years. However, if you fail to get a reasonable return on your capital, it is going to take you much longer to reach your retirement goals. For example, if you are one of many investors who unfortunately underperform the market, and achieve a 3.75% annual return, it would take you twice as long to get to your goal. Instead of reaching your objective in twenty years, it would take you forty!

Your chief aim – beating the market

When seeking long-term growth and higher returns for your ISA and SIPP, your main objective should be to beat the market, which means doing better than a particular benchmark. This is not easy to do, but it is possible.

Where people's opinions differ is when it comes to what benchmark they are measuring their performance against. In other words, which market, index, or indices they are trying to beat. At ISACO, our aim is to beat the NASDAQ Composite, arguably one of the strongest market indexes in the world. With the NASDAQ being such a powerful index, it means it’s a difficult task to beat it.

Even though we do try to beat the NASDAQ, our real goal is to beat the FTSE 100. The FTSE 100 has not been as strong as the NASDAQ in the past, however it has annualised 4.8% since its inception 28 years ago. That tells us that if we can beat the FTSE over the long term, we’re going to be blessed with a reasonable rate of return. Our secret to beating the FTSE 100 by 40.8% over the last 15 years (about 2.3% per year) is because we aim high. By aiming for the stars (to beat the NASDAQ) we end up getting to the moon (beating the FTSE 100).

By doing the math, if we continued to outperform the FTSE 100 at the same rate we have been, we might achieve a 7.1% return over a 28 year period, which would be an excellent long-term gain. However, this last 15 years has been a sideways trending market and my belief is that we will be able to beat the FTSE 100 by more than 2.3% a year in better market conditions. For example, in the latest uptrend, which has so far lasted 4 years, we are proud to have beaten the FTSE 100 by 5.1% per year. That shows you the possibilities of investing using our method if the market forms an uptrend over the next decade.

In our next post in this series, we'll explore four key questions that you need to ask each and every day when managing your portfolio:

1) Should I be invested right now?

2) If yes, should I be fully invested or partially invested?

3) If I should be invested, what should I be invested in?

4) Should I be staying in those investments or making an adjustment?

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO is a specialist in ISA and SIPP Investment and the pioneer of ‘Shadow Investment’, a simple way to grow your ISA and SIPP. Together with our clients, we have £57 million actively invested in ISAs and pensions*.

Our personal investment service allows you to look over our shoulder and buy into exactly the same funds as we are buying. These are investment funds that we personally own and so you can be assured that they are good quality. We are proud to say that by ‘shadowing’ us, our clients have made an annual return of 12.5% per year over the last four years** versus the FTSE 100’s 7.4%.

We currently have close to 400 carefully selected clients. Most of them have over £100,000 actively invested and the majority are DIY investors such as business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector such as IFAs, wealth managers and fund managers. ISACO Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Our firm reference number is 525147.

* 15th November 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

** (31st December 2008 - 31st December 2012).

ISACO investment performance verified by Independent Executives Ltd.

To download our free report 'A Golden Opportunity' >>

To download our Shadow Investment brochure >>

To start your 14 day free 'no obligation' trial of Shadow Investment >>