This post is the third in our series on managing your portfolio more effectively.

This post is the third in our series on managing your portfolio more effectively.

Your investment journey can be either smooth or rocky depending on your aims and what you invest in.

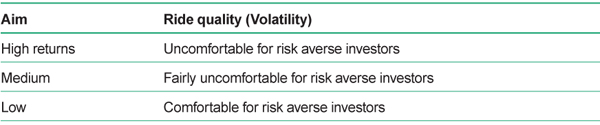

Here’s a table that explains how your investment aims are connected to volatility, or the quality of the ride.

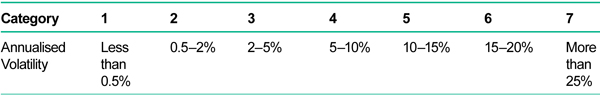

We aim for high returns. That means the ride quality can be uncomfortable at times, especially for low to medium risk investors. The rule is: the higher the returns, the higher the volatility. Collective investments come with a risk rating, which can be found in the Key Investor Information Document (KIID) and is based on the historic weekly price changes of the fund over a 5 year period (note that the fund company will use proxy data for recently launched funds). The categories on the scale correspond to different levels of volatility. The scale used is as follows:

For example, funds in category 1 are normally cash based and have seen very little, or very gradual change in price over the last 5 years. Funds in category 6, into which the majority of equity-based funds fall, have seen more rapid changes in price over the last 5 years.

A simple way to lower volatility

If your aim is an annual return of 12-15%, it means you’ll probably be purchasing funds with a risk rating of either 6 or 7. This means your portfolio in a typical year will experience price swings from its highs to its lows of up to 25% – or maybe even higher. If the threat of large corrections in your account value doesn’t appeal, and you’d be satisfied with a lower annual return in exchange for a smoother ride, we have a solution – you simply pair higher risk investments (quality growth funds) with lower risk investments (cash/fixed interest).

The most critical element of an investor’s portfolio

Some of our clients do not share our adventurous nature. Many of them are either close to retirement or in retirement and are more concerned with protecting their wealth rather than aggressively growing it. Instead of aiming for 12-15% annual returns (like us), some are happy with between 3-5% per year and others are looking for an annual return in the region of 7-10%. Some however, are adventurous like us and their ISA and SIPP portfolios will be made up purely of equity-based growth funds, which will be the same funds we're invested in. However, our clients requiring a smoother ride in exchange for lower returns have portfolios that contain a combination of equity based growth funds (the same ones we're invested in), fixed interest and/or cash.

Whatever their return aims, we remind them that the most important part of their portfolio is the equity element. This is because the equity is the tool you use to help generate your annual return. It’s therefore a mistake to think that some of your return should come from the fixed interest/cash element. My take is that the fixed interest/cash portion of a portfolio serves one purpose only; to help reduce volatility.

The five key things to remember are:

- Equity funds are what you use to help generate your annual return

- Fixed interest and cash funds are your tools for lowering volatility

- Use quality growth funds for the equity fund portion of your portfolio (risk rating 6 or 7)

- Use Cash Parks and SIPP Bank Accounts for lowering volatility (risk rating 1)

- If you prefer fixed interest over cash, use low risk rated (risk rating 2 or 3) quality bond funds

A perfect solution for low to medium risk ISA and SIPP investors

If you have a lower risk profile than us and/or a shorter investment horizon, our suggestion would be to use high quality growth funds for the equity element (which might be 50%), when creating your portfolio. For the fixed interest/cash portion of your portfolio (the other 50%), our number one preference would be the ISA Cash Park and/or a SIPP Bank Account, which both carry a risk rating of 1. These are both perfect tools to be used in combination with adventurous funds. However, make note that the ISA Cash Park can only be used as a temporary solution because HMRC do not like stocks and shares ISA investors keeping their capital in the Cash Park over long periods.

In the 2003–2007 bull market, the Fidelity's MoneyBuilder Income Fund carried a risk rating of 2, but right now it carries a risk rating of 4, which means its volatility has really picked up over the last five years. One that I prefer right now is the M&G Short Dated Corporate Bond A, which comes with a risk rating of 3. A rating of 3 means that over the last 5 years its annual volatility has been between 2% and 5% which is very low. Some fixed interest funds currently carry risk ratings of 5 and that means their annual volatility over the last five years has been between 10% and 15%. This type of fund would not be the right tool to use for helping you lower volatility. Why? Because a risk rating of 5 means it’s been behaving more like an equity fund over the last five years.

There is currently no set date limit for how long you can sit in the ISA Cash Park but in 2007 and 2008, during the bear market, we remained in it for a period of 13 months. During that time we didn’t get any letters from HMRC telling us that we needed to move out of it. If you have a SIPP, I suggest you use a SIPP Bank Account. If a client preferred to use fixed interest instead of cash as their tool for lowering the volatility, I would suggest they look for a quality bond fund.

Pairing up adventurous funds with fixed interest funds that carry high risk ratings is not the best strategy for helping you to lower volatility. Your best tool for lowering volatility is cash. Always remember that the equity portion of your portfolio is the most important part – because it’s the part that helps you get your return – and the tools to use to lower your volatility need to carry very low risk ratings and ideally a risk rating of 1. And remember that if you prefer fixed interest funds over cash, try not to use a fixed fund that carries a rating of more than 3.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO is a specialist in ISA and SIPP Investment and the pioneer of ‘Shadow Investment’, a simple way to grow your ISA and SIPP. Together with our clients, we have £57 million actively invested in ISAs and pensions*.

Our personal investment service allows you to look over our shoulder and buy into exactly the same funds as we are buying. These are investment funds that we personally own and so you can be assured that they are good quality. We are proud to say that by ‘shadowing’ us, our clients have made an annual return of 12.5% per year over the last four years** versus the FTSE 100’s 7.4%.

We currently have close to 400 carefully selected clients. Most of them have over £100,000 actively invested and the majority are DIY investors such as business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector such as IFAs, wealth managers and fund managers. ISACO Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Our firm reference number is 525147.

* 15th November 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

** (31st December 2008 - 31st December 2012).

ISACO investment performance verified by Independent Executives Ltd.

To download our free report 'A Golden Opportunity' >>

To download our Shadow Investment brochure >>

To start your 14 day free 'no obligation' trial of Shadow Investment >>