Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

Stephen Sutherland

Recent Posts

How to know if your fund is acting right

How to know if your fund is acting right

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

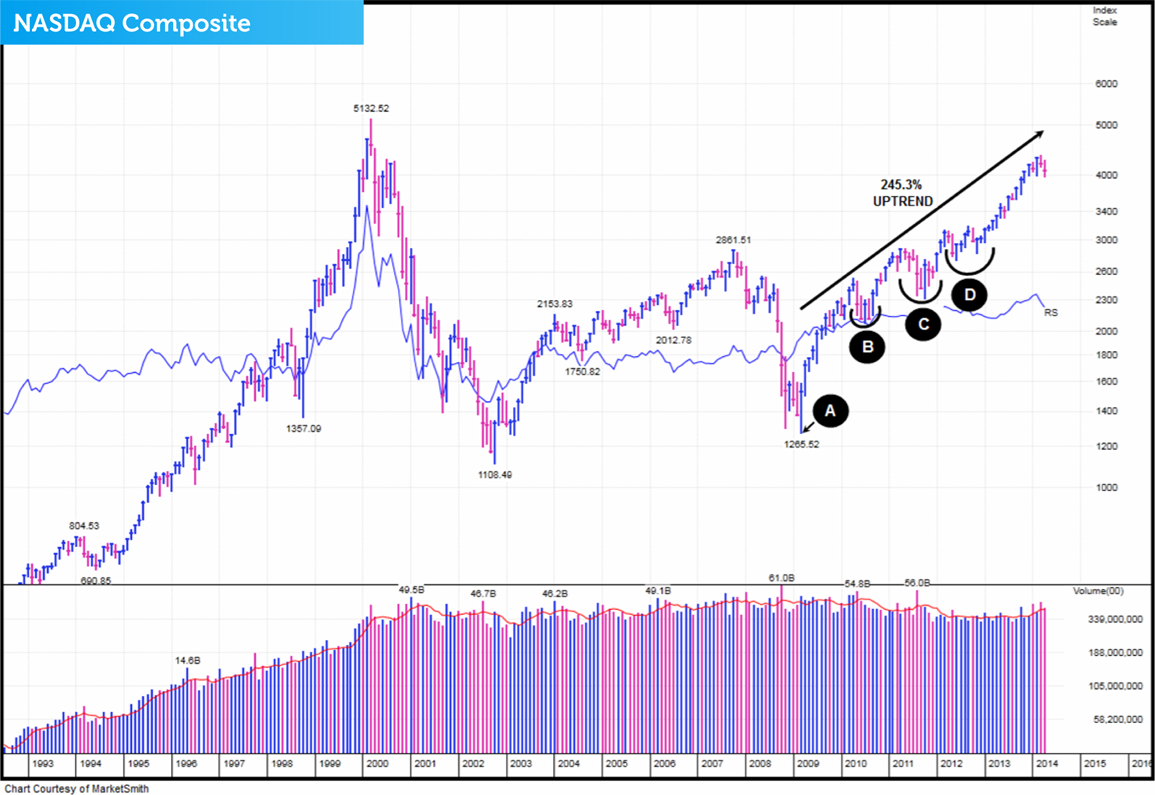

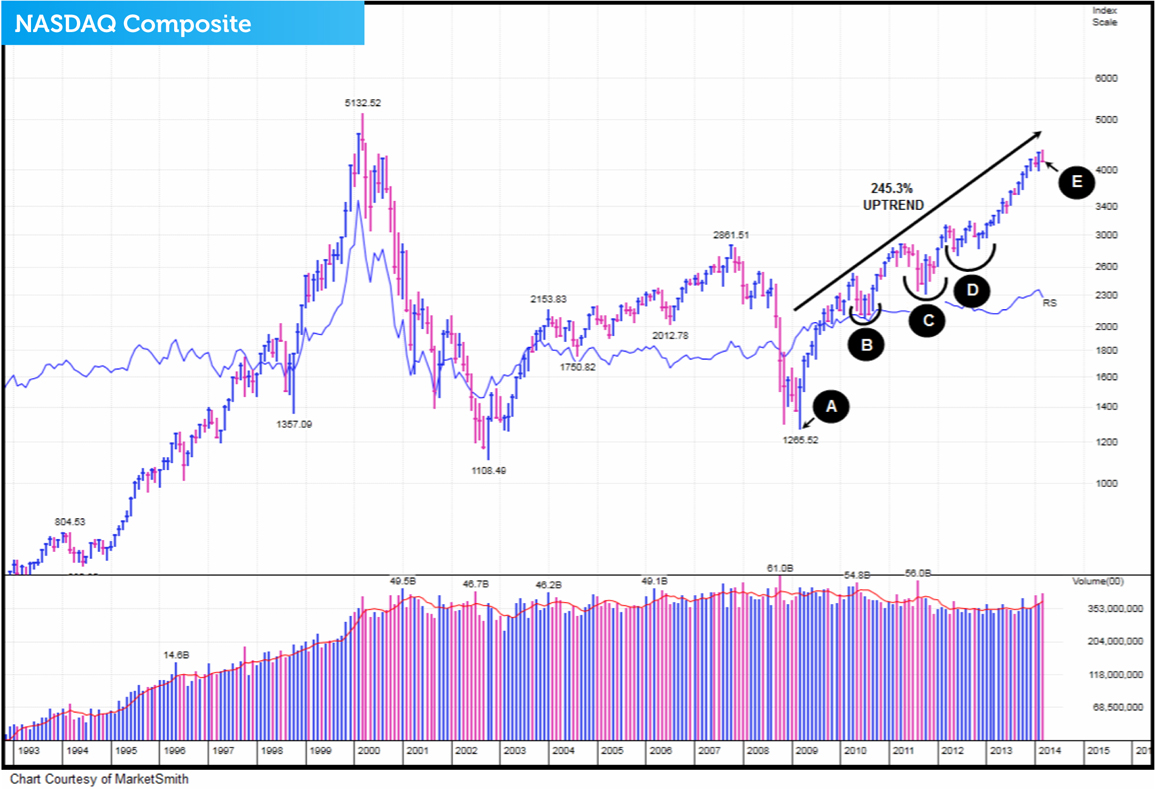

Have we just entered a new bear market?

In this post we'll take a look at what has been happening in the market since the beginning of March.

