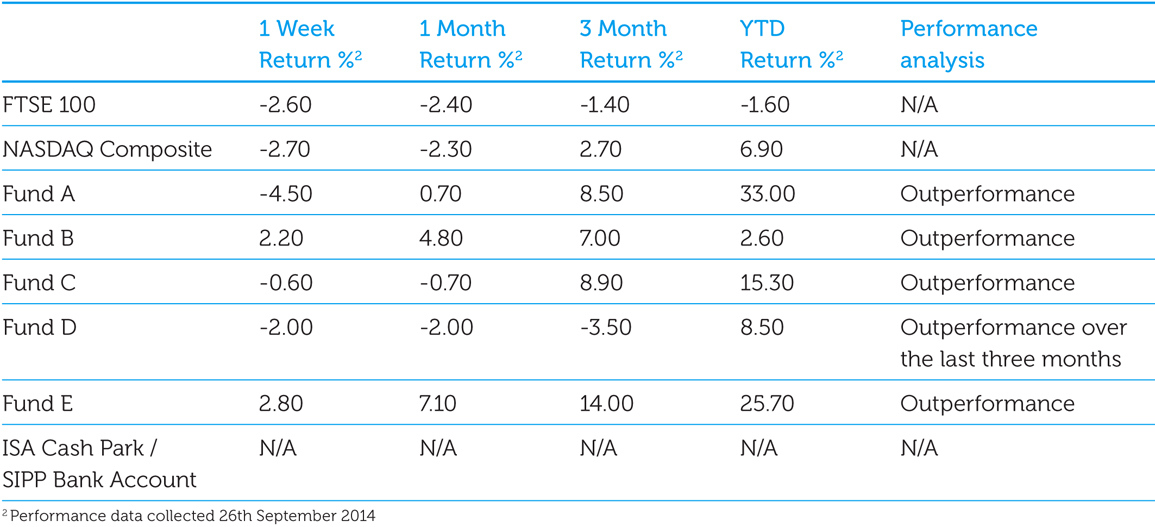

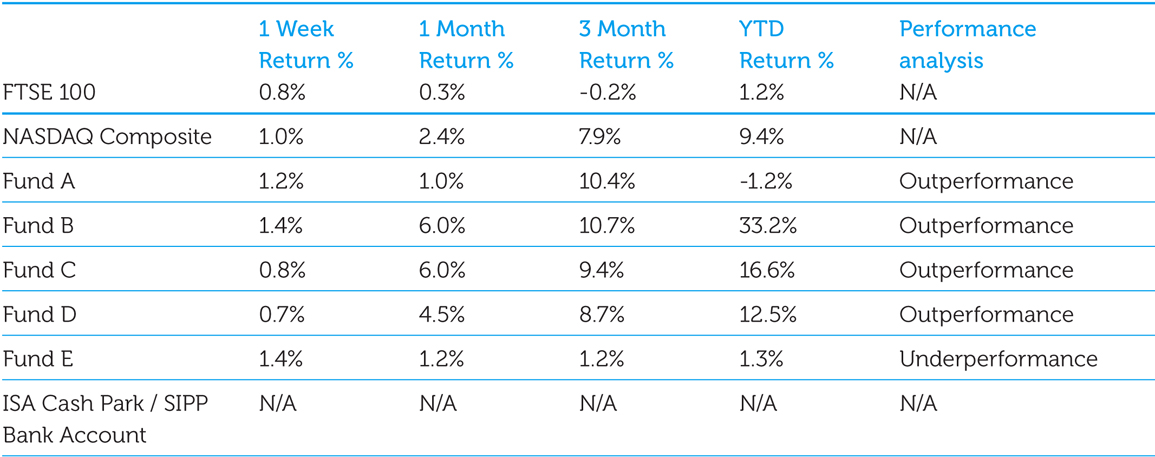

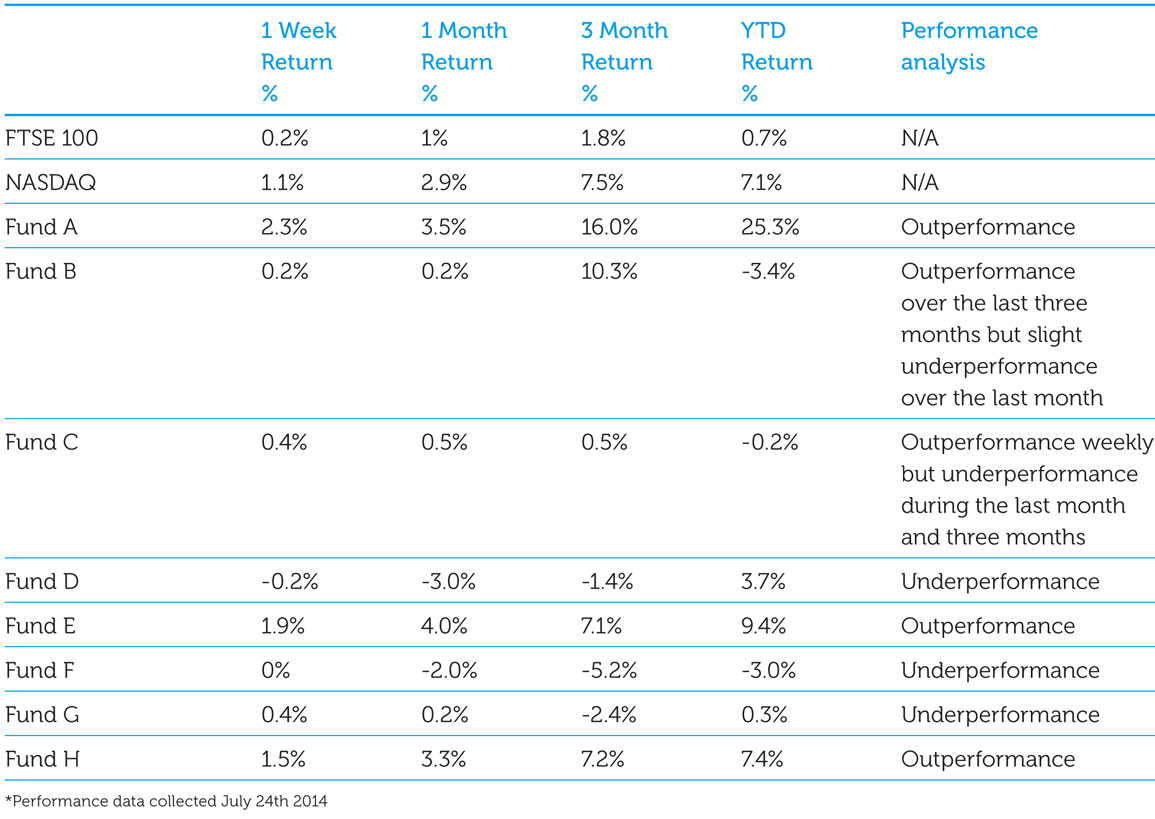

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

Stephen Sutherland

Recent Posts

Which of our funds are in the money flow?

Is the market's current correction a concern?

In this series of posts we've been looking in detail at 7 of the most common mistakes that investors make. In this post, we'll conclude with our nine investment lessons for success. By trying to avoid the mistakes and adhering to the lessons, you are probably going to have a much better chance of reaching your goals.

The 7 most common mistakes investors make: Mistakes number 6 and 7

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 6, 'not keeping score' and mistake number 7, 'investing too conservatively'.

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

The 7 most common mistakes investors make: Mistakes number 4 and 5

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 4, 'Concentrating too much on fundamentals' and mistake number 5, 'Playing ‘buy and hold'.

Tags: Investment strategy, Investment mistakes, Investment charges

The 7 most common mistakes investors make: Mistakes number 2 and 3

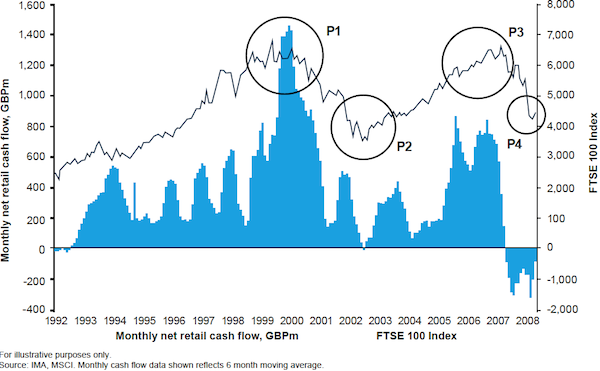

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 2, 'Choosing funds that own underperforming stocks' and mistake number 3, 'Buying at marketing tops'.

