In this new series of posts we are going to look at how understanding behavioural finance can help you make better investment decisions and the process starts with getting a good grip on your financial personality. The key is to try becoming aware of the decisions you make and how you are likely to react to the uncertainty that comes with investing in the stock market. Understanding your financial personality can also help to control the irrational and illogical elements of your investment decisions.

Mistakes ISA and SIPP investors make and how to avoid them

Tags: Investment strategy, Behavioural Investing, Investment mistakes

Which of our ISA and SIPP funds are in the money flow?

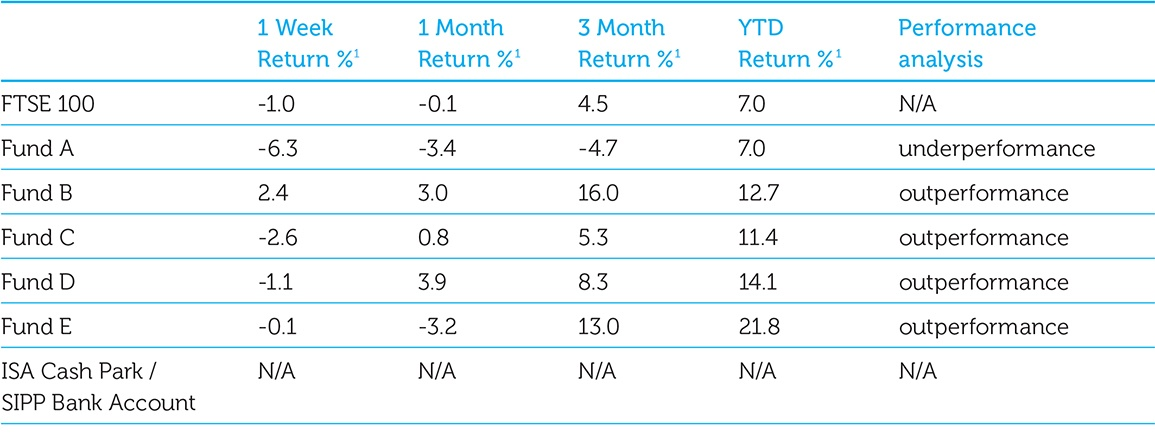

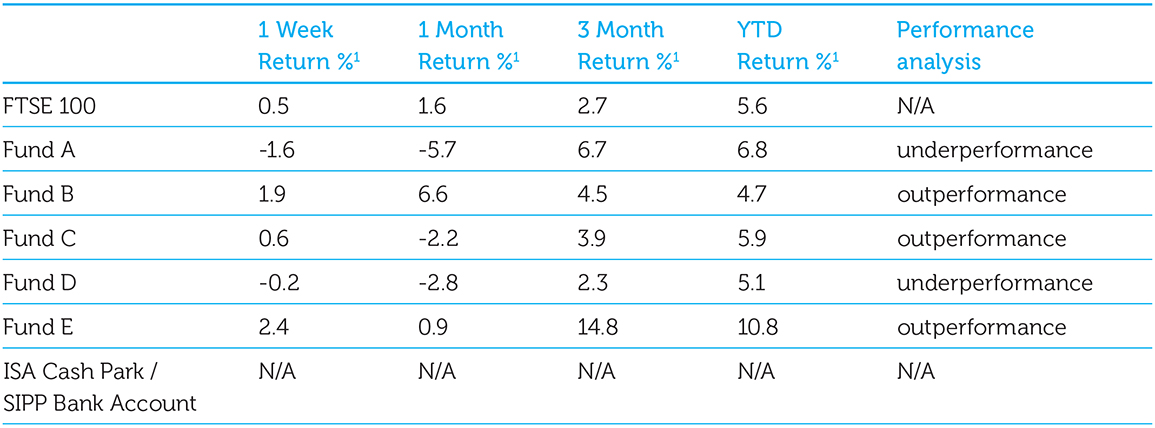

Each month we like to make sure that the funds we own are acting right. We have an active investment strategy which aims to control risk and deliver superior performance. We invest in a number of actively managed funds to form a complete investment portfolio and select what we believe to be the best funds in each asset class. We monitor all the investments selected, replacing under-performers and continuously rebalance the portfolios with the aim of maximising growth potential and managing risk.

For ISA and SIPP Investors: Where will the market head next?

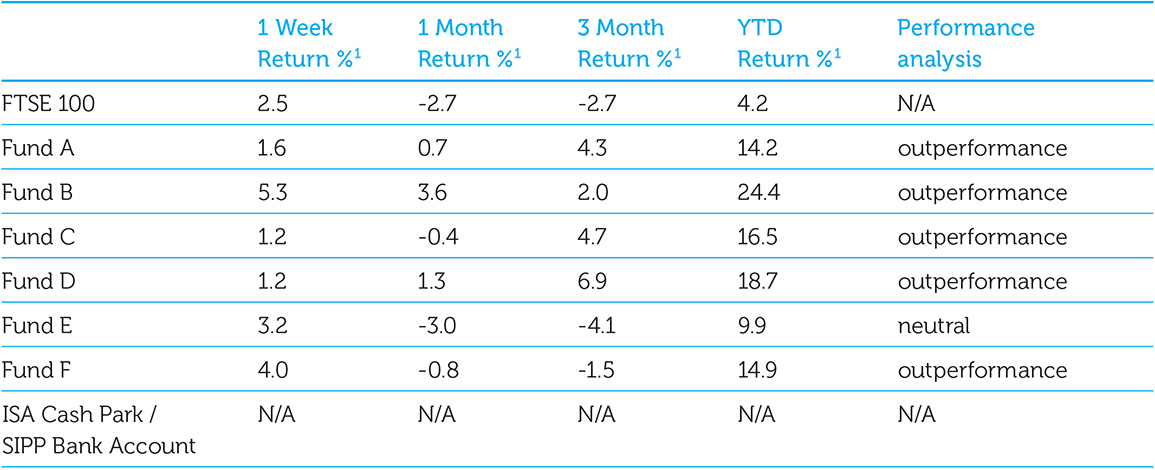

2015 has been a difficult year for equity investors. However we are very proud that we continue to outperform our benchmark, currently1 up 7.4% for the year versus the FTSE 100’s 2.8%.

Which of our ISA and SIPP funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. We have an active investment strategy which aims to control risk and deliver superior performance.

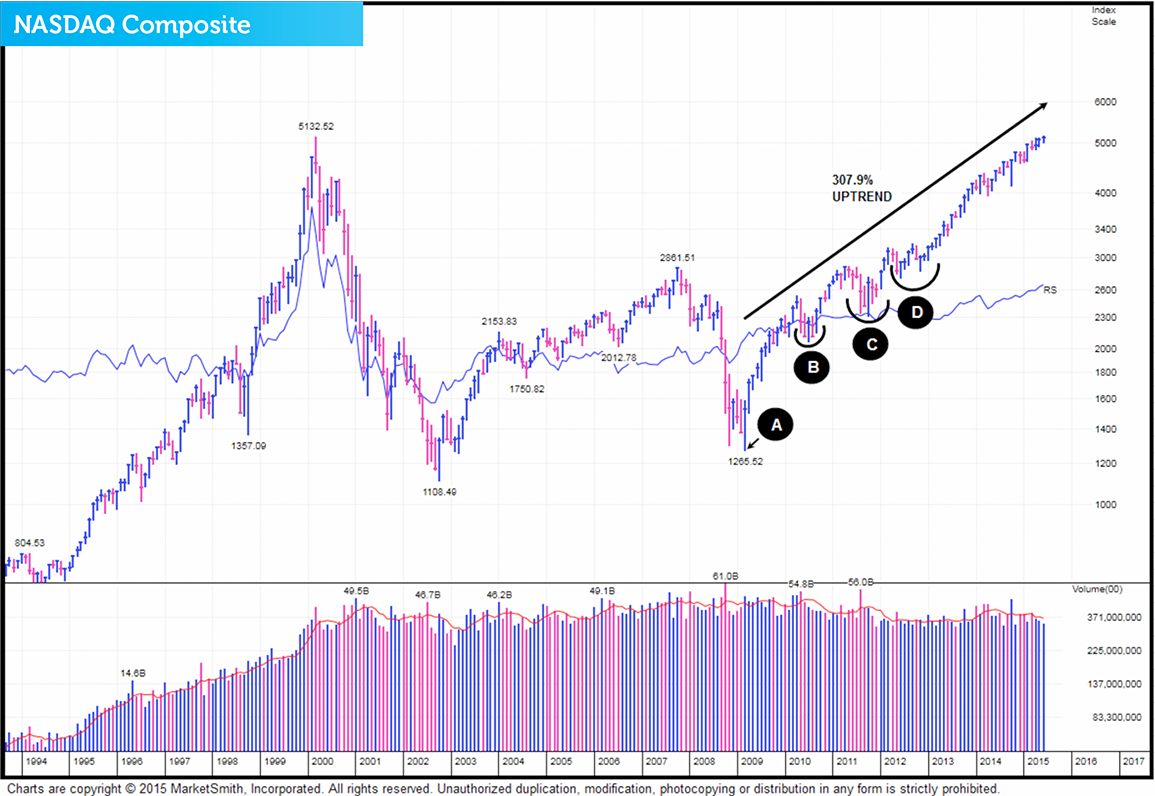

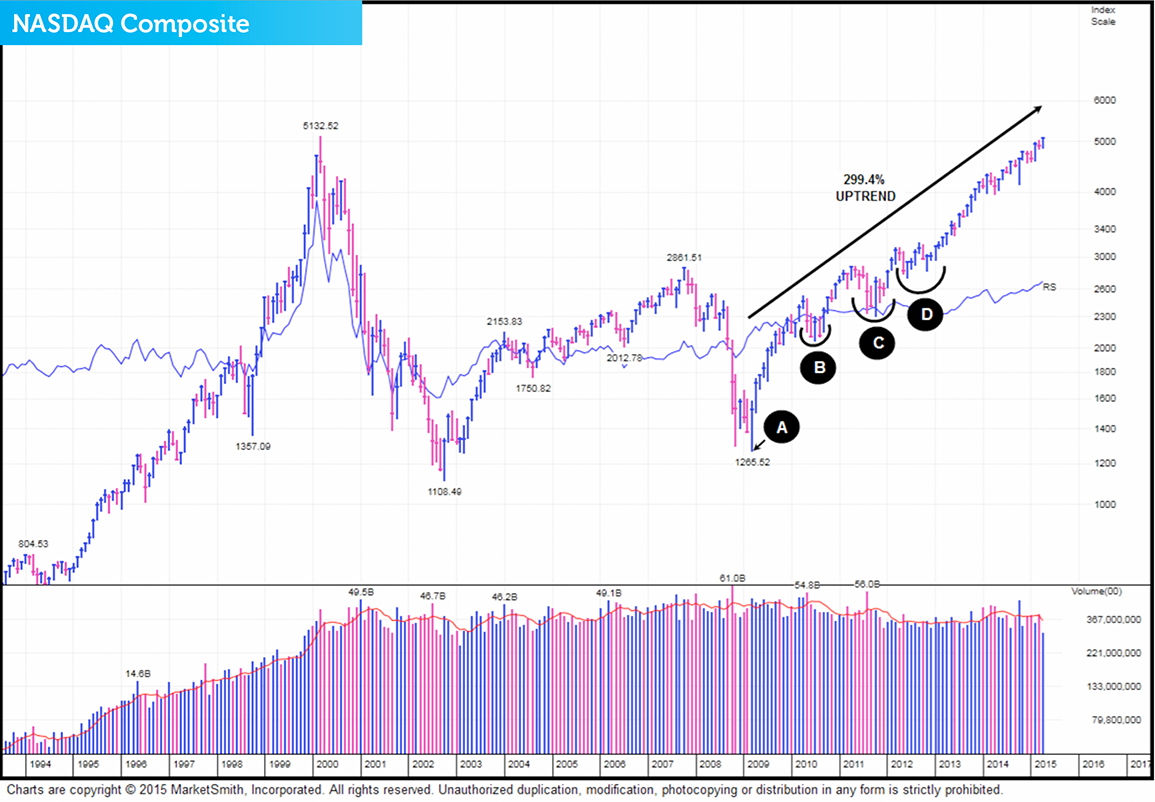

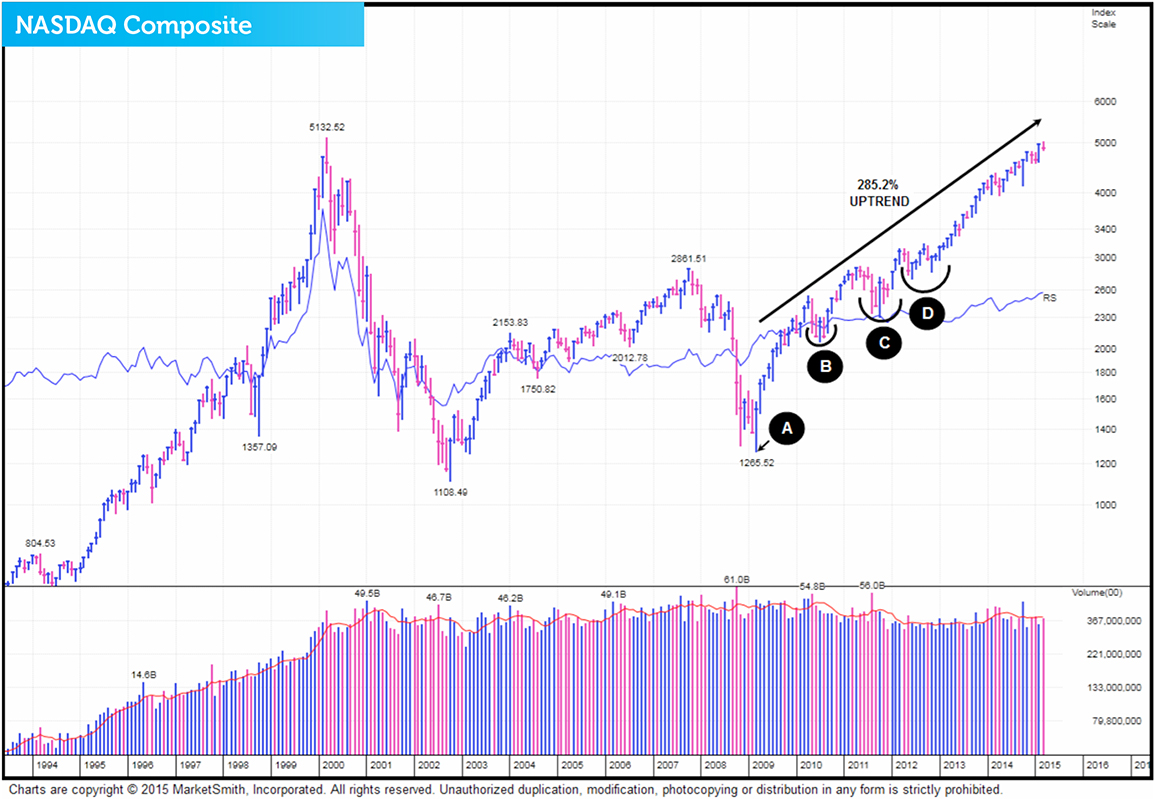

Attention ISA and SIPP Investors: Will the bull market continue?

Quarter 2 is over and we are delighted to report that we continue to outperform our benchmark. Year to date we have made a return of 7.4%1 compared to the FTSE 100’s 2.9%1.

Which of our ISA and SIPP funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. We have an active investment strategy which aims to control risk and deliver superior performance.

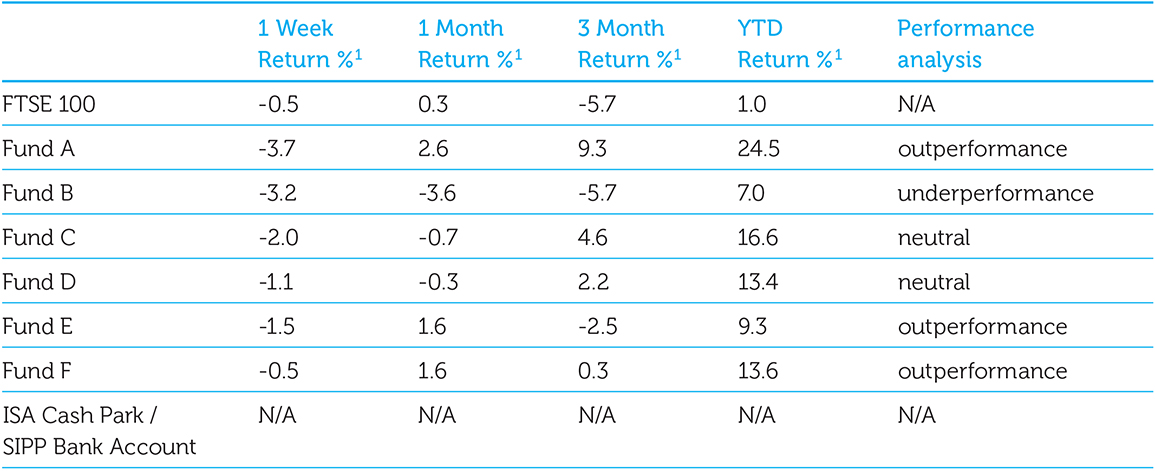

The equity markets in April made fresh highs. Our portfolio also hit a new year to date high1 of 14.4% compared to our benchmark, the FTSE 100’s 8.0%.

Quarter 1 is over and for now, we appear to be positioned in the right investments. Over the period our portfolio returned an impressive 9.1%1 compared to the FTSE 100’s 4.4%1.

