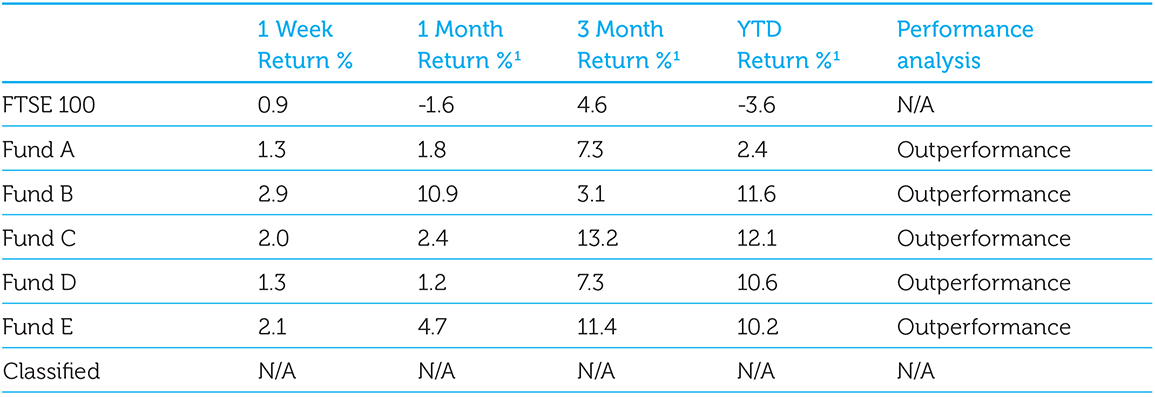

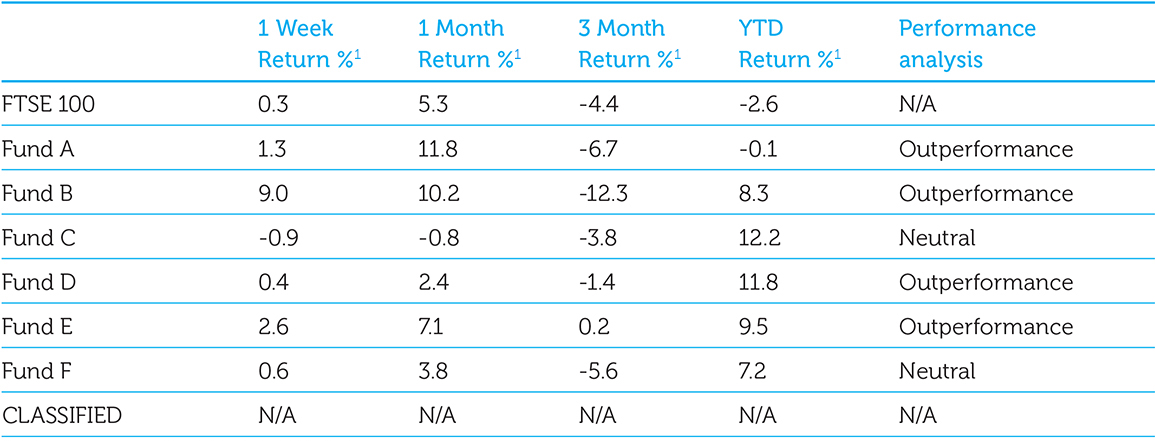

Happy New Year! 2015 was a disappointing year for equity investors. The FTSE 100 dropped 4.9% over the 12 months1 however we managed to eke out a fractional gain of 0.3%, effectively beating our benchmark by 5.2%.