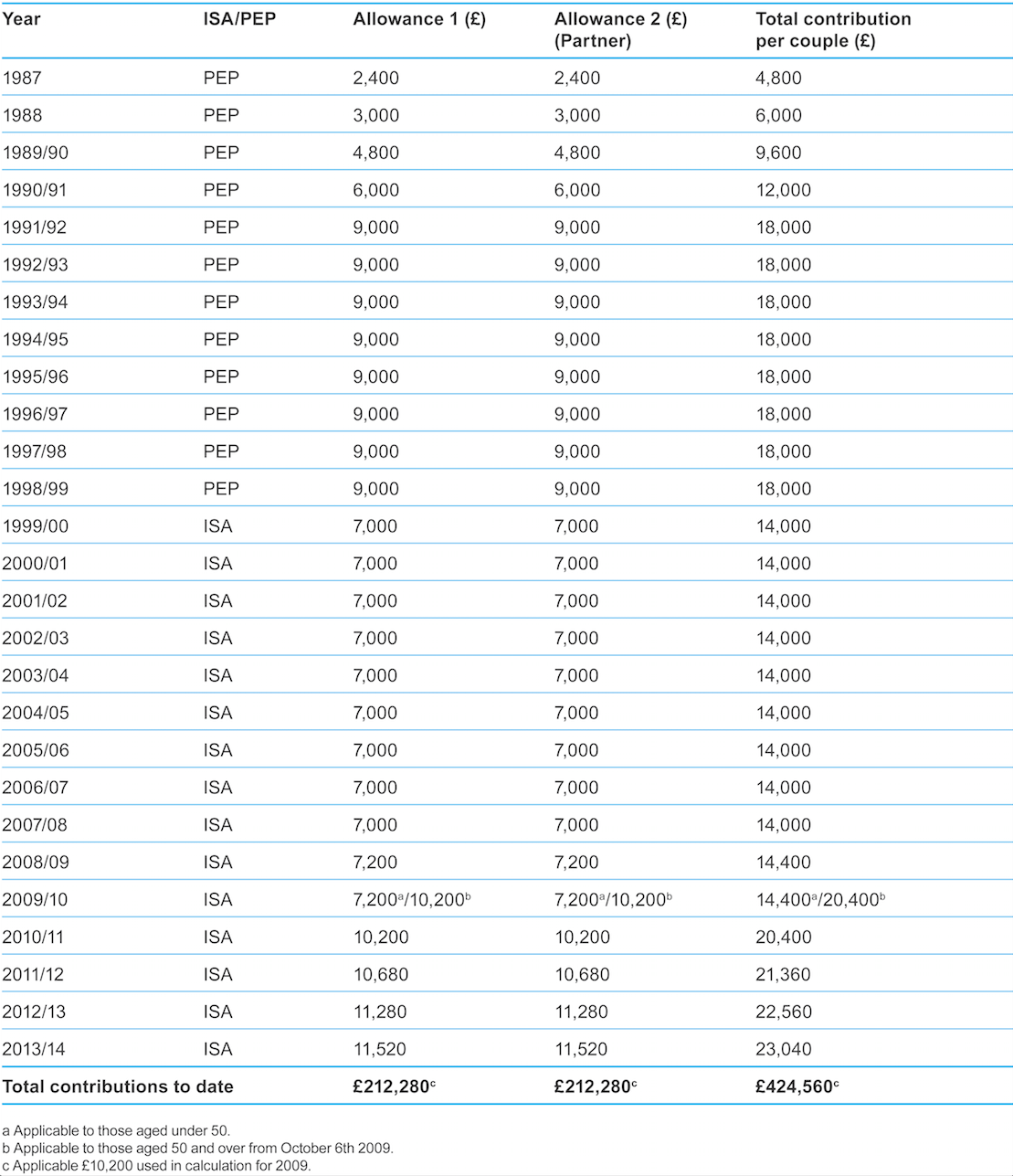

Your Annual ISA Allowance - Use it or lose it

With the April 5th deadline looming, we wanted to remind you that every tax year end marks the end of an annual opportunity to take advantage of one of the few tax benefits now available.