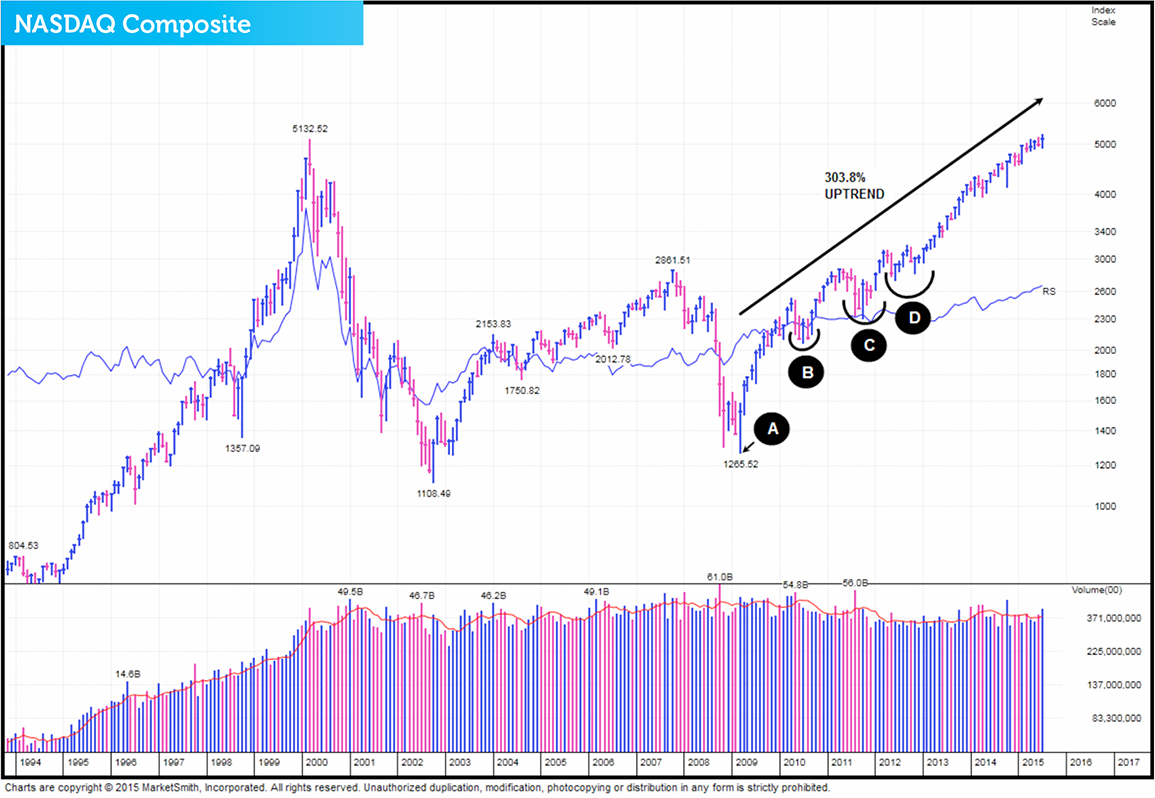

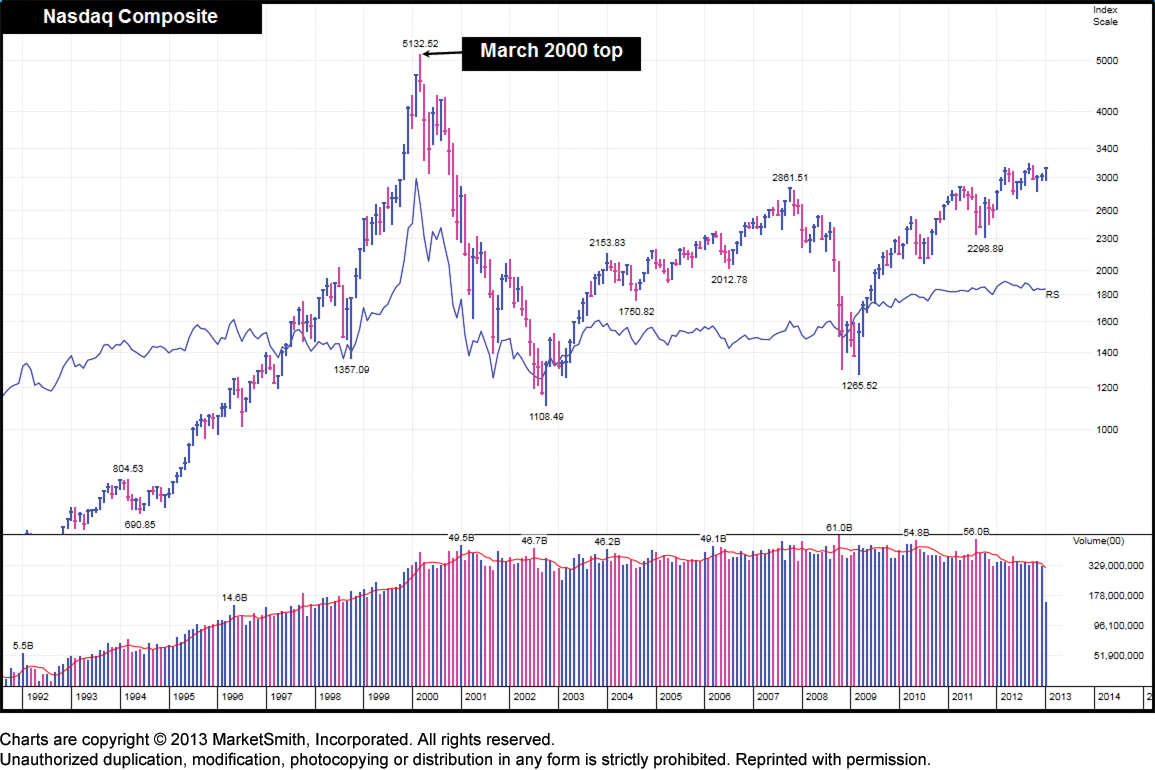

How ISA and SIPP investors can aim to spot a market top

This is the seventh in a series of posts where we're looking at gauging the stock market's direction.

Which of our ISA and SIPP funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as the long-term performance of the present fund manager being a key factor in fund selection, the short-term performance of the fund manager is very important too. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.