In this post we'll take a look at what has been happening in the market since early August.

The 7 most common mistakes investors make: Mistakes number 4 and 5

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 4, 'Concentrating too much on fundamentals' and mistake number 5, 'Playing ‘buy and hold'.

Tags: Investment strategy, Investment mistakes, Investment charges

The 7 most common mistakes investors make: Mistakes number 2 and 3

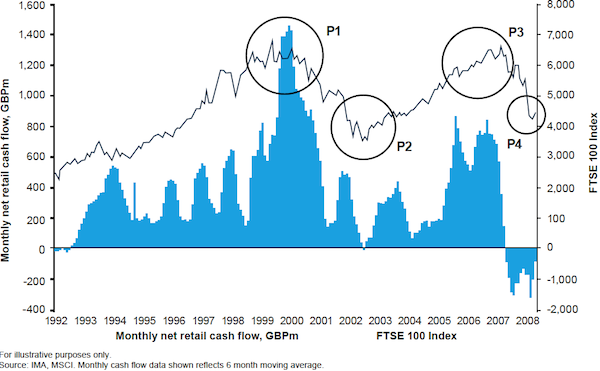

In this series of posts we're looking in detail at 7 of the most common mistakes that investors make. In this post, we'll be looking at mistake number 2, 'Choosing funds that own underperforming stocks' and mistake number 3, 'Buying at marketing tops'.

Tags: Investment strategy, Investment mistakes, Investment charges

New Book: How to Make Money in ISAs and SIPPs

"This book could be the best investment you've ever made."

I’m proud to say that these were the words Lawrence Gosling, Founding Editor of Investment Week used to describe my brother Stephen’s latest hot off the press book, How to Make Money in ISAs and SIPPs.

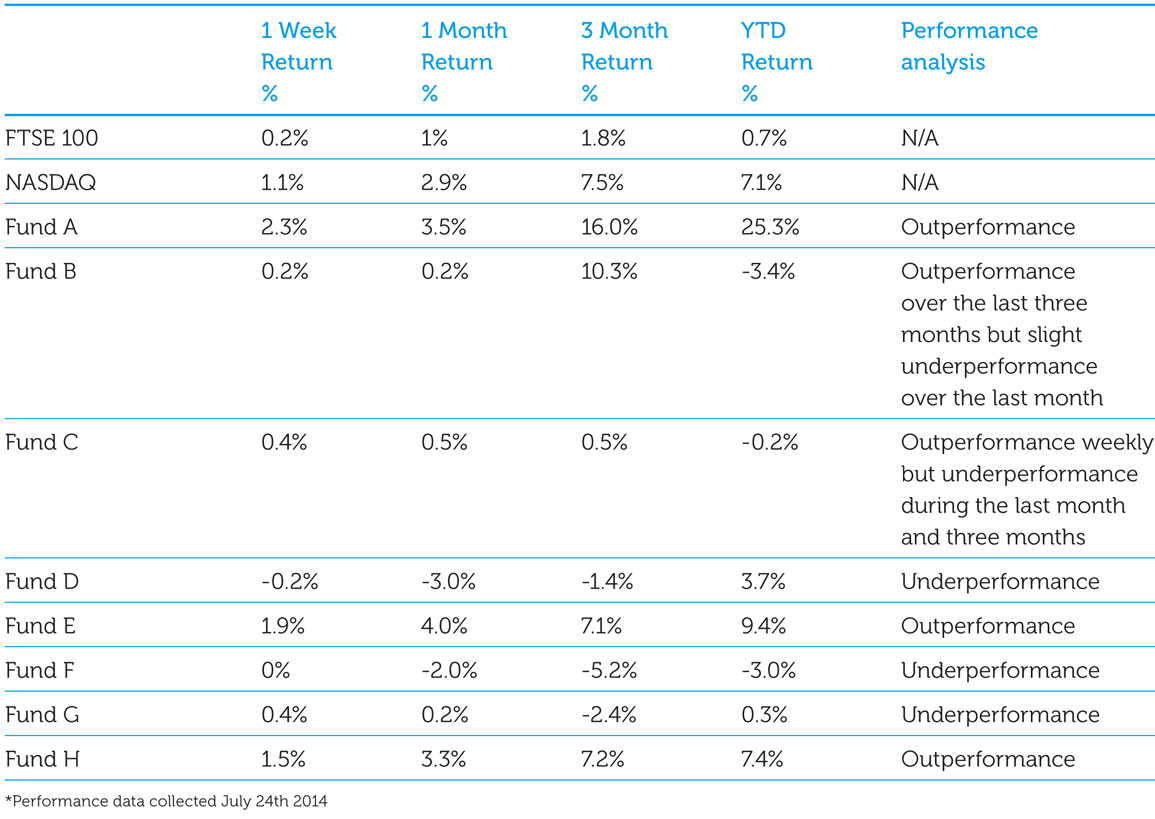

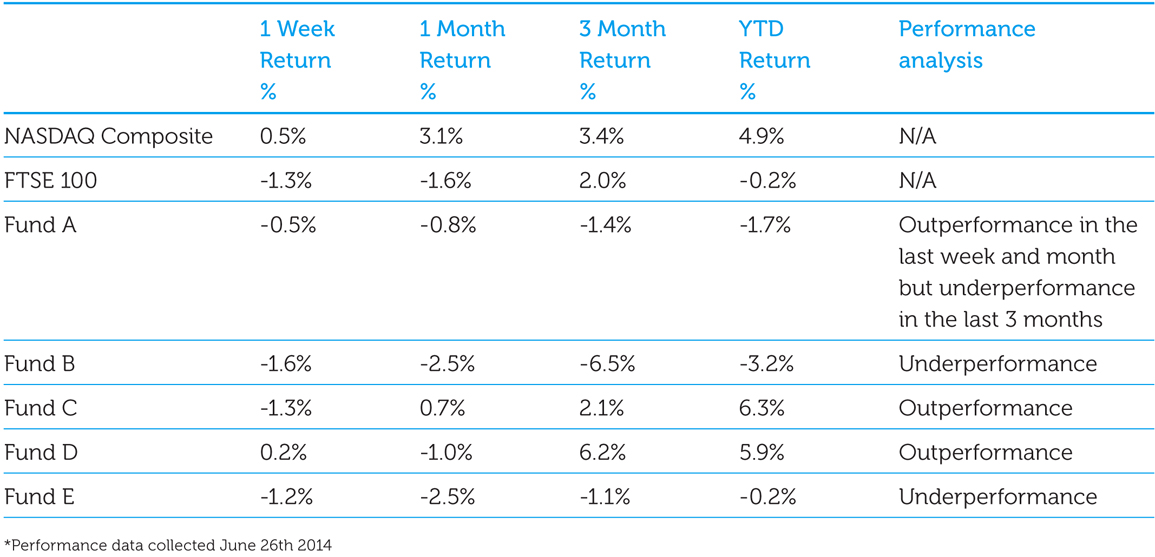

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

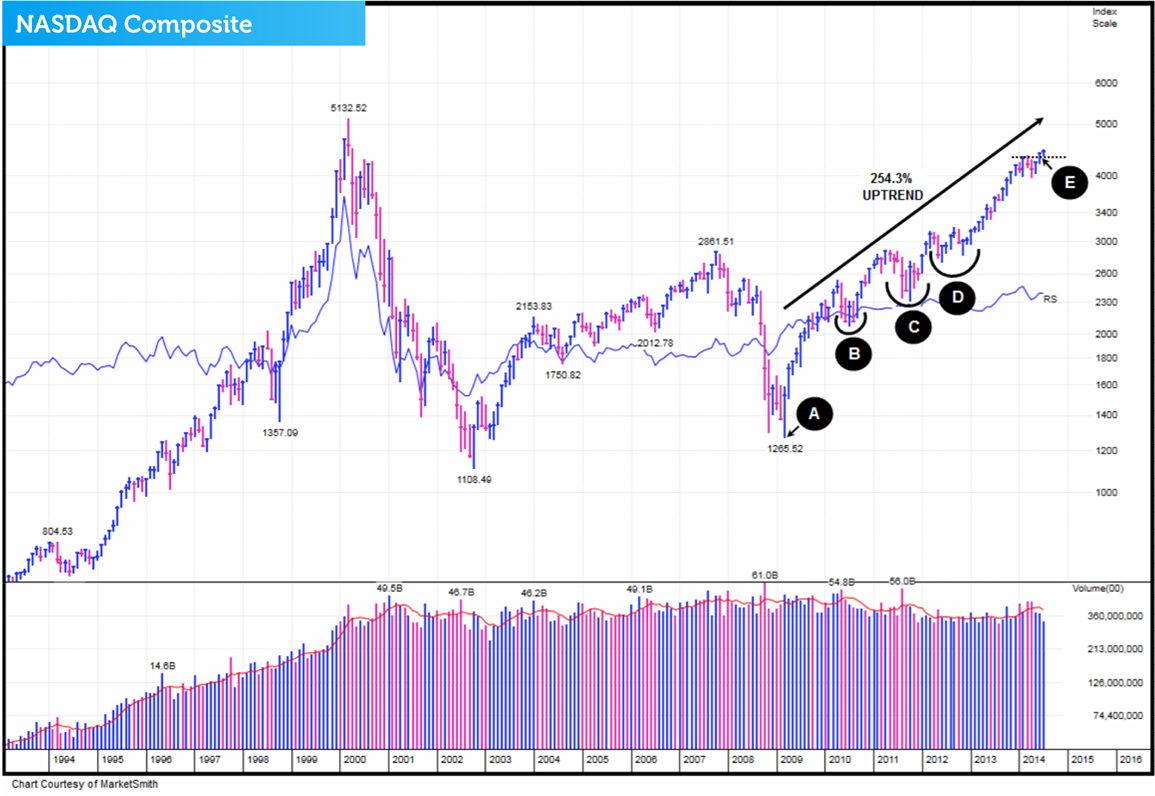

Will the market's current breakout be successful?

In this post we'll take a look at what has been happening in the market since early July.

This information is taken from The Big Picture, to download a sample copy please just click here.

As I’ve mentioned in four previous blog posts, I’m proud to say that David Mountain, an ISACO client and engineer was one of the many people that loved my new book, How to Make Money in ISAs and SIPPs. In his review, David said:

“I guess the part of the book I most enjoyed was ‘Chapter 9: Beyond Greed and Fear’ – I found myself saying ‘that’s me’ and I can fully recognise this behavioural finance, which is a very interesting subject. I would rate the book with 5 stars. “