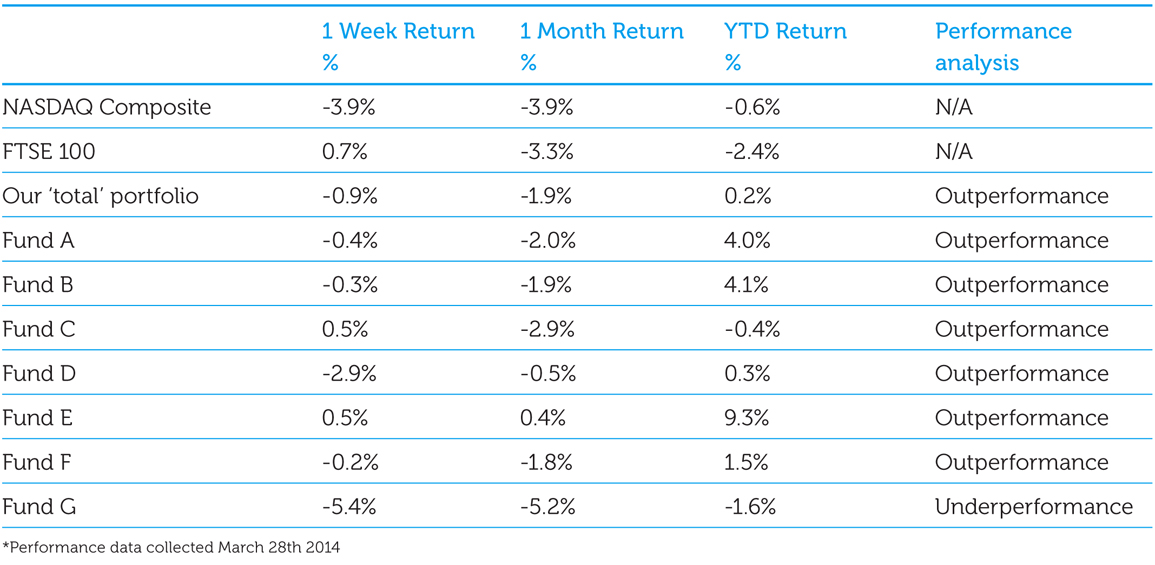

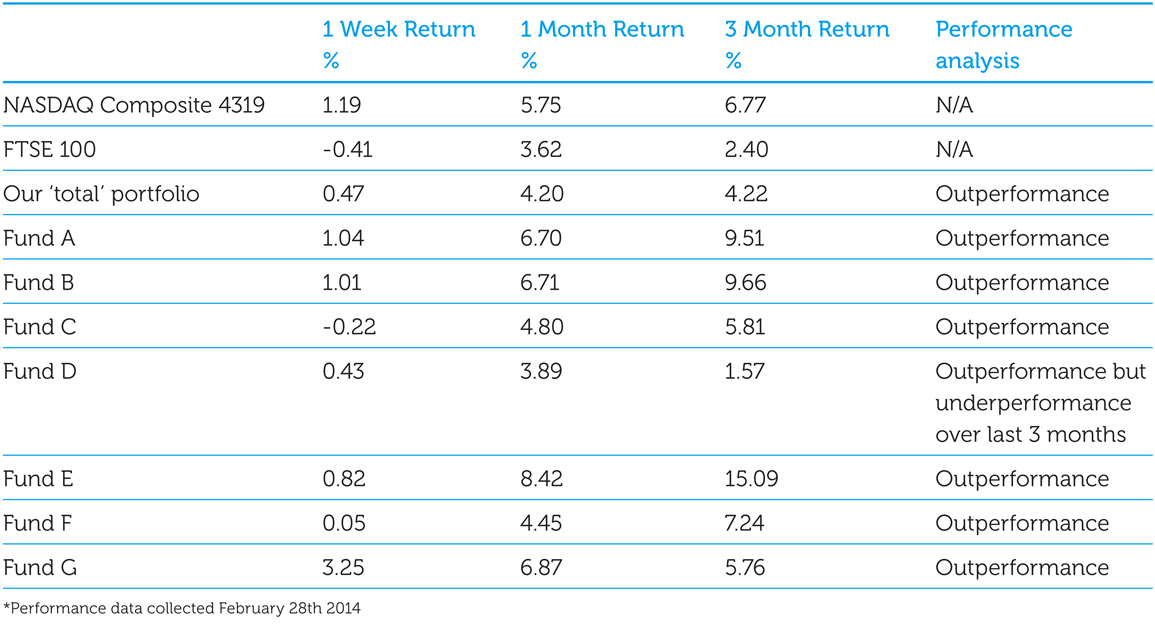

How have the funds in our portfolio been performing?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being a key factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