Stephen Sutherland

Recent Posts

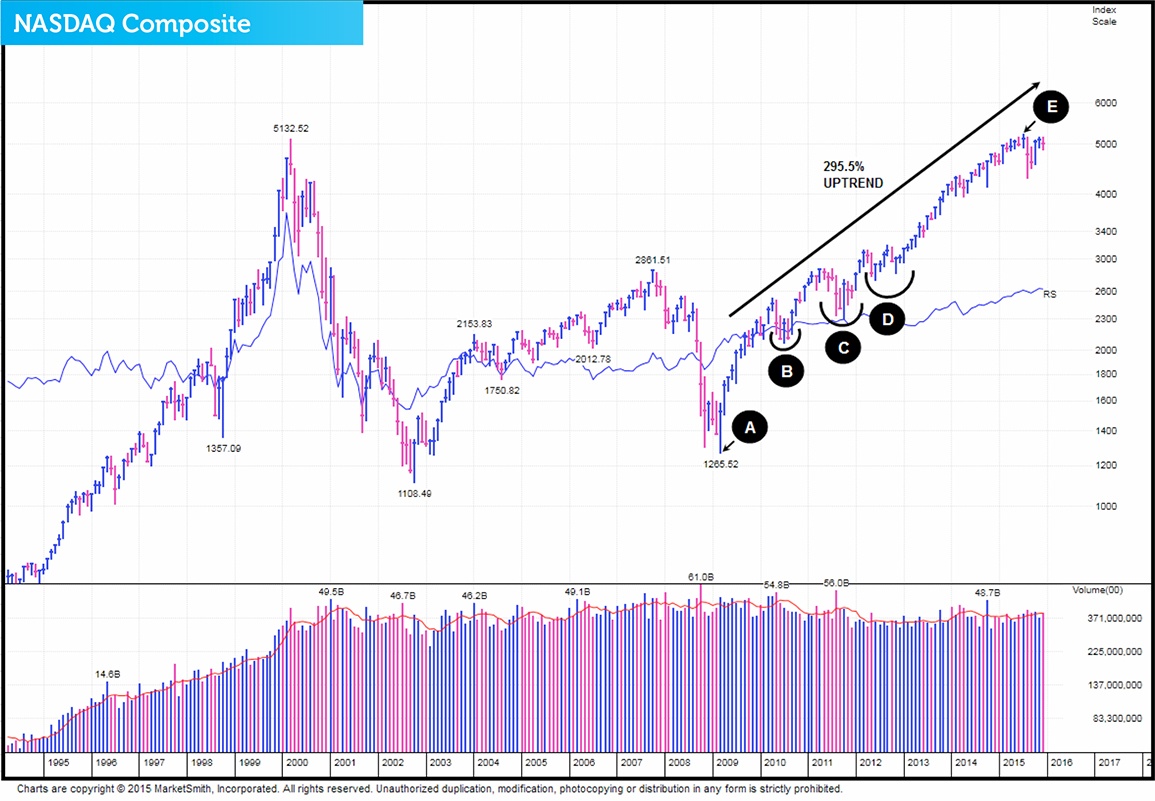

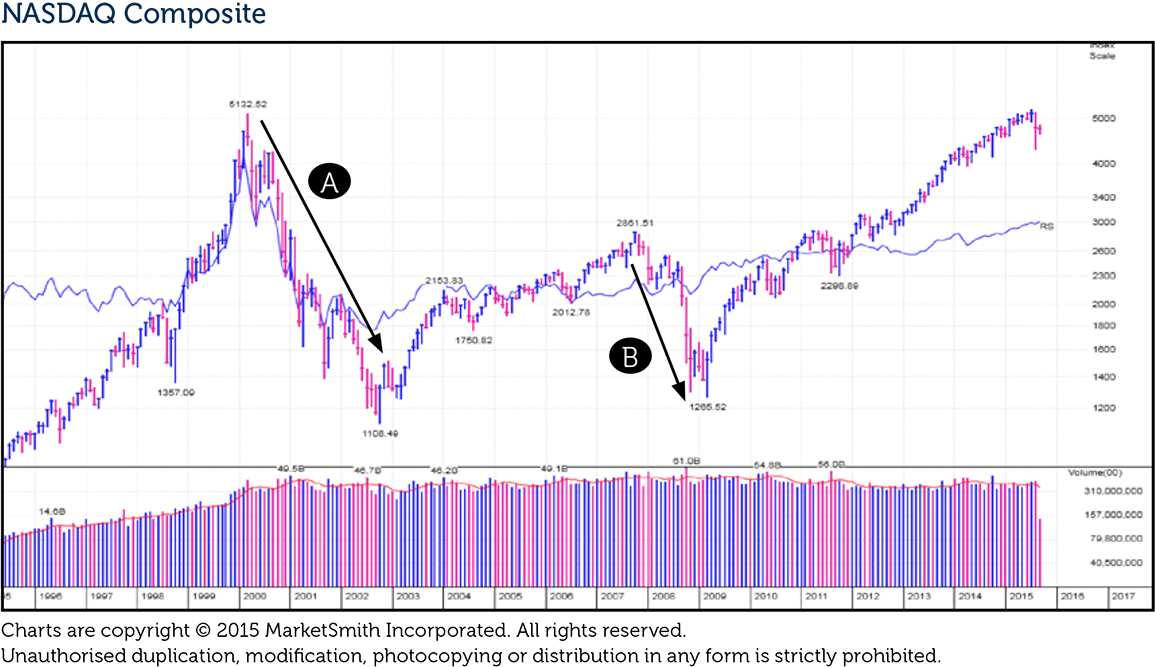

For ISA and SIPP investors: Where will the stockmarket head next?

A golden investment opportunity for ISA & SIPP investors

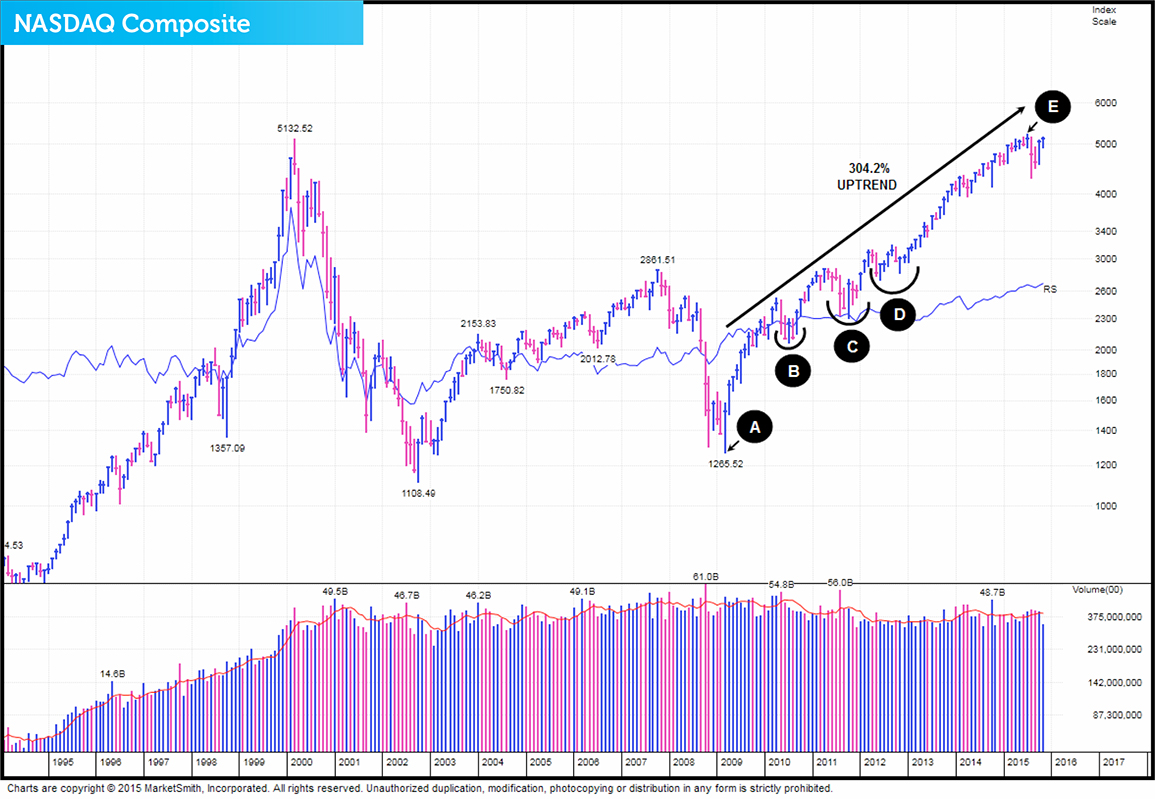

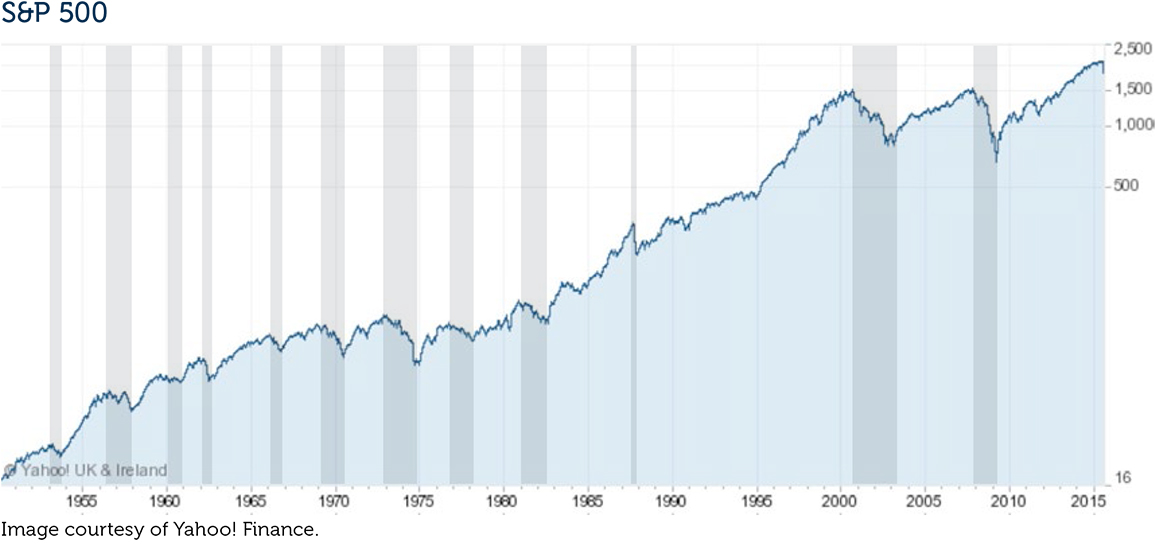

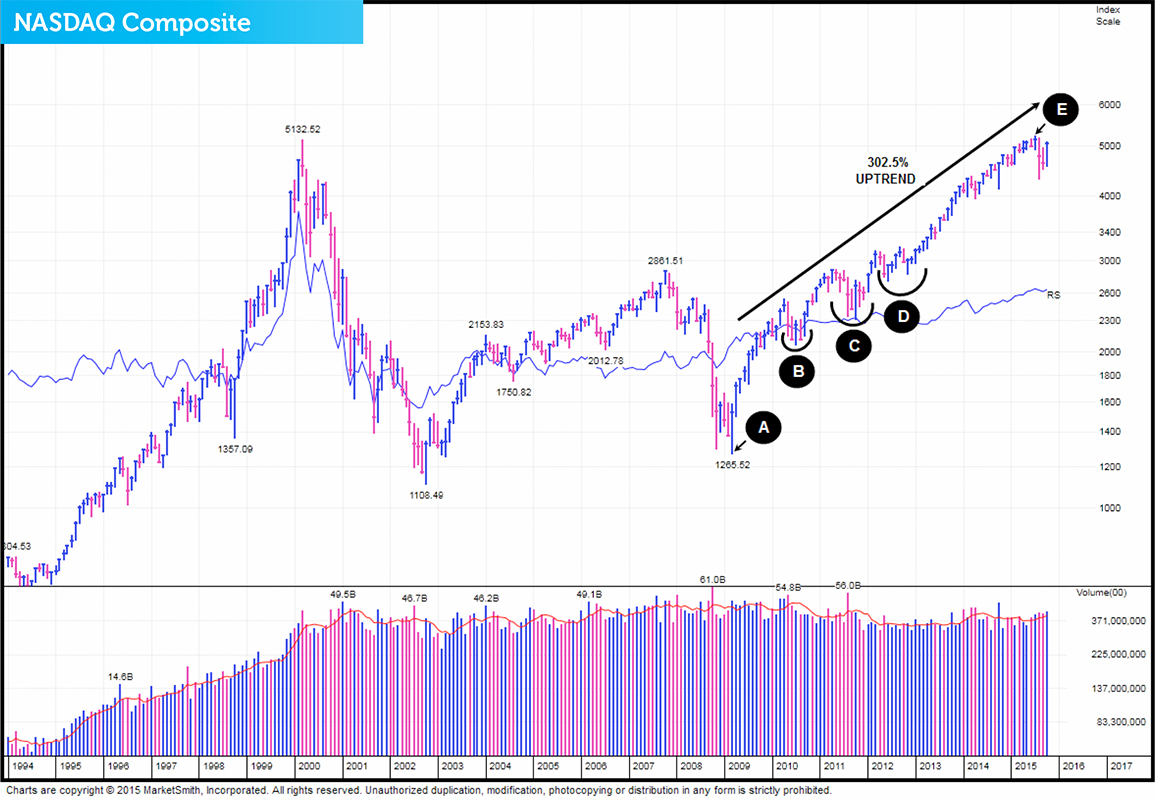

In this series of posts we're sharing an investment opportunity that could boost your ISA and/or SIPP portfolio over the coming years.

New Book: How to Make Money in ISAs and SIPPs

"This book could be the best investment you've ever made."

I’m proud to say that these were the words Lawrence Gosling, Founding Editor of Investment Week used to describe my brother Stephen’s latest book, How to Make Money in ISAs and SIPPs.

Which of our ISA and SIPP funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. We have an active investment strategy which aims to control risk and deliver superior performance. We invest in a number of actively managed funds to form a complete investment portfolio and select what we believe to be the best funds in each