Each month we like to make sure that the funds we own are acting right. In our opinion, as well as long-term performance being an important factor in fund selection, the short-term performance of a fund is very important once you own it. It’s vital because we’ve noticed that strong funds tend to get stronger and weak funds tend to get weaker.

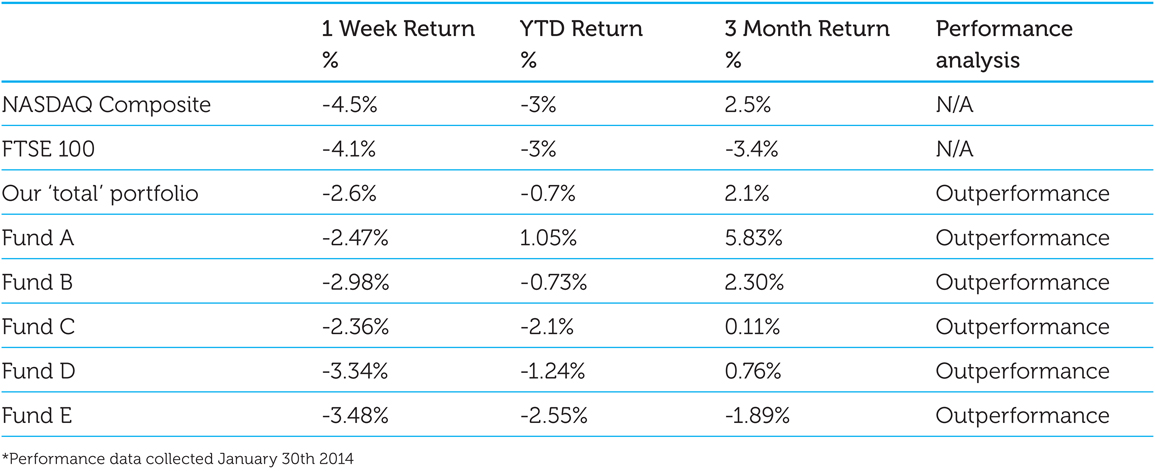

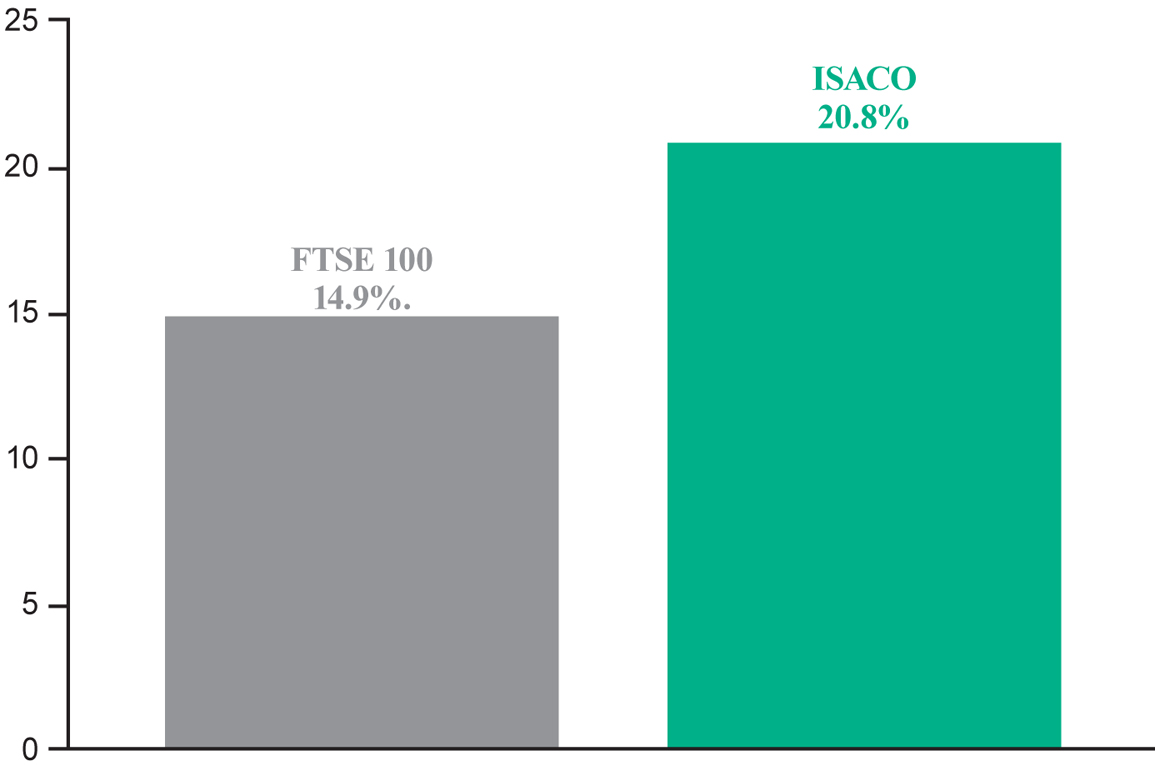

On January 30th 2014, we took a good look at the performance of the five funds that we own, our ‘total’ portfolio's performance, the performance of the FTSE 100 and performance of the NASDAQ Composite. This is what we discovered: