Over the last month* our portfolio has surged 9.4%, outperforming the FTSE 100’s 8% and the NASDAQ Composite’s 8.6%. Out of the six funds we own, five are outperforming the extremely powerful NASDAQ Composite. The one that is slightly lagging is the Fund C, which has returned 6.7% over the 4-week period.

Over the last month* our portfolio has surged 9.4%, outperforming the FTSE 100’s 8% and the NASDAQ Composite’s 8.6%. Out of the six funds we own, five are outperforming the extremely powerful NASDAQ Composite. The one that is slightly lagging is the Fund C, which has returned 6.7% over the 4-week period.

Over the same time frame, Fund D returned 9.15%, Fund B 10.17%, Fund E 10.66% and Fund A 10.9%. The current leader over the 4-week period is Fund F returning a very impressive 12.85%.

This information is taken from The Big Picture, to download a sample copy please just click here.

Ranked in the top 6% of all funds

Two funds have played a big part in helping us to slaughter the market over the last twelve months. On July 24th 2012 we purchased Fund B and in our first year of ownership, it has vaulted 43.1% (Point J), helping it to outperform 94% of the 5069 funds listed on the Morningstar.co.uk website.

1 star fund delivers 5 star performance

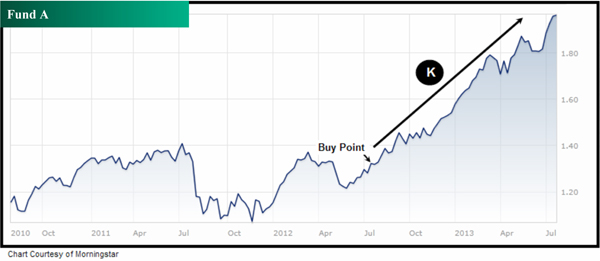

Some investors make the rookie error of purchasing a fund simply because it has a 5 star rating. They also avoid 1 star funds like the plague. This is a mistake. Many financial advisers do this to save time – as do plenty of private investors. It may surprise you that 1 star funds can turn out to be darlings and 5 star funds can turn out to be dogs. The ‘1 star’ rated Fund A is a classic example and it’s a fund that continues to impress us. This beauty has returned a remarkable 50.4% (Point K) in the 12 months since we bought it**.

Outperformed 98% of funds

We were very pleased – and proud – to discover that Fund A’s 50.4% return helped it to rank in the top 2% of the 5069 funds listed on the Morningstar.co.uk website.

Our outlook: 2013-2014 and beyond

At the beginning of this year, we said that we expect over the next two years to see the FTSE 100 make a return of approximately 30-35%. We also said that we expect to beat the FTSE 100 and we still stand behind that statement. So far we feel that we and the market are on track. As you heard before, we are currently sitting on a gain of 16.5% for the year. Beyond the next two years, we believe we’ll continue to experience solid performance from the equity markets, which means that if you are a long-term investor like us, and you stay in the game, the future is looking bright.

This information is taken from The Big Picture, to download a sample copy please just click here.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO is a specialist in ISA and SIPP Investment and the pioneer of ‘Shadow Investment’, a simple way to grow your ISA and SIPP. Together with our clients, we have £57 million actively invested in ISAs and pensions***.

Our personal investment service allows you to look over our shoulder and buy into exactly the same funds as we are buying. These are investment funds that we personally own and so you can be assured that they are good quality. We are proud to say that by ‘shadowing’ us, our clients have made an annual return of 12.5% per year over the last four years**** versus the FTSE 100’s 7.4%.

We currently have close to 400 carefully selected clients. Most of them have over £100,000 actively invested and the majority are DIY investors such as business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector such as IFAs, wealth managers and fund managers. ISACO Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Our firm reference number is 525147.

* June 25th 2013 - July 25th 2013.

** July 24th 2012 - July 24th 2013.

** November 15th 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

**** December 31st 2008 - December 31st 2012.

ISACO investment performance verified by Independent Executives Ltd.

To download our free report 'A Golden Opportunity' >>

To download our Shadow Investment brochure >>

To start your 14 day free 'no obligation' trial of Shadow Investment >>