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

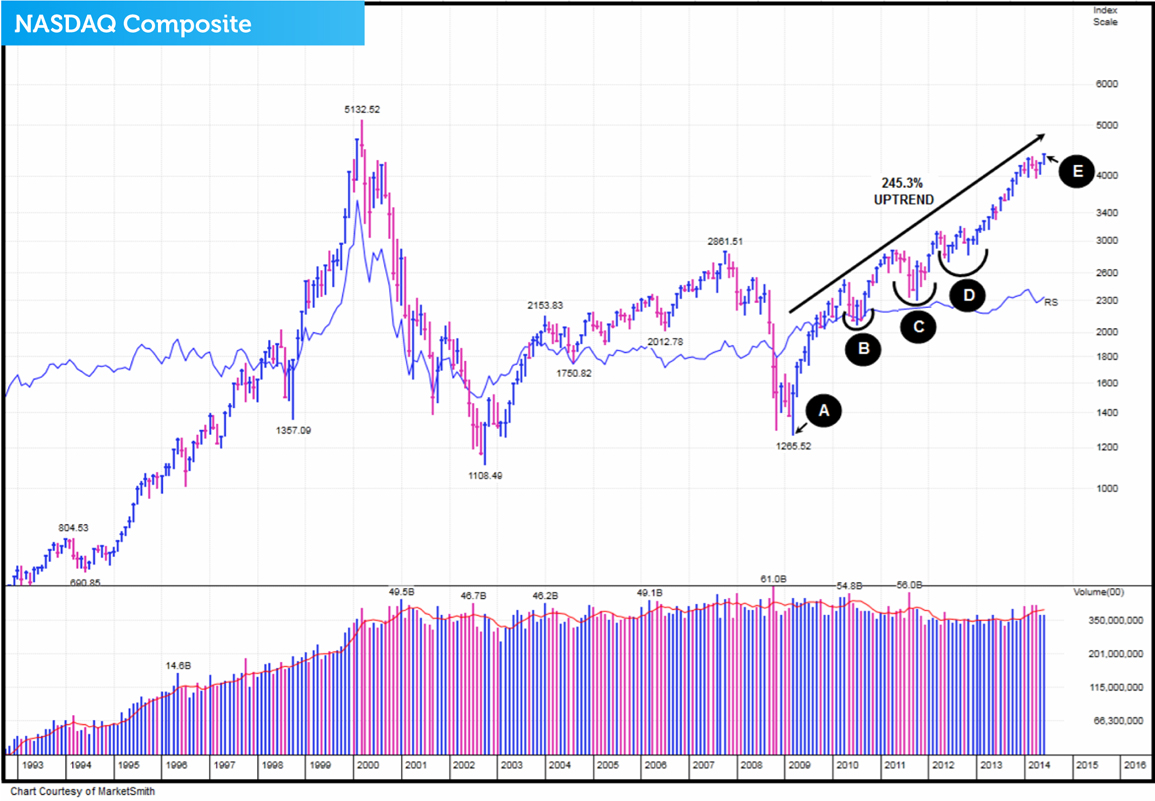

Will the market's breakout be successful?

In this post we'll take a look at what has been happening in the market since early June.

This information is taken from The Big Picture, to download a sample copy please just click here.

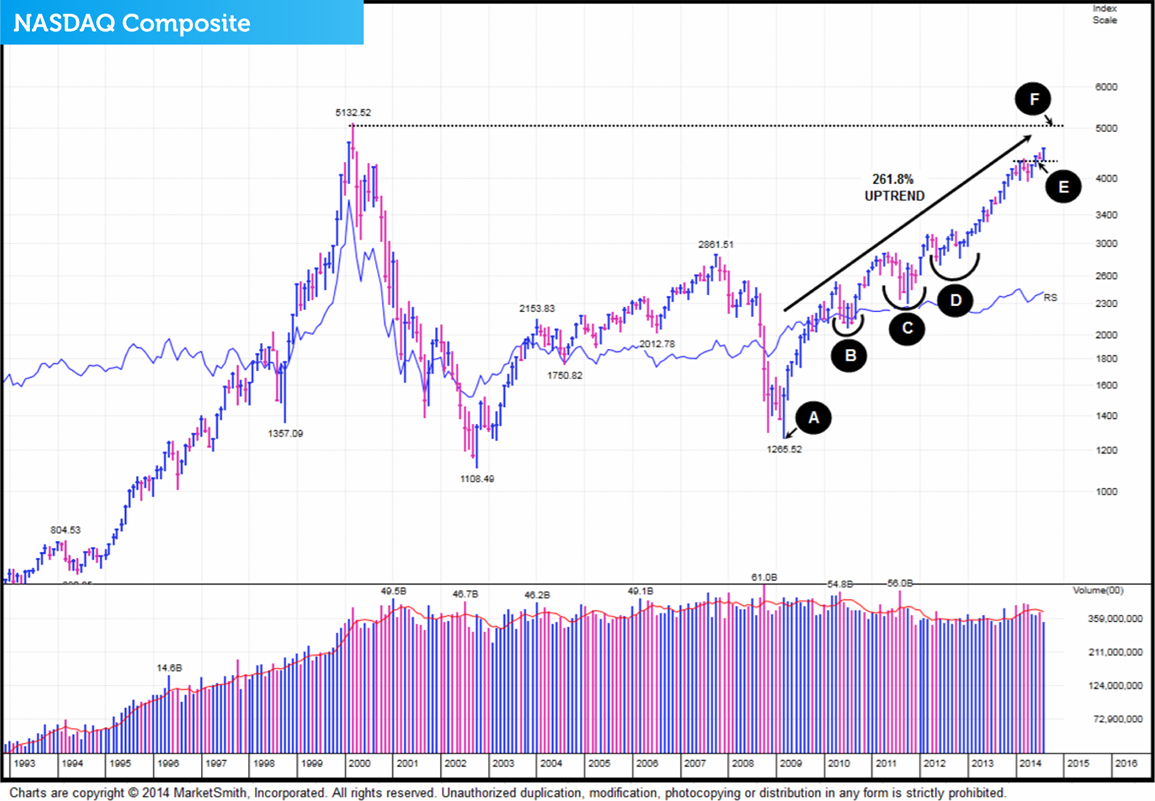

The good news is that the NASDAQ Composite has recently broken out of a bullish cup-with-handle base formation. But the big question is, will its breakout be successful?

The New ISA (NISA) FAQ - everything you need to know about the New ISA (NISAs)

In our last post we summarised the main NISA changes that came into effect on 1st July. Prospective clients of ours always have lots of questions regarding ISAs and we’re sure you do too, so we’ve put together a short Q&A covering the most frequently asked NISA related questions.

Tags: ISA investing tips, NISA, Investment news