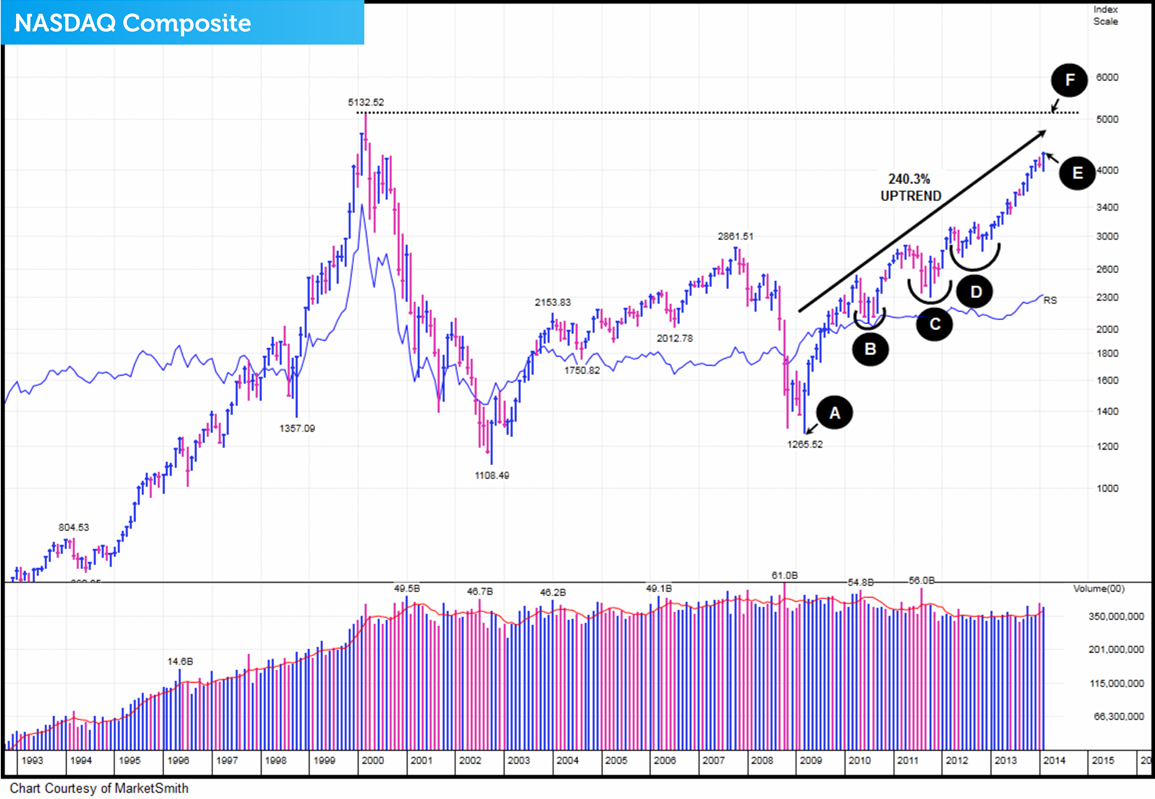

Does the bull market have further to run?

In this post we'll take a look at what has been happening in the market since the beginning of February.

A flaw that pushes brilliant people to make financial mistakes

Chapter 9 of my new book, How to Make Money in ISAs and SIPPs, has proved to be very popular. So I thought it best to run a series of articles taken from the chapter to see what you think. This is article number two in the series.

Tags: How to Make Money in ISAs and SIPPs, Investment strategy, Behavioural Investing

How to make better investment decisions

I’m proud to say that David Mountain, an ISACO client and engineer was one of the many people that loved my new book, How to Make Money in ISAs and SIPPs.

Tags: How to Make Money in ISAs and SIPPs, Investment strategy, Behavioural Investing

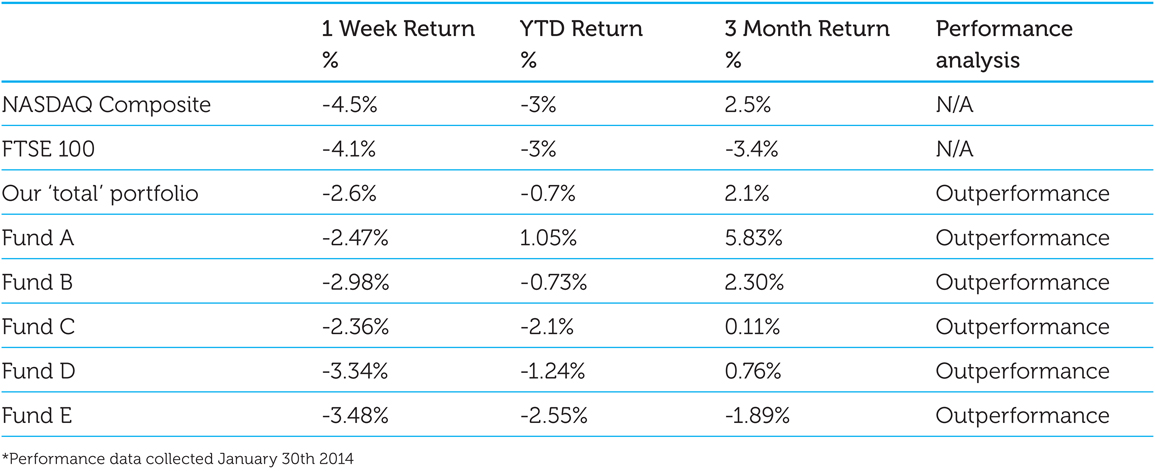

Which of our funds are in the money flow?

Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being an important factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

On January 30th 2014, we took a good look at the performance of the five funds that we own, our ‘total’ portfolio's performance, the performance of the FTSE 100 and performance of the NASDAQ Composite. This is what we discovered: