As I’ve mentioned in two previous blog posts, I’m proud to say that David Mountain, an ISACO client and engineer was one of the many people that loved my new book, How to Make Money in ISAs and SIPPs. In his review, David said:

“I guess the part of the book I most enjoyed was ‘Chapter 9: Beyond Greed and Fear’ – I found myself saying ‘that’s me’ and I can fully recognise this behavioural finance, which is a very interesting subject. I would rate the book with 5 stars. “

David wasn’t the only person to like Chapter 9. Ray Hughes, another ISACO client, entrepreneur and private investor said:

“I was delighted to see that Stephen also covered the psychology of investing within Chapter 9. In my opinion, as a more seasoned investor, this is one of the critical aspects that an investor must understand if they are going to be successful in the markets.”

Another person who loved that chapter Andrew Tait, a business owner and client of ours had this to say about it:

“I particularly enjoyed Chapter 9 on investor behaviour, seeing my past self in the descriptions of how we can act irrationally when investing.”

And so because Chapter 9 was so popular, I thought it best to run a series of articles taken from the chapter to see what you think. This is article number three in the series.

The good news is that we are currently offering the paperback version of How to Make Money in ISAs and SIPPs (RRP £9.95) and a paperback copy of my bestselling classic, Liquid Millionaire (RRP £19.95) – for just £4.95! But this offer is only available to the first 100 people that respond. Buy now to avoid disappointment.

Excerpt below taken from Chapter 9, How to Make Money in ISAs and SIPPs

|

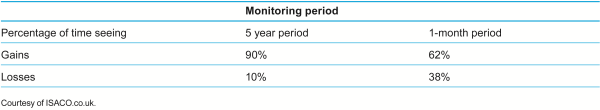

Framing People’s personality traits can hugely affect the way they react to the actual performance of their portfolio in the future. Consider a situation where two investors (Bob and Brian) have made the same investment. Over one year, the market average rises 10% but the individual investment value increases by 6%. Bob cares only about the investment return and frames this as a gain of 6%. Brian is concerned with how the investment performs compared to the benchmark of the market average. The investment has lagged behind the market’s performance and Brian frames this as a loss of 4%. Which investor is likely to be happier with the performance of their investment? Because individuals feel losses much more strongly than the pleasure of making a gain, Bob is much more likely to be happy with the investment than Brian. Their differing reactions here will frame their future investment decisions. Another problem for investors is the strong tendency for individuals to frame their investments too narrowly – looking at performance over short time periods, even when their investment horizon is long-term. People also struggle to consider their portfolio as a whole, focusing too narrowly on the performance of individual components. 70% rule Consider the 70% rule that advises people to plan on spending about 70% of their current income during their retirement. For most people, this rule of thumb is instantly appealing, which could explain why it has become so popular among financial planners. Now let’s reframe the 70% rule as the 30% rule and see what happens. That is, rather than focusing on the 70% of expenditure someone would keep through retirement, let’s consider the 30% of expenditure that should be removed. Most people find the 30% rule difficult to digest, even though the 70% and 30% rules are mathematically identical. Investors hate losses According to Hersh Shefrin, people feel losses much more strongly than the pleasure of making a gain. This emotional strain is magnified when you assume responsibility for the loss. This guilt feeling then produces an avoidance to risk. But this level of guilt can be changed depending on how a financial decision is framed. Myopic thinking Do you focus too much attention on the short-term volatility of your portfolio? While it is not uncommon for an average stock or fund to change a few percentage points in a very short period of time, a myopic (i.e. shortsighted) investor may not react too favourably to the downside changes. This is a recipe for disaster if your goal is to achieve attractive returns over the long term. Over-monitoring performance How frequently you monitor your portfolio’s performance can slant your understanding of it. Suppose you were investing over a 5 year period in higher risk funds.

However, if you were to monitor the performance of the same portfolio on a month-by-month basis, you would notice a loss 38% of the time! Once again, because of our in-built dislike to loss, monitoring your portfolio more frequently will cause you to see more periods of loss, making you more likely to feel emotional stress and take less risk than is suitable for your long-term investment objectives. End of excerpt |

I hope you liked the excerpt and thank you for reading it. Remember, we are currently offering the paperback version of How to Make Money in ISAs and SIPPs (RRP £9.95) and a paperback copy of Liquid Millionaire(RRP £19.95) – for just £4.95! This offer is only available to the first 100 people that respond.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO specialises in ISA and SIPP Investment and is the pioneer of ‘Shadow Investment’; an easy way to grow your ISA and SIPP at low cost. Together with our clients, we have an estimated £57 million actively invested in ISAs and pensions**. Clients like us because we have a great track record of ‘beating’ the FTSE 100***. Over the last 16 years, we’ve outperformed the Footsie by 60.2% and over the last 5 years, we’ve averaged 14.5% each year versus the FTSE 100’s 8.8%. You can find us at www.ISACO.co.uk.

What is Shadow Investment?

Picking the right fund for your ISA and SIPP is not exactly the easiest job in the world. And knowing 'when' to buy and 'when' to exit is even more difficult! Our ‘Shadow Investment’ Service is here to help. Our service allows you to look over our shoulder and buy the same funds that we are buying.

When we are thinking of buying a fund, we alert you so that you have the opportunity to buy it on the same day that we buy it. We also tell you about when we are planning to exit the fund. You control your investment account, not us. You can start small and invest as little or as much money as you like.

By knowing what we are buying, when we are buying and when we are exiting, throughout the year you can mirror our movements and in effect replicate our trades. This means you have the opportunity to benefit from exactly the same investment returns that we get. Our investment aims are 10–12% per year.

We are totally independent, fully transparent and FCA compliant. We’re warm, friendly and highly responsive and it’s a very personal service that gives you direct access to the Sutherland brothers; ISACO’s two founders.

Who are ISACO’s clients?

Clients who benefit most from our service have over £250,000 actively invested and the majority of them are wealthy retirees, business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector, such as IFAs and wealth managers.

Do you have questions?

To have all your questions answered, call 0800 170 7750 or email us at: info@ISACO.co.uk.

* Kahneman and Riepe, 1998.

**November 15th 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

***Long-term performance: December 31st 1997 - December 31st 2013 ISACO 91.3%, FTSE 100 31.1%. 5 year performance: December 31st 2008 - December 31st 2013. ISACO Investment performance verified by Independent Executives Ltd.

> " target="_self"> To download our free report 'A Golden Opportunity' >>

>" target="_self"> To download our Shadow Investment brochure >>

> " target="_self"> To start your 14 day free 'no obligation' trial of Shadow Investment >>