Tags: Investment strategy, Investment mistakes, Investment charges

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

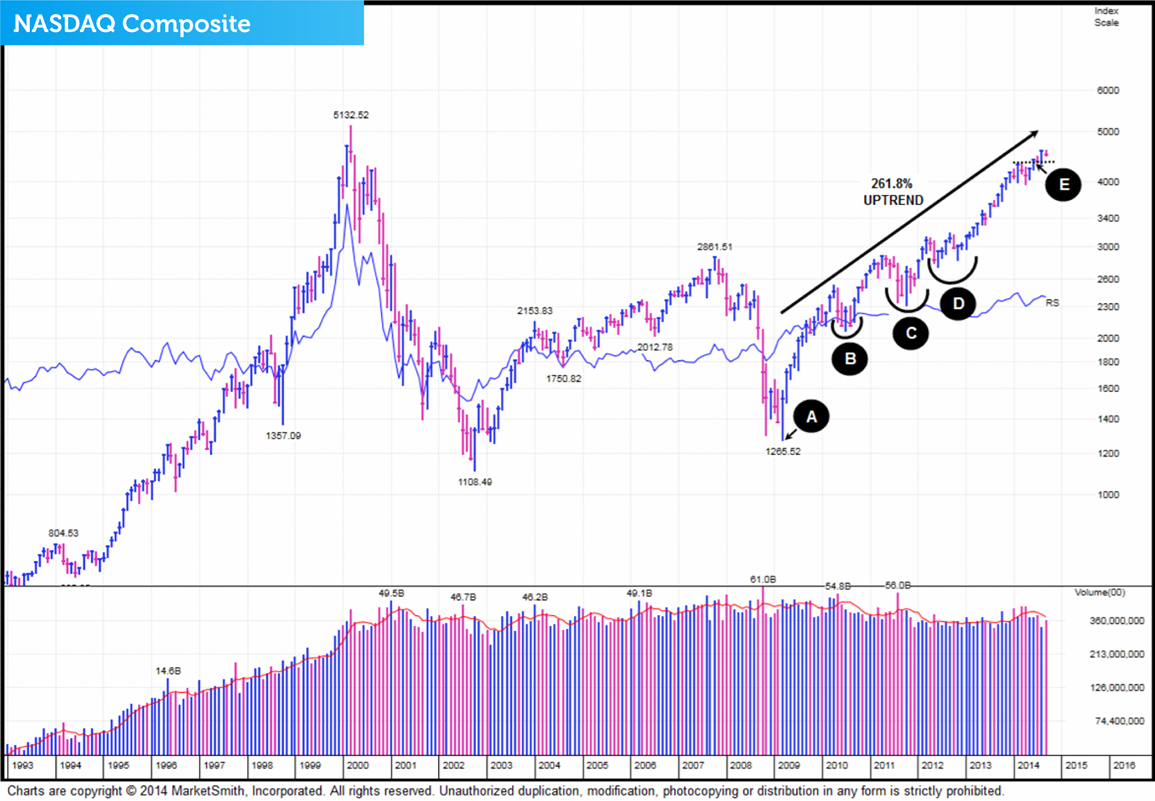

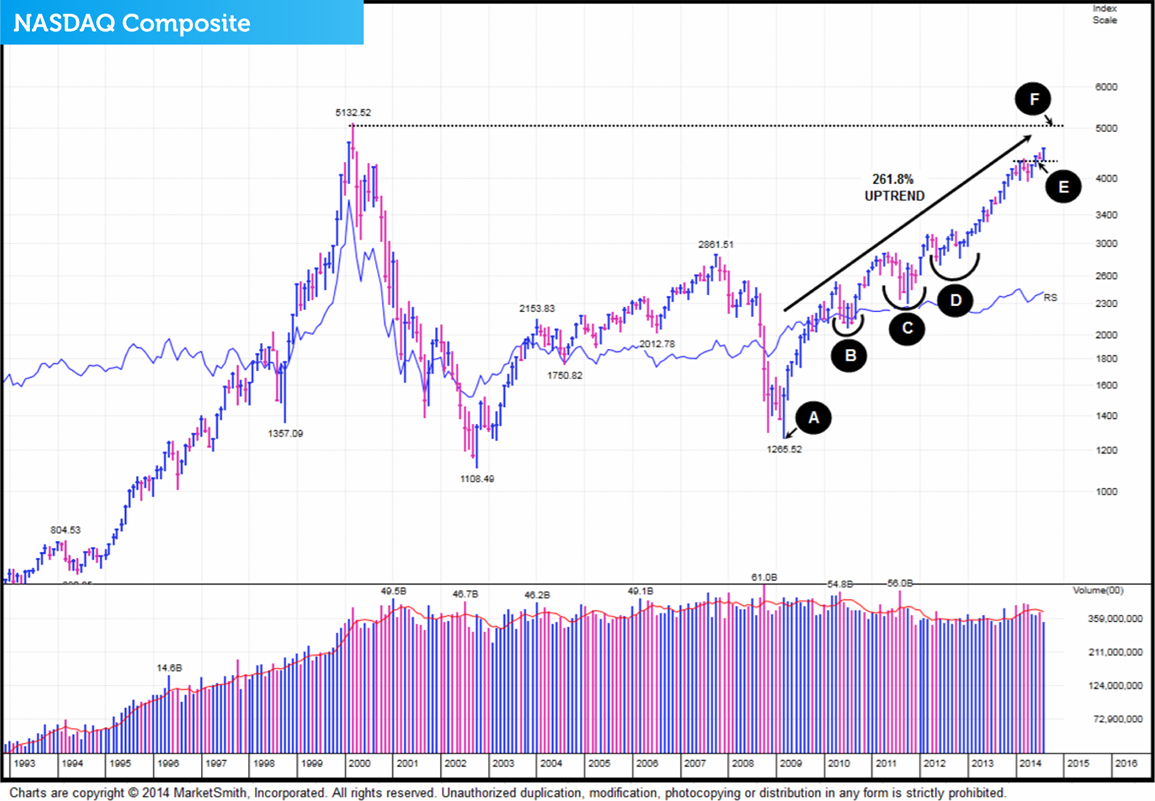

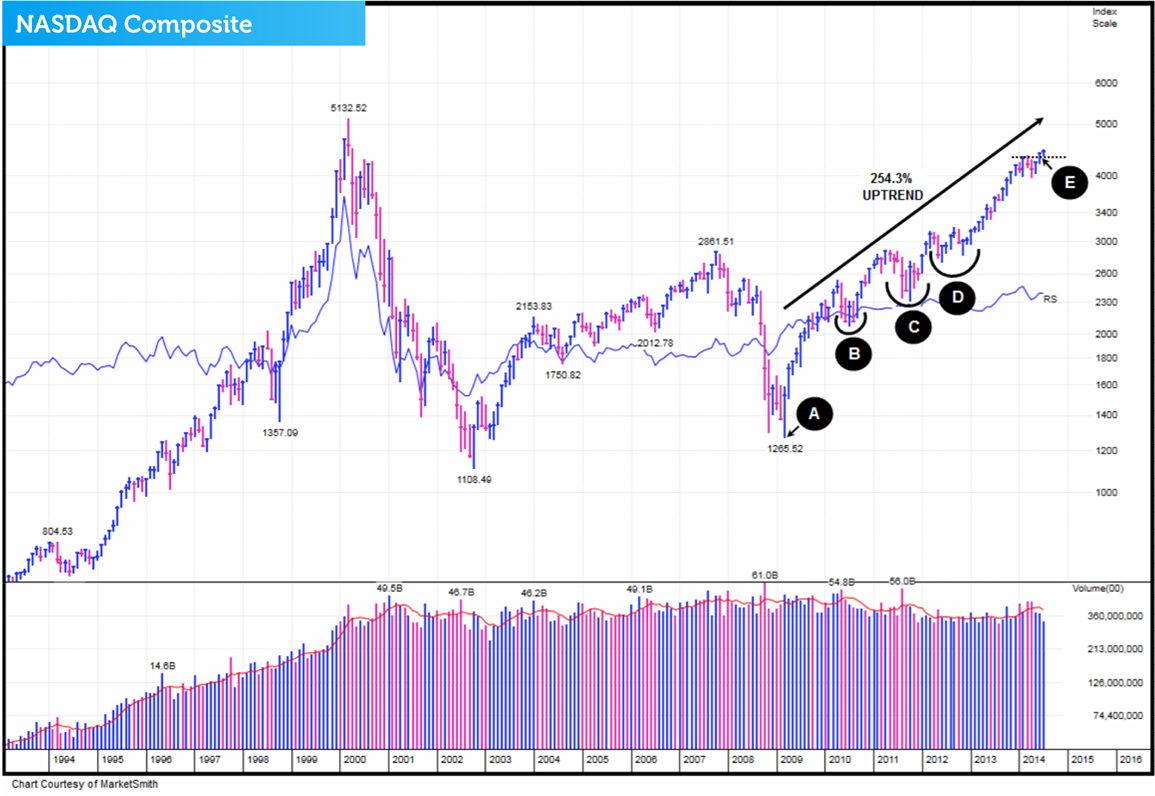

Will the market's current breakout be successful?

In this post we'll take a look at what has been happening in the market since early July.

This information is taken from The Big Picture, to download a sample copy please just click here.