asset class. We monitor all the investments selected, replacing under-performers and continuously rebalance the portfolios with the aim of maximising growth potential and managing risk.

For ISA and SIPP investors: Where will the stockmarket head next?

November’s market behaviour was constructive, as was our investments. We are also pleased that our portfolio remains ahead of our FTSE 100 benchmark, by a fairly respectable 5.7%1.

We first ran this article July 22nd 2015 and because it proved so popular amongst the adviser community, we thought it would be a good idea to run it again. Enjoy!

A golden investment opportunity for ISA & SIPP investors

In this new series of posts we're going to share an investment opportunity that could boost your ISA and/or SIPP portfolio over the coming years.

Which of our ISA and SIPP funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. We have an active investment strategy which aims to control risk and deliver superior performance. We invest in a number of actively managed funds to form a complete investment portfolio and select what we believe to be the best funds in each asset class. We monitor all the investments selected, replacing under-performers and continuously rebalance the portfolios with the aim of maximising growth potential and managing risk.

For ISA and SIPP investors: Is the stockmarket setting up for a breakout

October was a much kinder month for investors than those of late. We are also delighted that our investment portfolio continues to outperform our FTSE 100 benchmark1.

The dangers of overconfidence for ISA and SIPP Investors

In this series of posts we are looking at how understanding behavioural finance can help you make better investment decisions. In this post we'll look at the dangers of overconfidence.

Tags: Investment strategy, Behavioural Investing, Investment mistakes