During his 2014 budget speech on March 19th, the Chancellor announced a raft of changes designed to help savers and investors. This included a new increased ISA allowance that came into effect yesterday, 1st July 2014.

How behavioural finance can help improve investment returns

As I’ve mentioned in three previous blog posts, I’m proud to say that David Mountain, an ISACO client and engineer was one of the many people that loved my new book, How to Make Money in ISAs and SIPPs. In his review, David said:

“I guess the part of the book I most enjoyed was ‘Chapter 9: Beyond Greed and Fear’ – I found myself saying ‘that’s me’ and I can fully recognise this behavioural finance, which is a very interesting subject. I would rate the book with 5 stars. “

Tags: How to Make Money in ISAs and SIPPs, Investment strategy, Behavioural Investing

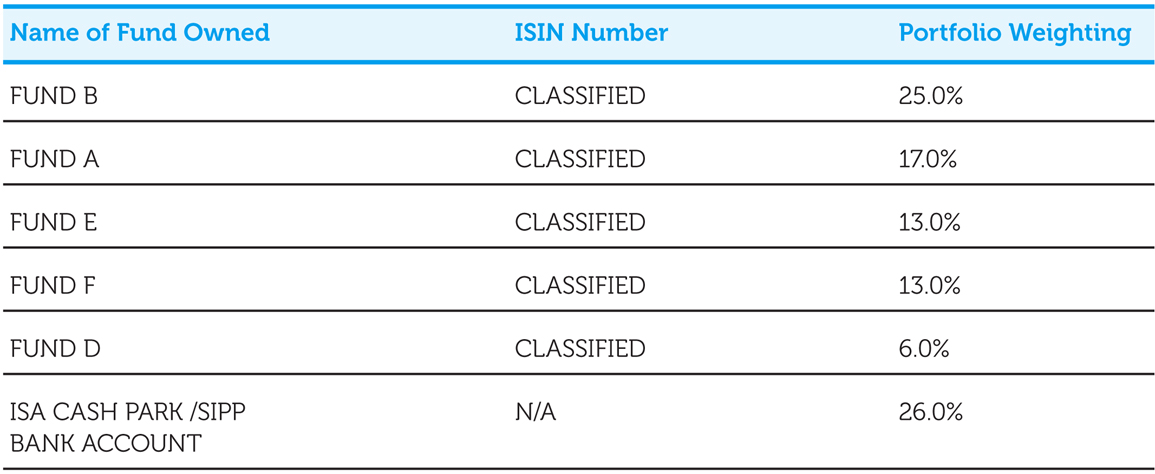

On the weekend of Sat 7th June/Sunday 8th June we made some changes to our portfolio. As you will see below, Fund A and Fund C had recently been underperforming. This prompted us to take some profits from Fund A (switch 50% of the fund into cash) and exit completely out of Fund C. We also found a couple of potential buying opportunities that excited us. These are Fund E and Fund F. We made a 13% allocation of our total portfolio in each of these two new funds. This left us with approximately 27% in cash. After the switch was complete and the trade is settled, our new portfolio looked something similar to this:

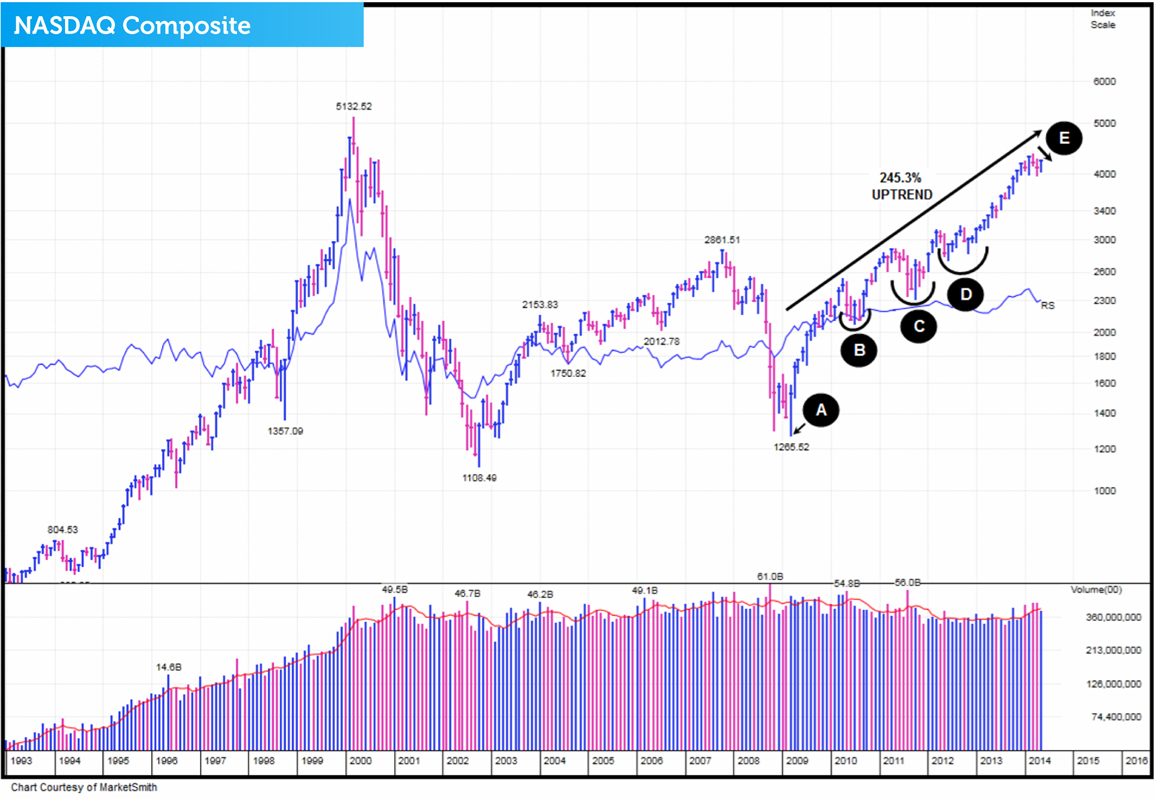

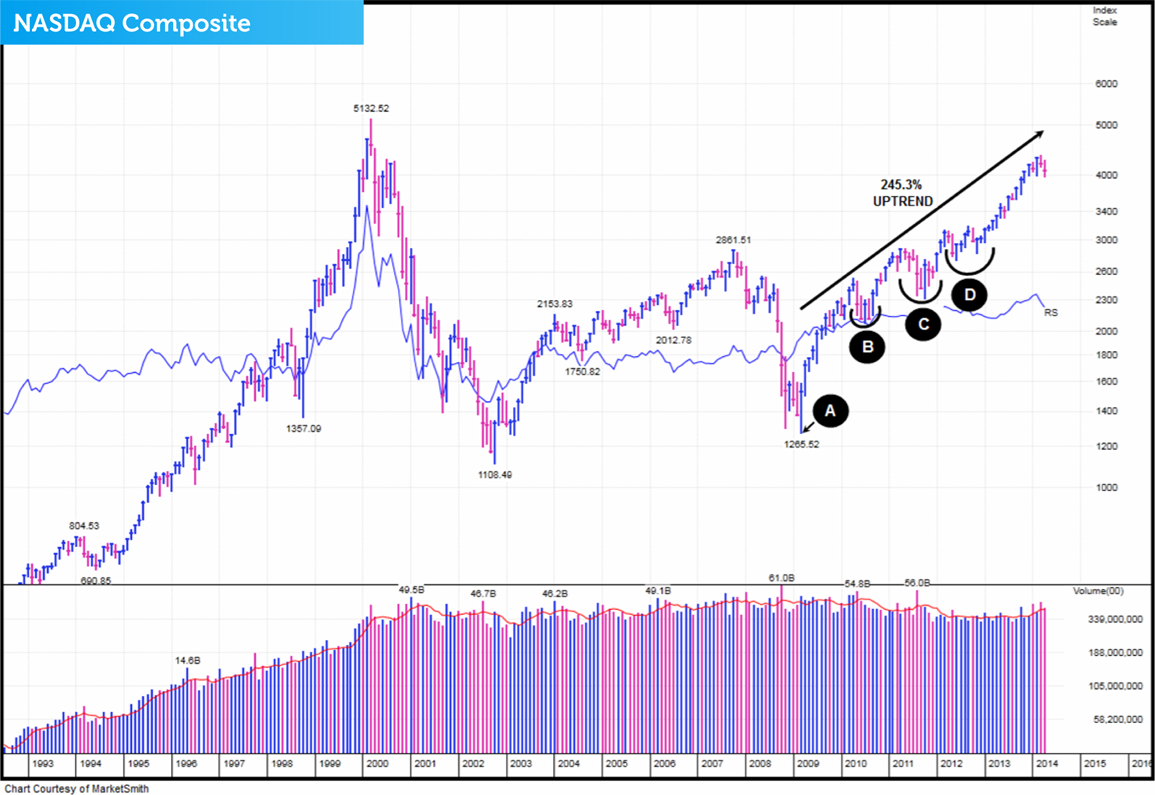

In this post we'll take a look at what has been happening in the market since early May.

This information is taken from The Big Picture, to download a sample copy please just click here.

The way we use to check if the market is behaving as it should is to look at the trading action (price and volume activity) of institutional investors. Why do we do this? The stock market is about six month forward looking and its daily activity is the consensus conclusion whether institutional investors like or don’t like what they see happening down the road. By watching what the big players are doing (buying or selling) each and every day, it can provide essential clues to which way the market is likely to head.

The 7 most common mistakes investors make: Mistake number 1

In this new series of posts we're going to look at 7 of the most common mistakes that investors make. In this post, we'll start by looking at maistake number 1, 'Making 'low fees' the highest priority'.

Tags: Investment strategy, Investment mistakes, Investment charges

As I’ve mentioned in two previous blog posts, I’m proud to say that David Mountain, an ISACO client and engineer was one of the many people that loved my new book, How to Make Money in ISAs and SIPPs. In his review, David said:

“I guess the part of the book I most enjoyed was ‘Chapter 9: Beyond Greed and Fear’ – I found myself saying ‘that’s me’ and I can fully recognise this behavioural finance, which is a very interesting subject. I would rate the book with 5 stars. “

Tags: How to Make Money in ISAs and SIPPs, Investment strategy, Behavioural Investing

New! "This book could be the best investment you've ever made"

I’m proud to say that these were the words Lawrence Gosling, Founding Editor of Investment Week used to describe my brother Stephen’s latest hot off the press book, How to Make Money in ISAs and SIPPs.

How to know if your fund is acting right

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

INTRODUCTION:

Your “how to” blog post should teach the reader how to do something by breaking it down into a series of steps.

Begin your blog post by explaining what problem you are going to solve through your explanation and be sure to include any relevant keywords. Add in a personal story to establish your credibility on this topic. And make sure to end your blog post with a summary of what your reader will gain by following your lead.

Need some inspiration? Check out these "How-To" examples from the HubSpot blog: